The EU poultry sector maintained moderate growth through mid-2025, according to the latest Poultry Market Situation report released by the European Commission. Despite continued challenges from disease outbreaks and trade disruptions, both production and prices remain high, underscoring the industry’s resilience.

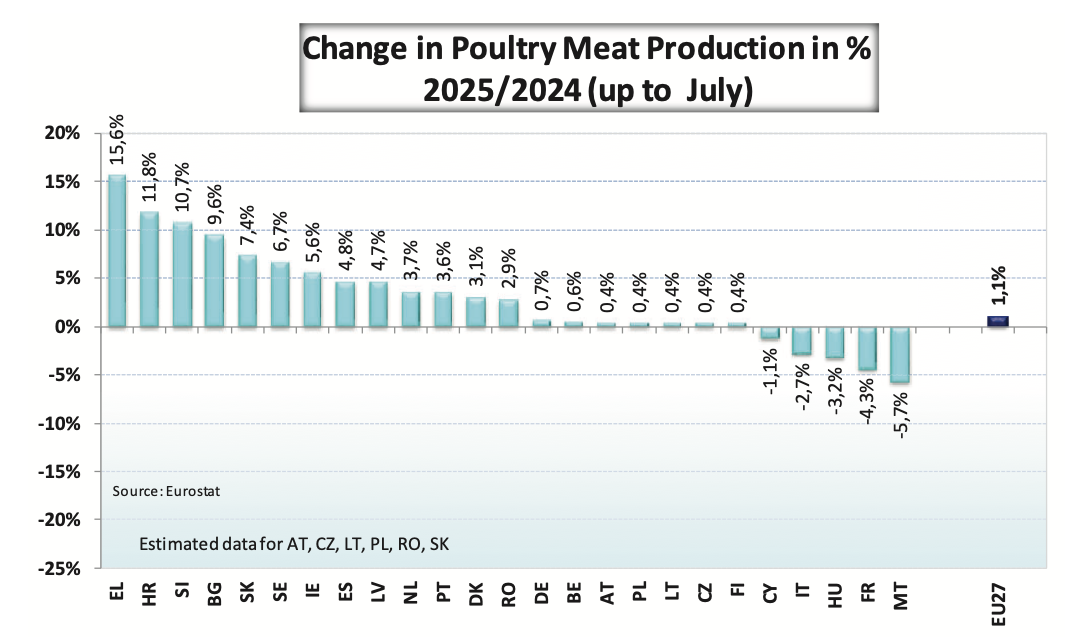

Production up slightly, but uneven across member states

Between January and July 2025, EU total poultry meat production increased by 1% compared with the same period in 2024. Growth was uneven across the bloc: while several countries maintained positive trends, output declined in Hungary, France and Italy.

The report attributes these differences to varying national market conditions and the lingering effects of avian influenza in key producing areas.

