An overview at continent level

This overview will list the leading countries in each continent and document their share in the poultry meat production volume of the continent as well as at the global level. In a first paper, this method was used in the analysis of the spatial pattern of global egg production (Zootecnica International, November 2020).

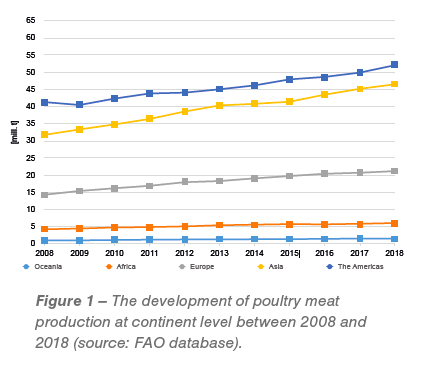

Between 2008 and 2018, global poultry meat production increased from 92.7 mill. t to 127.3 mill. t or by 37.4%. Parallel to this remarkable growth, the regional concentration also grew considerably (Figure 1).

Two countries dominated poultry meat production in the Americas

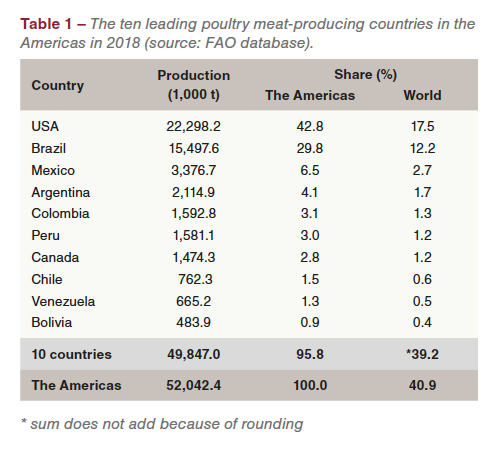

In 2018, countries of the American double continent contributed 40.9% to global poultry meat production. The regional concentration in the Americas was very high, as can be seen from the data in Table 1.

The ten leading countries shared 95.8% in the production volume of all American countries, the two leading countries, USA and Brazil, 72.6%. The gap between these two countries and the following five ranks was quite wide, as they together contributed only 19.5% to the continent’s production volume. Because of the high production volume in the USA and Brazil, the ten leading countries shared 40.9% in global poultry meat production in 2018. Without these two countries, it would only be 11.2%. This documents the extraordinary role of the USA and Brazil at a global scale.

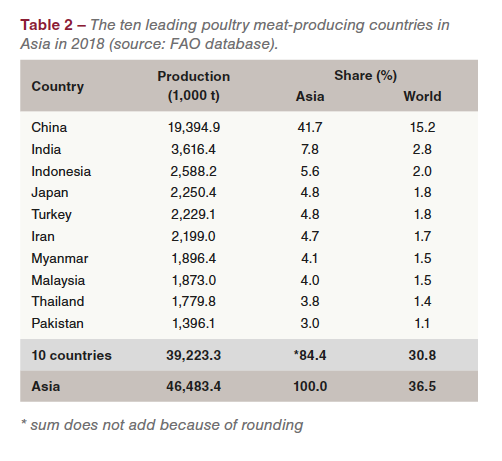

Without China, production in Asia was distributed more evenly

The countries of Asia contributed 36.5% to the global poultry meat production in 2018. Without China, it would be only 21.3%. The regional concentration was very high. The ten leading countries shared 84.4% in the continent’s production volume; China alone 41.7%, followed by India with 7.8%. Almost half of the Asian production volume was concentrated in these two countries. The share of the other listed countries differed between 5.6% (Indonesia) and 3.0% (Pakistan).

A comparison of the data in Tables 1 and 2 shows that the USA and China shared almost the same percentage in the poultry meat production of the respective continents. In contrast to Brazil, there was no country in with a similar contribution to the production in Asia.

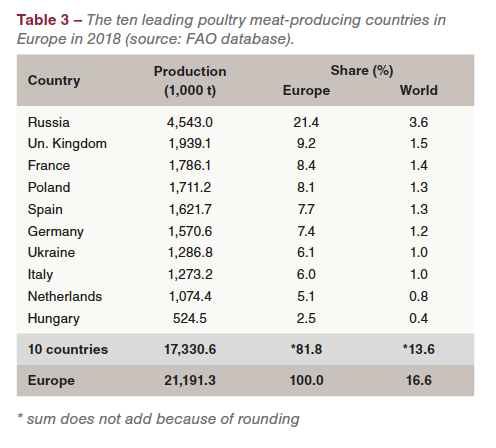

In Europe, Russia dominated poultry meat production

In Europe, poultry meat production grew from 14.3 mill. t in 2008 to 21.2 mill. t in 2018 or by 47.9% (Table 3). To the remarkable increase of 6.9 mill. t, Russia contributed 1.5 mill. t or 21.7%. The fast growth resulted in an unchallenged first rank with a share of 21.4% in the continent’s production volume. The contribution of the following eight countries differed between 1 mill. t (Netherlands) and almost 2 mill. t (United Kingdom). High absolute growth rates were also to be found in Poland (846,000 t), Spain (515,000 t) and the United Kingdom (510,000 t). In contrast, poultry meat production stagnated in France. These four countries contributed almost exactly on third to the continent’s production. With 81.8%, the regional concentration in Europe was almost as high as that in Asia.

