Brazil’s poultry industry has undergone a remarkable development over the past decade. While the production of chicken meat and eggs has risen sharply, the production of turkey meat has declined significantly since 2017 after an initial increase. The reasons for this will be discussed in more detail later. The export of chicken meat developed particularly dynamically. In contrast, turkey meat exports more than halved between 2013 and 2023. Foreign trade in eggs was insignificant compared to chicken meat. The aim of this article is to trace the dynamics in the individual areas of the poultry industry and identify the driving factors.

Brazil’s position in the global poultry industry

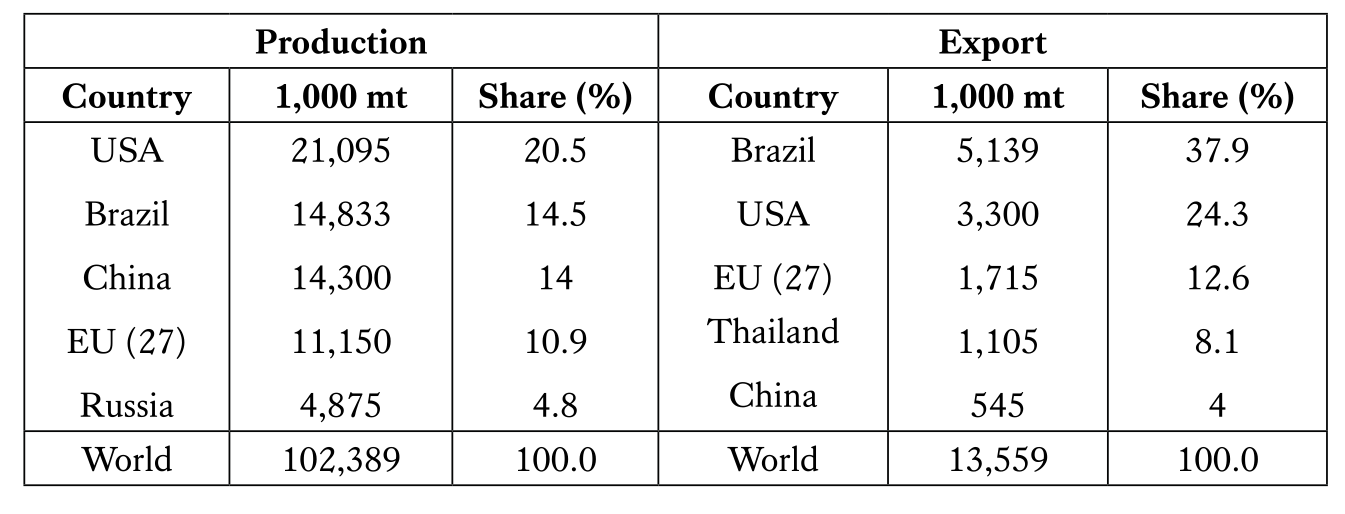

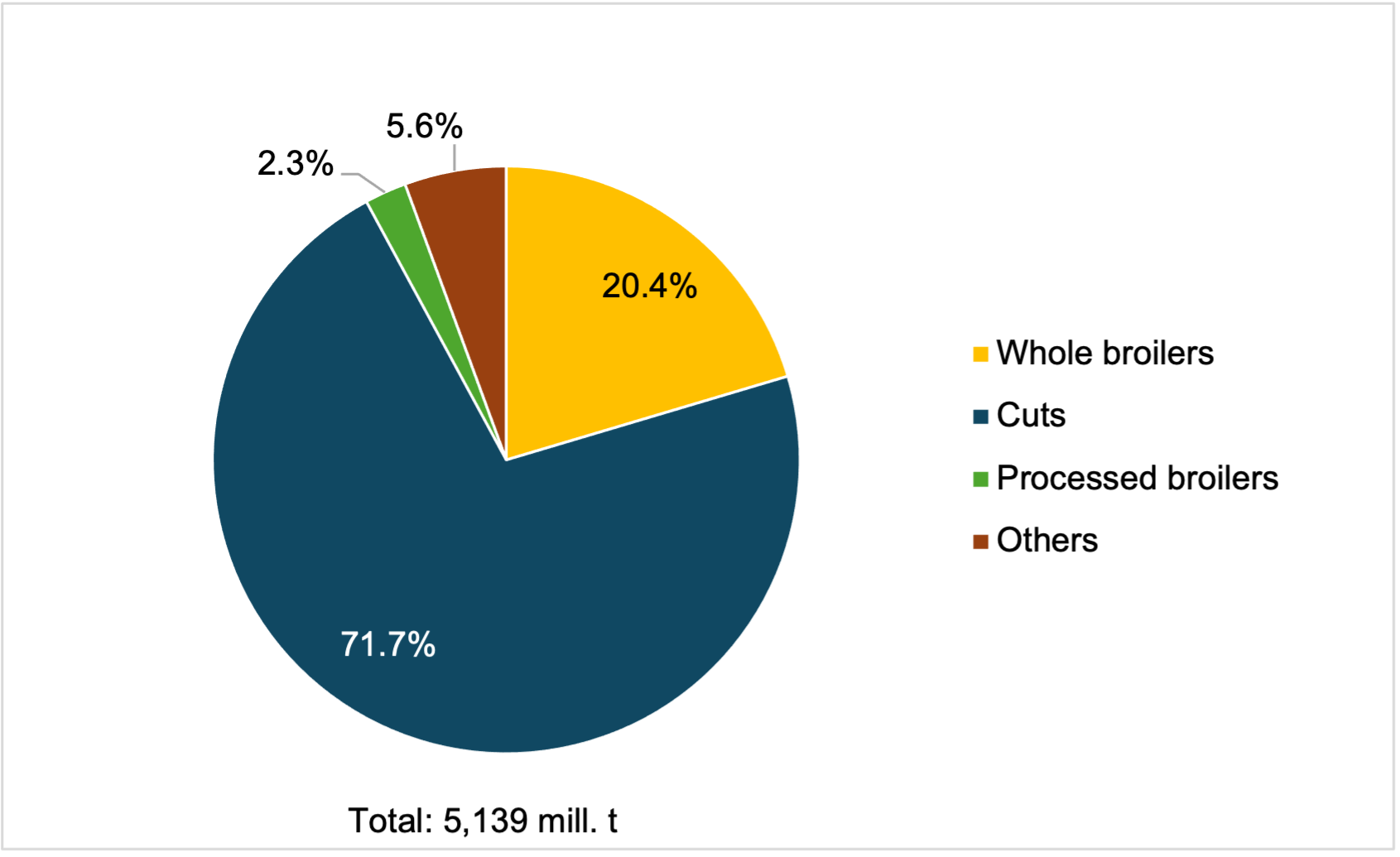

In 2023, Brazil ranked second behind the USA in the production of chicken meat, fifth in eggs and ninth in turkey meat (Table 1). It was the undisputed leader in chicken meat exports and ranked fourth in turkey meat exports behind the USA, Poland and Germany. Brazil already held this position in 2013, albeit with a much higher trade volume. It ranked fifth in egg production, but exports of eggs were quite insignificant, as over 99% of production was consumed domestically.

The following analysis will focus primarily on the development in the production and trade of chicken and turkey meat and will only consider the situation in egg production in terms of the dependence of the production volume on the per capita consumption (Table 2).

Chicken meat – exports grew faster than production

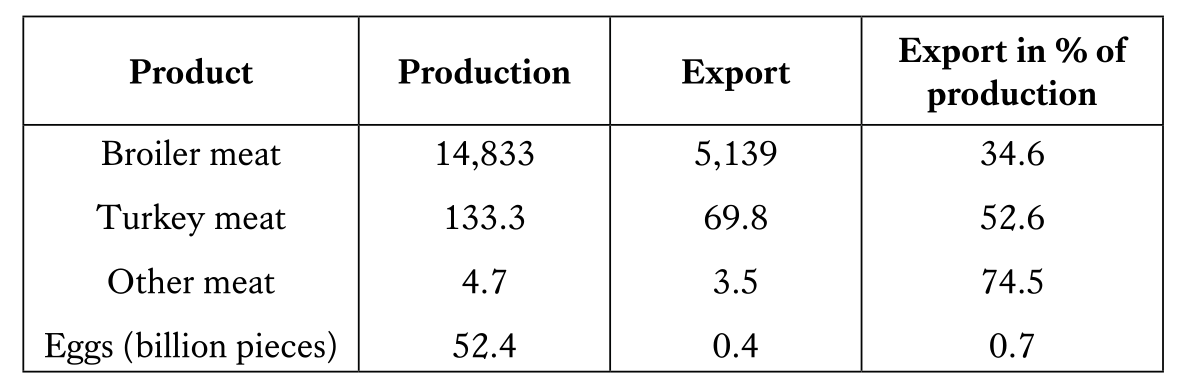

