With only 4.7 million laying hens, which corresponds to around 1.2% of the EU flock, Denmark is one of the smaller egg-producing countries. It is therefore not surprising that there are only a few scientific publications on the development and structure of laying hen husbandry and egg production in this Northern European country. It is surprising, however, that the special structure of egg production and egg marketing has not received more attention, as it is unusual compared to the EU member countries with much larger egg production. This structure will be analysed and documented in more detail in the following article1.

A remarkable dynamic

When looking at the long-term development of the Danish egg industry, there are two years in particular in which far-reaching decisions were made. The first was in 1895, when the Dansk Angels Ægexport co-operative was founded, from which Danæg was to develop over the years. The second was in 1980, when Hedegaard A/S bought the Farm-Æg company. In the years that followed, acquisitions in Denmark, Sweden, Finland and Estonia transformed the company into DAVA Foods. These two companies are not only the largest egg producers and marketers in Denmark, but also largely determine the egg market in Scandinavia.

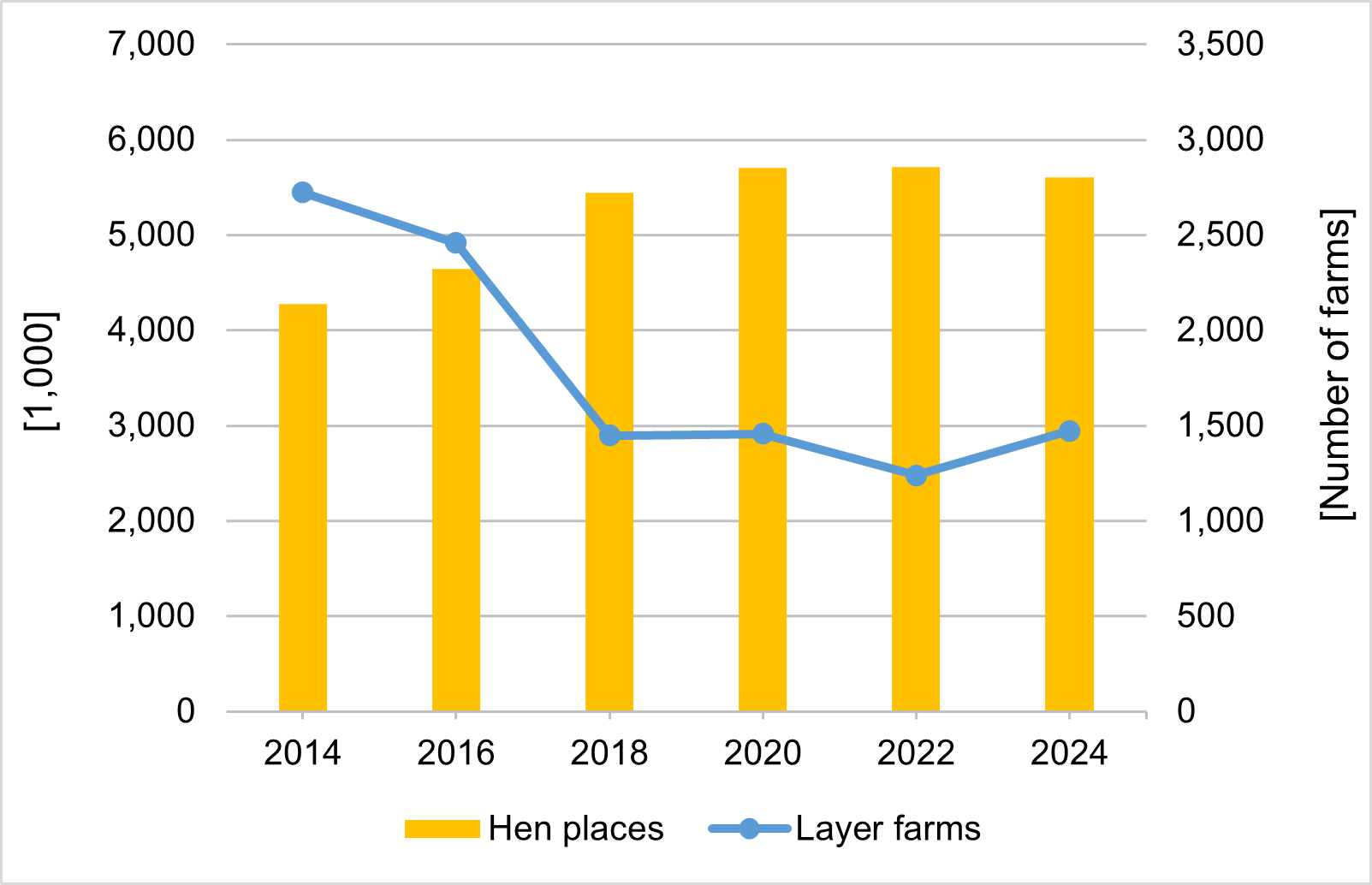

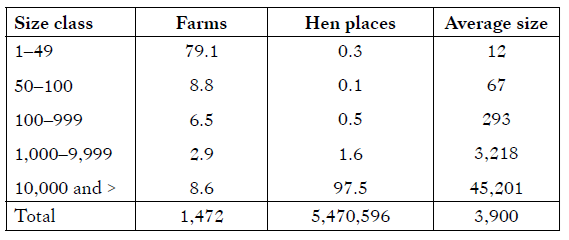

Between 2014 and 2024, the number of farms keeping laying hens fell from 2,722 to 1,471, or by 46.0%. In 2024, only 132 commercial egg farms were registered, however. In the same decade, the number of hen places increased from 4.27 million to 5.61 million, or by 31.2%. Figure 1 shows that the situation regarding hen places has been very stable since 2018, while the number of farms has increased slightly between 2020 and 2022. This is mainly due to the expansion of flocks with 1,000 or more places, while the number of small holdings (up to 50 places) has fallen significantly2. A comparison of the shares of farms and hen places by size class shows the high degree of sectoral concentration (Table 1). Market supply beyond the local area is almost exclusively provided by farms with more than 10,000 hen places.

Source: A. S. Kauer based on Statistics Denmark data.

Source: Statistics Denmark.

Danish laying hen farmers, like their Swedish counterparts, changed from conventional cage systems much earlier than other EU member countries to barn and free-range systems. Denmark was one of the few countries which had fully converted conventional cages to enriched cages in 2012. Figure 2 documents the change that has occurred over the past decade. While 34% of eggs were still produced in enriched cages in 2014, this share fell to 12% in 2020 and only 8% in 2024. In the same decade, barn systems increased from 13% to 35% and then to 40%. The share of organic egg production increased until 2022, but then fell slightly because barn eggs were cheaper for consumers than organic eggs. Free-range eggs have contributed 6% since 2018. A larger increase is not expected in the coming years for organic and free-range eggs due to the threat of avian influenza