European countries contributed one sixth to the global poultry meat production, the ten leading countries 13.6%, without Russia it would be 10.0%. The pattern in Europe resembles that in Asia with one dominating country in first rank and several countries with similar production volumes.

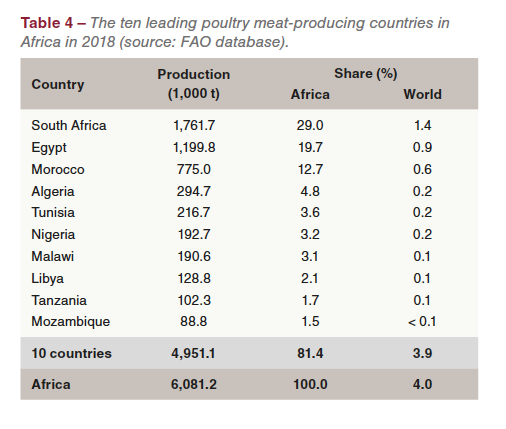

High regional concentration in Africa

Between 2008 and 2018, poultry meat production in Africa grew from 4.3 mill. t to 6.1 mill. t or by 43.0%. To the increase of 1.8 mill. t, South Africa contributed 428,000 t and Egypt 461,000 t. These two countries ranked as number one and two among the ten leading poultry meat-producing countries. Together with Morocco, ranked as number three, they shared 61.4% in the continent’s production volume (Table 4). This was the highest concentration in the three leading countries behind Oceania and the Americas. The data impressively documents that poultry meat production was concentrated in the countries of Northern Africa and in South Africa. Together the six countries, as listed in Table 4, contributed 71.9% to the continent’s production volume.

With only 4.0%, Africa’s share in global poultry meat production was very low. Considering that 17.2% of the global population lived in this continent in 2018, the situation was very imbalanced. In contrast, 13.1% of the world population lived in the Americas, which contributed 40.9% to the global production volume.

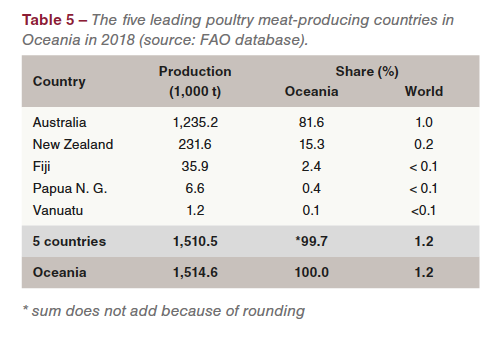

The regional concentration was highest in Oceania

With a production volume of 1.5 mill. t, Oceania shared 1.2% in global poultry meat production. Table 5 reveals that 96.9% of the production was concentrated in the two leading countries, 81.6% in Australia alone. This was the highest regional concentration of all continents. Between 2008 and 2018, the production volume of Oceania grew from 1.0 mill. t to 1.5 mill t, a very dynamical development. To the absolute growth, Australia contributed 391,000 t or 78.2%. This documents the dominating role of the country in the poultry meat industry of Oceania.

Summary and perspectives

The preceding analysis could show that the regional concentration of poultry meat production was high in all continents, with the highest values in the Oceania and the Americas. Above that, in all continents, production was even more concentrated in only a few countries.

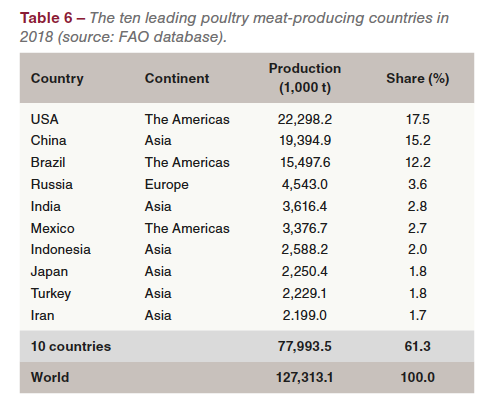

Table 6 lists the ten leading poultry meat-producing countries in 2018. They shared 61.3% in the global production volume, the top three countries 44.9%. Six of the countries are located in Asia, three in the Americas and one in Europe. The lists reflects the remarkable concentration in the production of this commodity. Of the 127.3 mill. t of poultry meat which were produced in 2018, 89.8% were chicken meat, mainly broiler meat, 4.6% turkey meat, 3.5% duck meat and 2.1% goose and guineas fowl meat.

The high regional concentration in global poultry meat production is also reflected in a list of the ten leading broiler producers (Table 7). It is worth noting that no European company was listed among the top ten. LDC (France) ranked as number 13 with an annual slaughter of 541.2 mill. head, followed by Plukon (Netherlands) with 426.4 mill. head.

The success story of poultry meat, especially broiler meat, will go on. No religious barriers, an excellent feed conversion rate, the strong position in the leading fast food chains and the broad variety of meals based on poultry meat will be the main steering factors. What impact plant-based meat alternatives and cell-cultured meat will have over the next ten years is difficult to project. Plant-based alternatives will become more important, especially among younger consumers, and may reach a share between 10% and 15% in 2030. Cell-cultured meat will even in five to ten years play only a minor role, considering the unsolved problems, which the new technology is still facing.

Database

FAO database: http://www.fao.org/faostat

Top world broiler companies: www.WATTAgNet.com (October 2019)