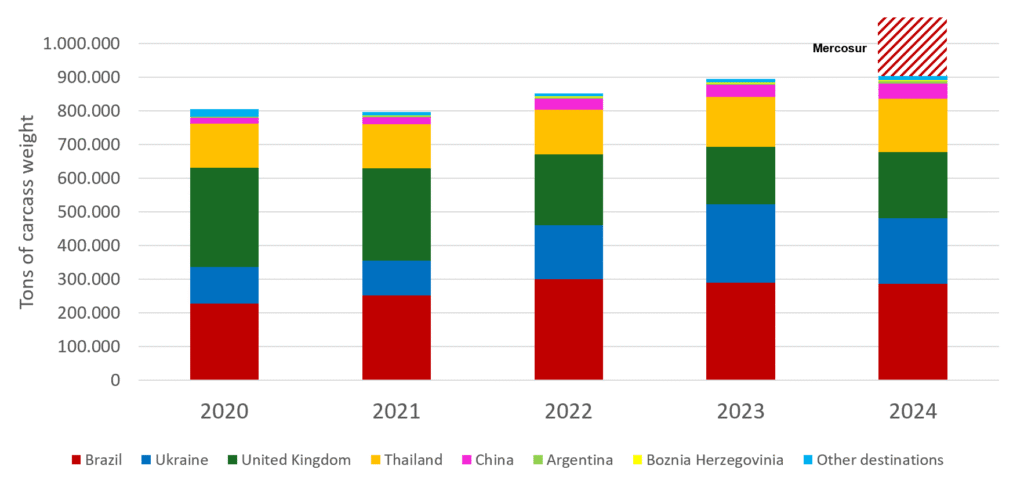

“Our sector is one of Europe’s quiet success stories: efficient, sustainable, and truly circular. We deliver a high-quality protein with the lowest carbon footprint among meats, using every part of the bird in food, pharmaceuticals, pet nutrition, fertilisers and energy” said AVEC’s President, Gert-Jan Oplaat. “That makes poultry indispensable to Europe’s food security.”Despite these strengths, the sector faces growing pressure. Poultry imports from 3rd countries such as Brazil, China and Ukraine continue to rise, often produced under conditions that would never be authorised in the EU – “25% of poultry breast meat consumed in the EU now comes from third countries” states Oplaat.

It has emerged that farmers and processors are weighed down by increasingly complex laws, which widen the competitiveness gap, while European gold-plating creates new costs and distortions within the Single Market.

As if that were not enough, there is also a severe demographic gap: “Only 6.5% of EU farmers are under the age of 35, and just 11.9% under 40” said Sébastien Pérel of CEJA, adding that “without young farmers there is no future for agriculture at all.”

The MERCOSUR agreement was also discussed, seen as a threat since it continues to disregard the European sustainability model and risks creating unfair competition. “Our standards, our sustainability efforts, and the trust of EU consumers must not be traded away” Oplaat stressed. “The Council and the European Parliament should reject this proposal and defend European agriculture.”

Source: DG Agri.

Looking to the future

Looking to the future, for the EU’s new report Vision for Agriculture and Food competitiveness, food security and fair trade are the priorities. “We (referring to the EU poultry sector and the Commission) are much more aligned than we used to be”, confirmed Catherine Geslain-Lanéelle, Director at the European Commission’s DG AGRI. AVEC sees this as the foundation for stronger cooperation in the years ahead. “The more we engage in evidence-based dialogue and partnership, the better we can deliver sustainable competitiveness for Europe’s citizens, its farmers and its environment” said AVEC’s Secretary General, Birthe Steenberg.

To underpin this new strategic direction towards competitiveness with facts, AVEC announced that it will release a new Competitiveness Study in early 2026. Building on 2024 cost data, it will quantify the impact of EU legislation, assess competitiveness against non-EU producers, and model trade policy scenarios. “The new study aims to provide the evidence policymakers need to ensure Europe’s high standards remain an asset, not a handicap” added Steenberg.

From the General Assembly in Copenhagen, a clear and urgent message to policymakers emerged: rules and bureaucracy must be simplified, European producers must be protected from unfair competition, and support must be given to innovation and generational renewal. “We can and want to remain competitive” Oplaat concluded, “but we need Europe to stand with us. Without reciprocity in trade and a level playing field at home, Europe risks outsourcing its own food security.”