Prices remain high amid limited supply

Prices remain high amid limited supply

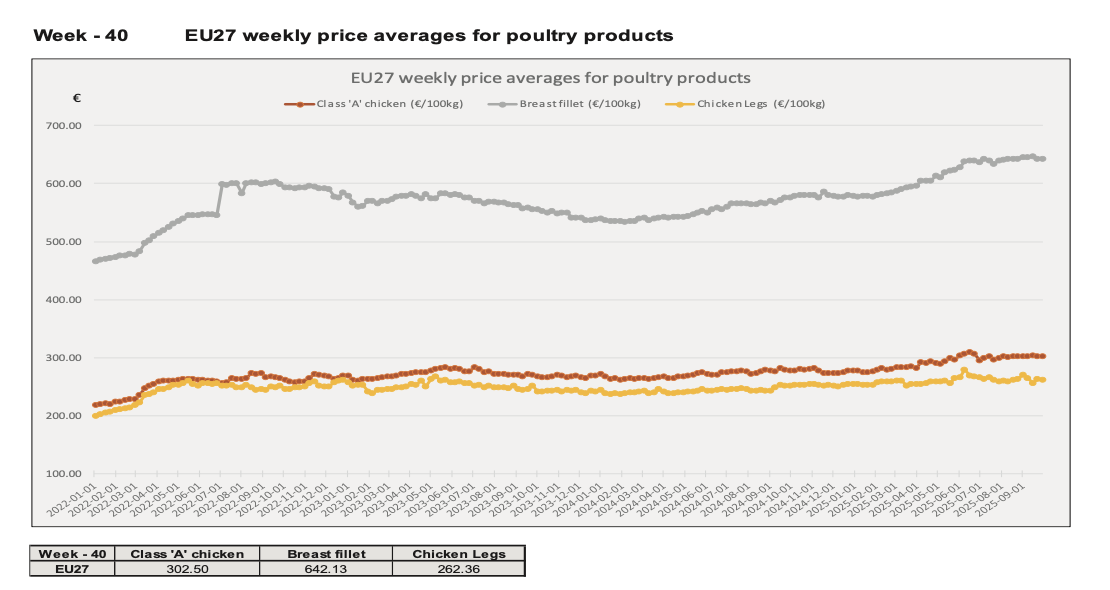

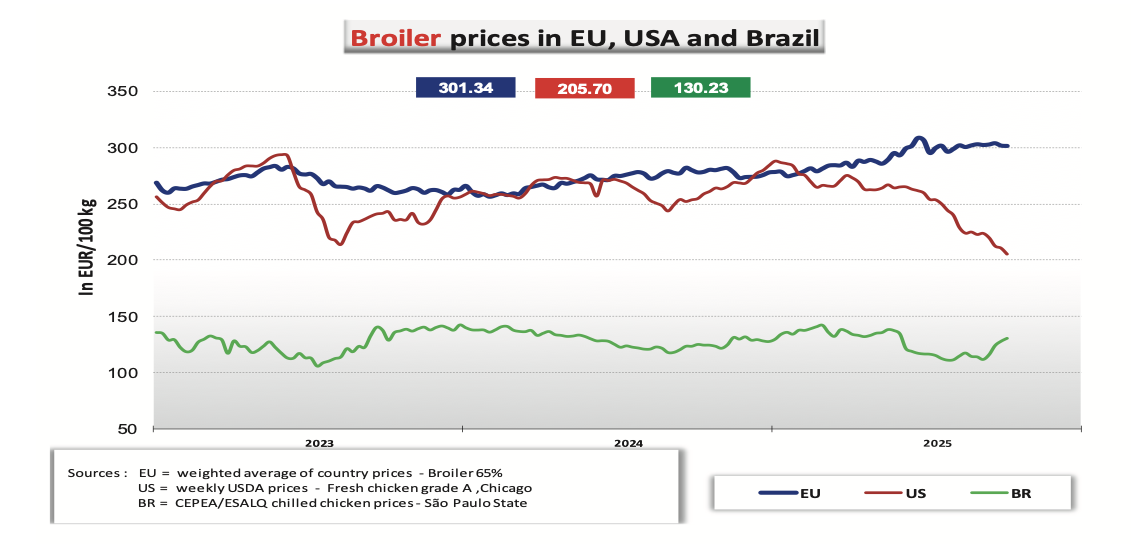

EU poultry prices continued to rise through October, reflecting strong demand and constrained supply.

-

Average broiler price: €301/100 kg (+9% year-on-year)

-

Chicken breast: €642/100 kg (+2% week-on-week, +12% year-on-year)

-

Chicken legs: €262/100 kg (+5% week-on-week, +4% year-on-year)

The report notes that high output prices, combined with favourable feed costs, confirm tight supply conditions and sustained consumer demand.