outbreaks. The large number of wild birds (geese, ducks) that stay in southern Sweden and Denmark during the winter months until spring discourages egg farmers from investing in this housing system. Production in the barn systems will, however, grow constantly. Between January 2024 and January 2025 production increased by 7.7%. This was an answer to the decreasing production in the Netherlands and Belgium and the high demand in Germany. The two large companies, Danæg and DAVA, are pursuing corresponding strategies, as will be shown in the following paragraph.

Design: A. S. Kauer based on Danske Æg data.

Danæg – a successful cross-border co-operative

To understand the long success story of Danæg, it is necessary to take a brief look back at its beginnings33. Towards the end of the 19th century, England was an important destination for Danish agricultural exports. The main export products were butter and eggs, although eggs were much less important. From 1880 onwards, complaints from English importers about the poor quality of the eggs increased and they even threatened to stop buying them altogether if the quality of the eggs did not improve significantly. The poor quality of the eggs was a consequence of the exporting farmers’ strategy. They often held back the eggs for very long because they were waiting for price peaks. Because the laying rate of the hens decreased in the winter months, the farmers stored eggs in pits containing lime water. When prices were high, they were then taken out and marketed. These eggs were often spoilt or of very poor quality.

In order not to lose the English market, the most important export farmers founded the Dansk Andels Ægexport co-operative in 1895. The member farmers promised to export only high-quality eggs, to keep the barns clean and to collect the eggs laid every day. In addition, all eggs were stamped so that they could be traced back to a specific producer. As a result of these measures, exports to England increased and domestic sales also rose.

Since the beginning of the 21st century, Danæg has expanded its activities in Sweden and Finland. In 2004, Danæg merged with the Swedish joint-stock egg company Kronägg, in 2009 it took over Källbergs Industri AB and in 2023 Torggummans Ägg was added.

The merger with the Swedish companies raised the group to an international level, and after thorough rationalizations, automations and efficiency improvements at all levels, the Danæg Holding is the leading market player in Northern Europe.

In 2021, the Danæg Group acquired the remaining 76% of the Finnish Munax OY in Laitila – a company of which it had owned 24% since 2015. Munax Oy was established in 2003 and has subsequently developed at an impressive speed and today is the market leader in Finland within both the retail and foodservice sectors. With the acquisition of Munax Oy, the Danæg Group is in a strong position in developing innovative products and strengthening exports out of the group’s domestic market. Danæg is producing considerable amounts of eggs in Finland (personal information from Jørgen Nyberg Larsen).