In conjunction with the General Assembly, AVEC released its 2025 Annual Report, which provides comprehensive insights into the European poultry sector’s priorities, challenges, and achievements over the past year. The report also outlines the association’s strategic goals for the future.

2025 Annual Report

Let’s look at what the statistics from the 2025 annual report show.

First of all, in 2024 poultry production in the EU increased compared to previous years, reaching 13,925 thousand tonnes carcass weight, up from 13,393 in 2023. Consumption (12,281) and per capita consumption (25.1 kg/head) also increased compared to previous years. Self-sufficiency remained stable at 108%, while imports decreased by 4 points compared to the previous year.

As in 2023, the top producers in 2024 were Poland, the UK, and France. While Poland and France saw increases compared to previous years, UK production experienced a slight decline compared to 2023 (Table 1).

Note: partial provisional or estimated. For EU countries some significant differences between national and EUROSTAT data. Rows partly revised, as Eurostat does not continue supply balances. Now, the data are based more on other sources and own calculations.

Sources: MEG according to EU Commission, national data, FAO and EUROSTAT.

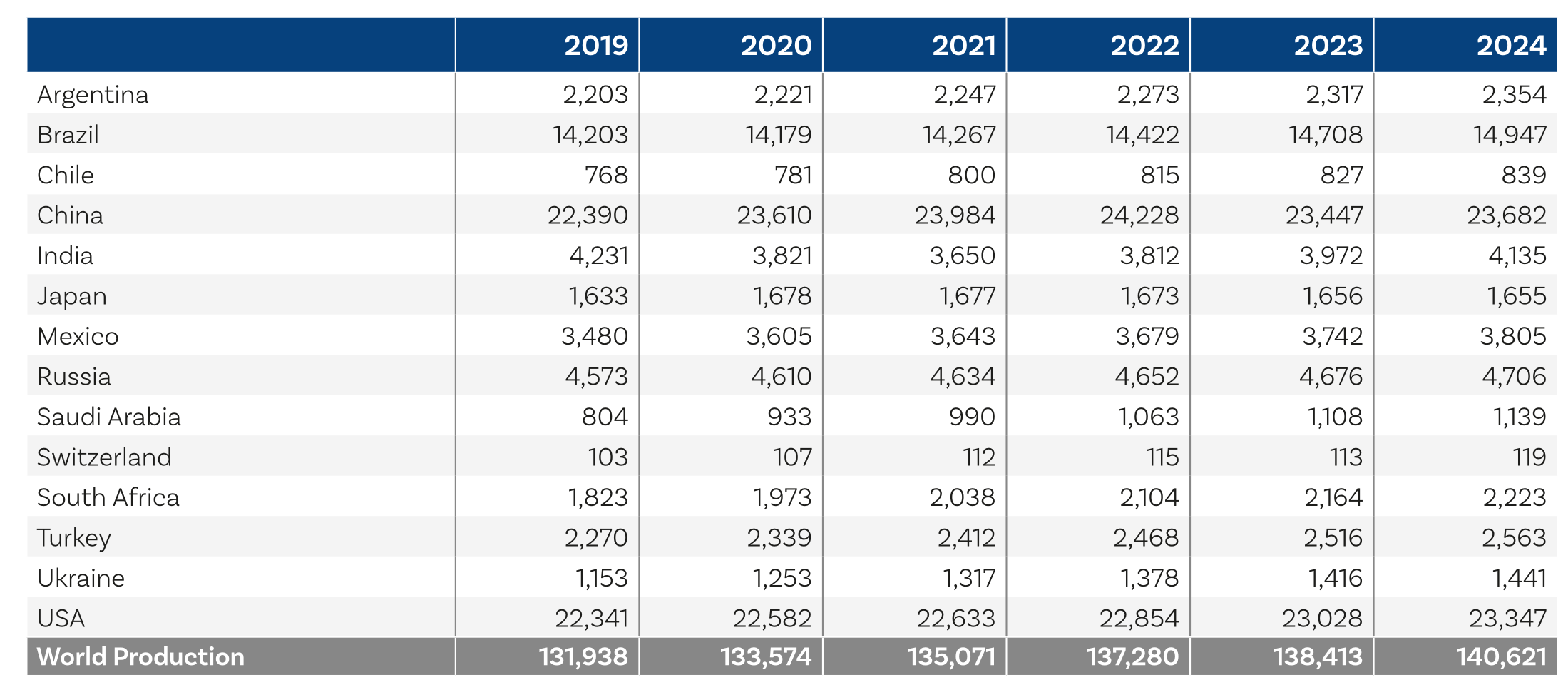

Looking at poultry meat production in the rest of the world, which reached 140,621 thousand tonnes in 2024, up compared to 2023, China ranked first, followed by the USA and Brazil—all three showing growth compared to the previous year (Table 2).

Note: partial provisional or estimated. Mostly gross domestic production. *) Only chicken and turkey meat.

Sources: MEG to USDA, FAO and national data.

Now let’s move on to imports and exports.

