Reports from South America indicate a robust harvest that will start in just a few weeks. A wild card is the trade tensions between the US and China. Soybean prices are likely to remain low for those allowed to purchase US grain without a tariff while higher prices will prevail in China.

With the Chinese 25% tariff in place, the production and trade of soybeans is shifting. Production will increase in South America and decrease in the US. US farmers will shift some production from soybeans to corn thereby reducing the price of corn. After a period of unusually low soybean prices over the next year, soybean prices are likely to rise worldwide.

Despite the current beneficial grain price climate for most grain users, low prices will not last. Trade wars reduce efficiency and end up increasing prices in the long run, not only for those behind a tariff wall but for all grain users. In addition, grain prices appear to be at the bottom of a long-term cycle. The next move is therefore more likely to be up. Corn may move up in this crop year even as soybean continue to fall. However, by 2019-2020 it can be expected that both corn and soybean prices will be rising at the beginning of a long-term cycle upward in grain and commodity prices.

Corn

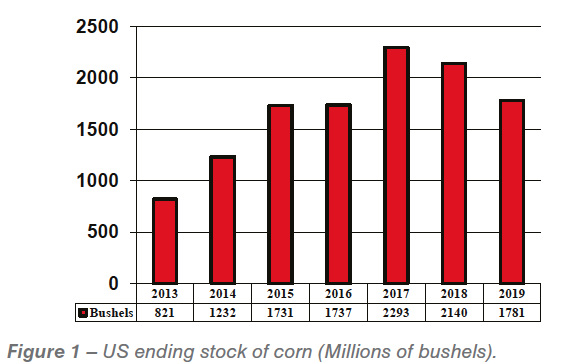

The USDA numbers for world ending corn stock for the last several years changed significantly after adjustments were made to the numbers from China. Hopefully, the adjusted numbers from China are now accurate since China is so important in the world ending stock numbers.

Soybeans

Ending stocks of soybeans are rising not falling. The December USDA WASDE report shows that both US and world soybean stocks are rising. Soybean meal prices rose last crop year due to the drought in Argentina and then plummeted because of the trade war between China and the US, combined with clearly abundant supplies worldwide.

US ending stocks rose an unusual amount due to the trade war with China. The effect of that increase is already reflected in the market price. Yet to be determined are the trade politics of 2019. China may purchase some US soybeans next year.

The domestic supply of meat in the US rose by 2.5 billion pounds in 2018, an amount that exceeded demand. A billion pounds of that was additional chicken production. The result for the chicken industry was a substantial drop in prices. After years of profitable production, the chicken industry is now operating at a loss that will continue at least through the winter and could last all next year.

A clue to future supply can be found in the number of chicks being placed by the industry. The recent numbers clearly show that the industry has tapped the brakes on production. Current numbers of chicks placed are lower than year earlier numbers.

- low grain prices help poor feed converting animals;

- rising median income;

- the time lag for increased red meat production.

As all of these factors reverse in the coming years, poultry consumption will, if history is a guide, once again outperform red meat consumption. “Outperform” may mean staying the same while red meat consumption falls.

With a preliminary agreement on a new trade deal in North America, US chicken leg quarter exports to that country appear safe for the moment. Mexico is the number one destination for US chicken exports buying nearly one billion pounds of leg quarters per year.

Deboned Breast

The seasonal peak for skinless boneless breast (SBB) came early his year and was disappointing. Now SBB has fallen to just 80 cents per pound (Northeast Price). The issue appears to be too much SBB and red meat combined with a surprising lack of food service demand. The price has dropped so much recently that it has fallen below the world price.

World Chicken Growth Rate

World economic growth and per capita

The long-term world chicken production growth appears to be 2%. The USDA expects world growth to slightly exceed 2% in 2019. However, if the world economy falters and/or grain prices increase, the growth rate could decline somewhat in 2020.

Source: Aviagen