In 2013, Danæg decided to sell part of the company to the Danish co-operative DLG (Dansk Landbrugs Grovvareselskap). Today, Danæg Holding A/S is owned equally by DANÆG AMBA (Danish and Swedish egg producers) and DLG4. The holding is based in Christiansfeld in Jutland (Photo 1 and 2).

In Denmark, just 39 farms and 29 farmers produce eggs for Danæg. They are mainly located on Jutland, but a few also on Sealand, Funen and Lolland. Together they have a total of 1.9 million hen places. The laying hens are kept in four different housing systems, the barn systems are dominating with a share of 58.5%, followed by organic farming with 20.0%. Both housing systems are used by 12 farmers each. Only two farms still have enriched cages, which account for 13.8% of the hen places. With three farms and a share of 7.6%, free-range systems are only of minor importance for the reasons mentioned above.

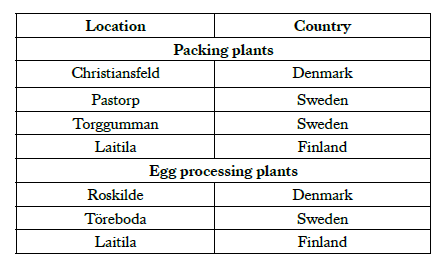

In addition to the production and distribution of shell eggs, the company processes eggs into various egg products. In total, Danæg packs, processes and markets shell eggs and egg products at the following locations:

DAVA Foods – growth through acquisition

DAVA Foods is the younger of the two leading companies. It has the legal form of a public limited company and has become the largest marketing company for shell eggs in Northern Europe, primarily through mergers and acquisitions. It began in 1980 with the purchase of Farm-Æg by Hedegaard A/S. In the years that followed, other smaller companies were acquired and packing plants and egg processing plants were built, e.g. a packing plant and an in-line egg processing plant in Hadsund in 1995. In 2008, Danish Agro purchased Hedegaard A/S, and in 2013 Svenska Landägg was fully acquired after a 70% share had already been bought in 2011. A 50% share in Finland’s largest egg marketer (Munakunta) was added in 2014 as well as a packing plant in Estonia. The company was renamed DAVA Foods A/S in 2015. The holding company, which has been wholly owned by Danish Agro since 2023, is based in Hadsund, Jutland. The packing and egg processing plants outside Denmark are run as independent companies (DAVA Foods Sverige AB, DAVA Foods Finland OY, DAVA Foods Property Norway AS and DAVA Foods Estonia AS). The company’s commitment to the production and sale of plant-based products (seeds, legumes, oils) and plant-based meat substitutes (No Series) is remarkable5.

In 2025, DAVA Foods operated a total of six packing plants, three egg processing plants and one egg cooking plant. Around 2 billion eggs are produced, processed and marketed each year.

Barn and organic farming – focal points in egg production

In Denmark, 43 contract farms owned by 33 farmers produce eggs for the company. Together they have about 2.3 million hen places. With a share of 63.2%, the barn systems are dominating in total egg production, followed by 23.0% in organic farming. Free-range farming and keeping hens in enriched cages are less important. Even though the proportions of housing types are very similar to those of Danæg, the average DAVA flocks are larger. It is not unusual that big organic farmers keep several flocks in the same barn. They are separated by fences in the barn and in the outdoor areas. DAVA Foods itself keeps about 125,000 hens in enriched cages and has applied for the construction of five barns with 70,000 hen places, each near their packing station in Skara.

Summary and perspectives

In Denmark, the two largest companies in the production, processing and marketing of eggs and egg products have a market share of 90%. They differ in their legal form and age. While Danæg was founded as a co-operative at the end of the 19th century, the public limited company DAVA Foods was only established in 1980. Both companies are active in several Northern European countries and dominate the market for shell eggs and egg products. While Danæg specialises exclusively in the production and sale of eggs and egg products, DAVA Foods has also added the production and sale of plant-based products and meat substitutes to its portfolio. Currently, their share of the overall turnover is still very low and may not reach 3%. But the company is expecting considerable future growth.

The production of eggs and chicken meat in Denmark is currently characterised by a remarkable dynamic. Numerous new laying hen barns and broiler houses are being built. The expansion of production is as well focused on the growing domestic market as on exports to other EU member countries.

While in the past, eggs for both companies were almost completely produced by contracted farmers, a new trend is the production in company-owned barns, such as by Danæg in Finland and by DAVA Foods in Sweden.

Data sources

Danske Æg, www.danskeæg.dk

Statistics Denmark, www.dst.dk