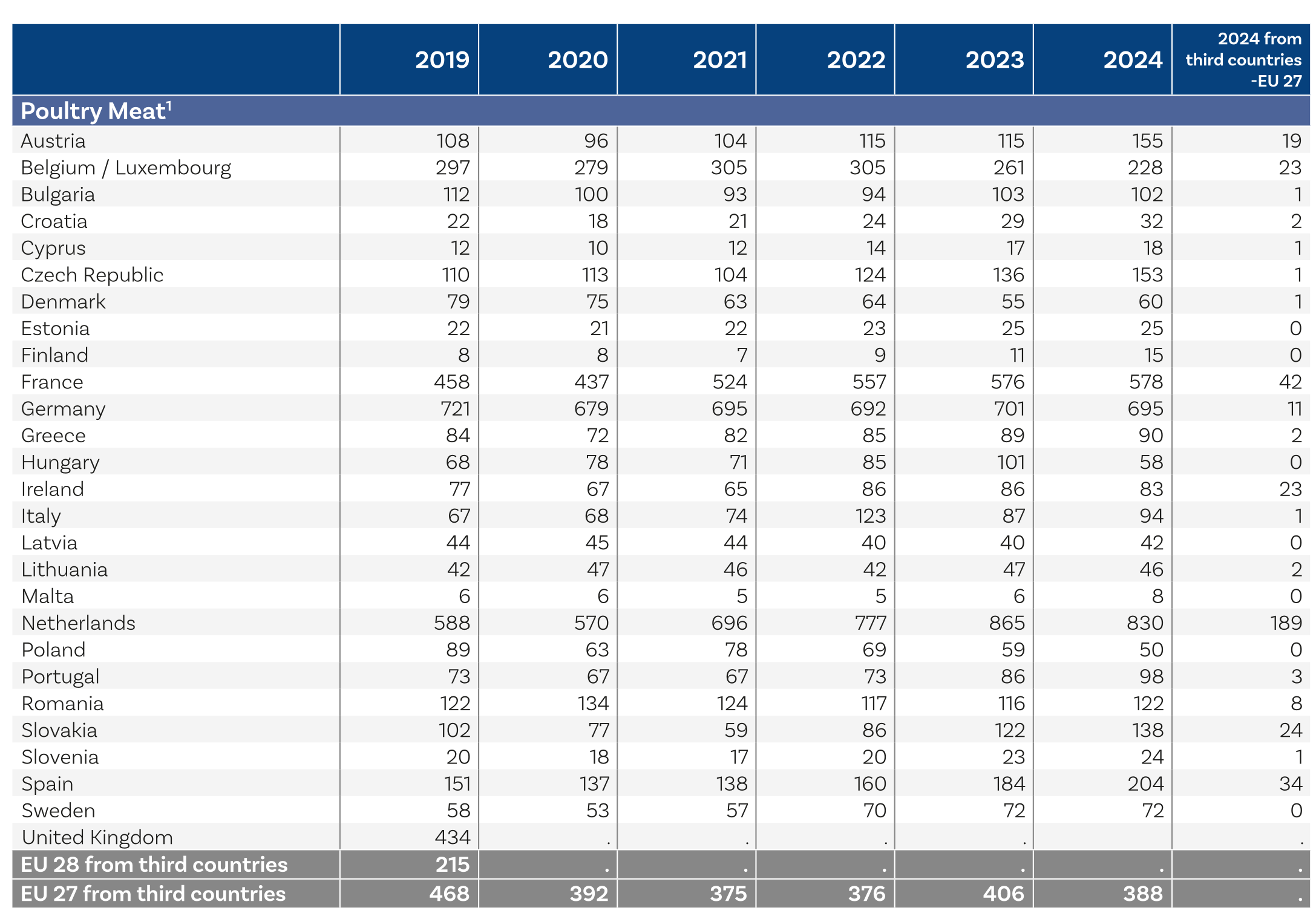

In the EU, the largest importers of poultry meat were the Netherlands and Germany, both down compared to the previous year, and France, which showed a slight increase (Table 3).

Note: 1) without preparations, livers, salted meat and live poultry. – 2019 partly preliminary. – Data in the EUROSTAT trade statistics and trade balance are partially different.

Sources: MEG to Eurostat and national statistics.