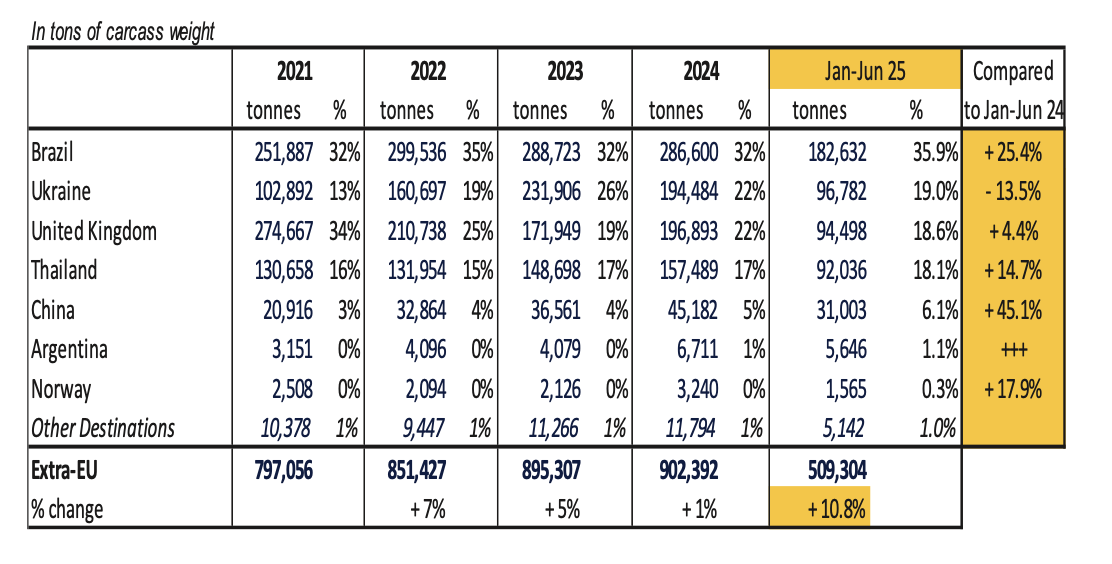

Imports rise sharply, driven by Brazil, the UK and Thailand

From January to June 2025, EU poultry imports from third countries rose by almost 11% in volume and 29% in value compared with the same period in 2024. Growth was driven mainly by Brazil, the United Kingdom and Thailand, while imports from Ukraine decreased by more than 14%.

Brazil and EU exports show mixed performance

According to the report, Brazilian poultry exports decreased by 1%, reaching 2.47 million tonnes in the first half of 2025. Shipments declined to the UAE, China, Saudi Arabia, Japan and South Africa, while increasing to the Philippines and Mexico.

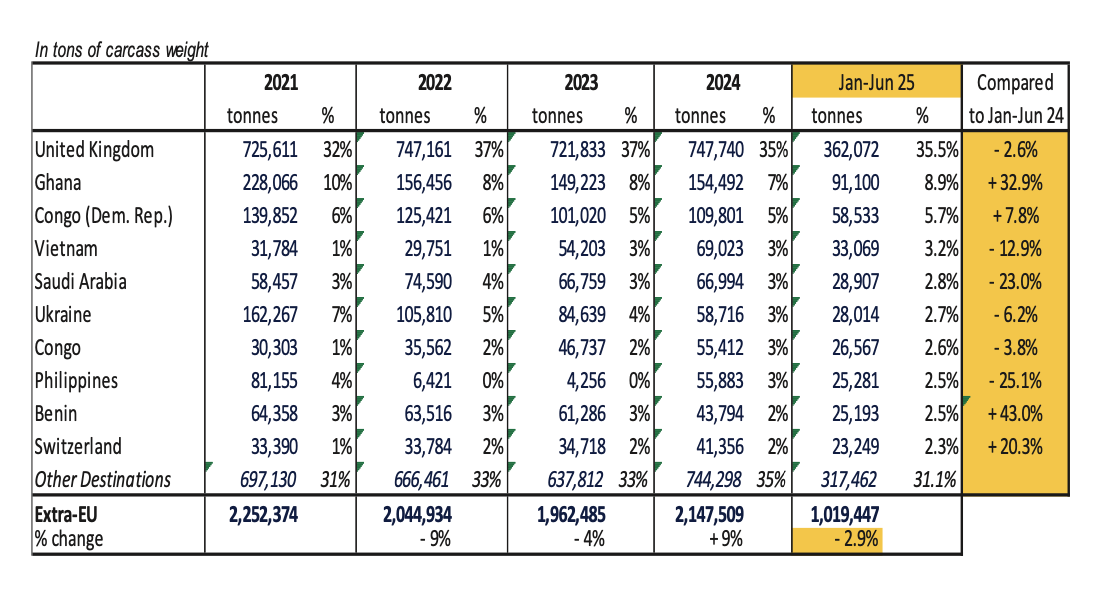

In contrast, EU poultry exports to third countries fell by almost 3% in volume but rose by 8% in value, reflecting firmer prices. Shipments increased to Ghana, Benin and Switzerland, while the largest declines were recorded for the United Kingdom, Vietnam, Ukraine, Saudi Arabia, Congo and the Philippines.

Avian influenza: 538 outbreaks in 12 months

Avian influenza: 538 outbreaks in 12 months

Between October 2024 and September 2025, the EU recorded 538 outbreaks of highly pathogenic avian influenza (HPAI) across 19 member states, leading to the culling of 22.6 million birds.

The highest number of outbreaks occurred in Hungary (53%), followed by Poland (19%) and Italy (19%). Ducks and turkeys were the most frequently affected farm types, while laying hens accounted for most birds culled.

Despite the high number of cases, the situation remained under control thanks to improved surveillance and rapid containment measures.

Outlook: stable market under cautious optimism

The European Commission’s October update presents a picture of relative market stability, supported by steady consumer demand, export diversification and stable feed costs. However, analysts warn that disease risks, trade policy uncertainty and global competition will continue to shape the EU poultry market heading into 2026.

Source: European Commission – Poultry Market Situation, October 2025 (published 23 October 2025).

Source: European Commission – Poultry Market Situation, October 2025 (published 23 October 2025).