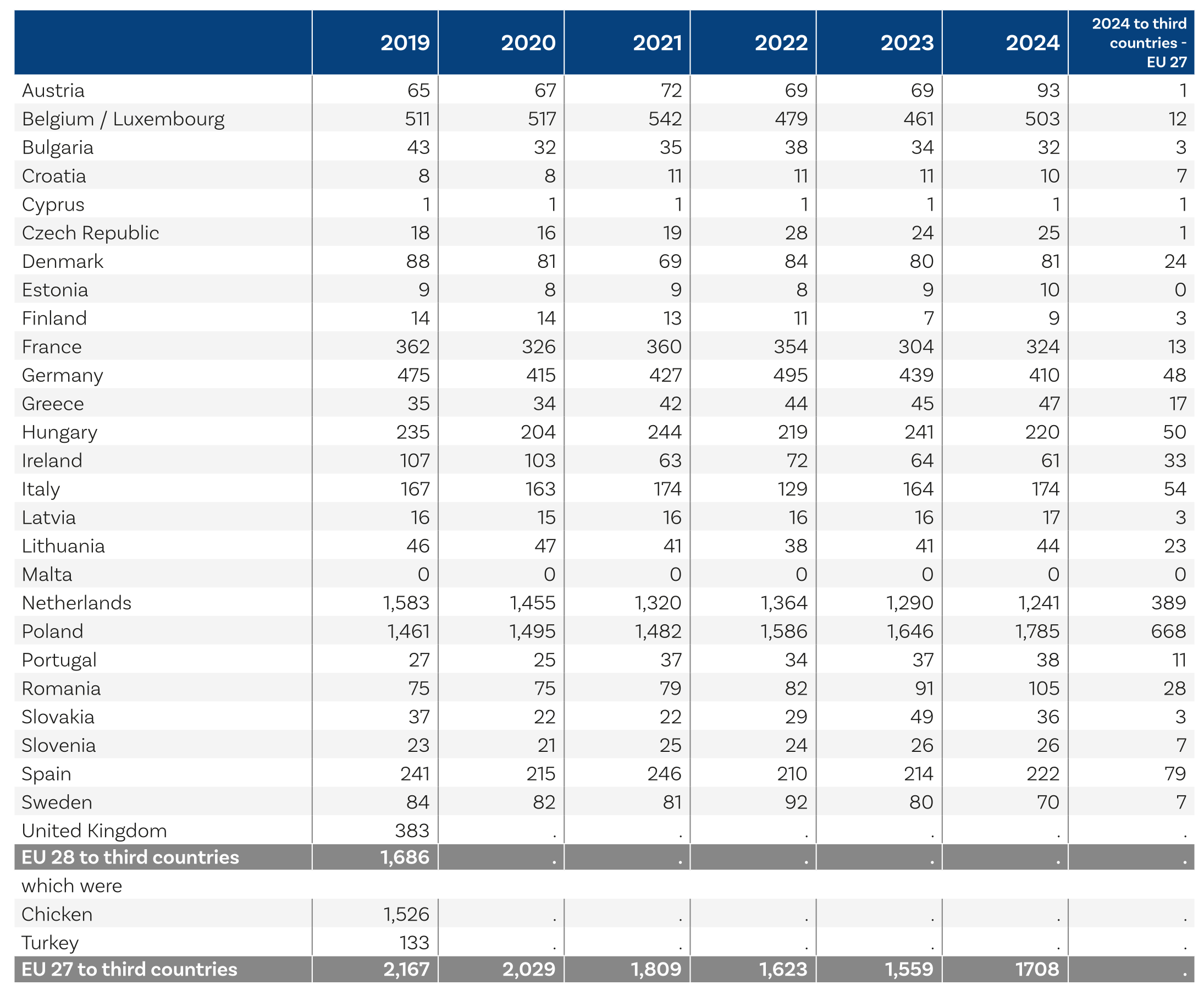

Regarding exports, Poland, the Netherlands, and Belgium/Luxembourg remained the top exporters, just as in the previous year (Table 4).

Note: 1) without preparations, livers and salted meat

Source: MEG to Eurostat and national statistics.

The most imported products were salted/brined poultry meat, frozen chicken, and fresh chicken; the most exported products were frozen chicken, fresh chicken, and poultry-based preparations.

In the rest of the world, Japan, Saudi Arabia, and Iraq were the largest importers of broiler chickens, all three showing increases compared to the previous year, while the main exporters were Brazil, the USA, and Thailand.

As usual, the AVEC report also analyzes per capita consumption. As in the previous year, the top three positions were held by Portugal, Ireland, and Poland.

Future outlook

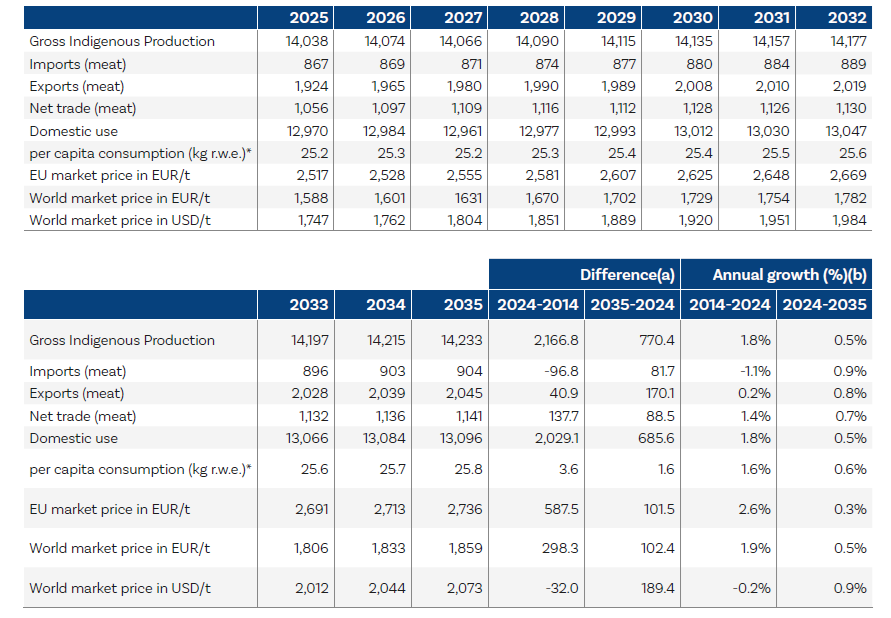

After a detailed analysis of the poultry market, the AVEC report also outlines future prospects up to 2035, forecasting that by that year nine indicators will show positive growth (Table 5). These are:

- Gross domestic production

- Imports

- Exports

- Net trade

- Domestic use

- Per capita consumption (kg r.w.e. – retail weight equivalent)

- EU market price (EUR/t)

- World market price (EUR/t)

- World market price (USD/t)

* r.w.e. = retail weight equivalent. Coefficients to transform carcass weight into retail weight are 0.7 for beef and veal, 0.78 for pigmeat and 0.88 for both poultry meat and sheep and goat meat.

Source: https://agriculture.ec.europa.eu/data-and-analysis/markets/outlook/medium-term_en

Source: https://avec-poultry.eu/wp-content/uploads/2025/08/07394-AVEC-annual-report-2025.pdf