Between 2013 and 2023, the production of chicken meat increased from 12.3 million mt (1 mt = metric tonne, 1,000 kg.) to 14.8 million mt, or by 20.5%. Figure 1 shows that the continuous increase was interrupted between 2016 and 2018. Exports increased in the same period from 3.9 million mt to 5.1 million mt or by 32.0%. There was a decline in export volumes in 2017 and 2018, with exports only increasing again from 2021 onwards. A more detailed analysis of the development of the per capita consumption shows that there was also a slight decline from 42.1 kg to 42.0 kg in 2018, but that consumption then rose by almost 3 kg to over 45 kg from 2020 and remained at this level. What were the reasons for this downward trend in 2017 and 2018 and the renewed increase?

In March 2017, the Brazilian federal police launched Operation “Carne Fraca” (Operation Weak Meat). Leading companies in the production and marketing of meat were accused of extending the expiry dates, mixing spoilt meat with fresh meat and distributing it nationally and internationally. Government inspectors were arrested because they had been bribed by companies and had issued clearance certificates. Leading politicians were also involved in the scandal. When the fraud was publicised by the media and legal proceedings began, not only did domestic consumption decrease, but numerous countries also banned meat imports from Brazil. There was a massive loss of confidence and it took several years for the situation to stabilise again. The meat industry suffered losses running into billions. Broiler meat exports were significantly less affected than turkey meat, as will be shown in a later section.

The Covid-19 pandemic also played an important role. Because many restaurants, school and university canteens were closed, more meals were prepared in private households, which led to an increase in meat sales in the food retail sector and a decline in exports. Exports then rose again significantly once the pandemic ended.

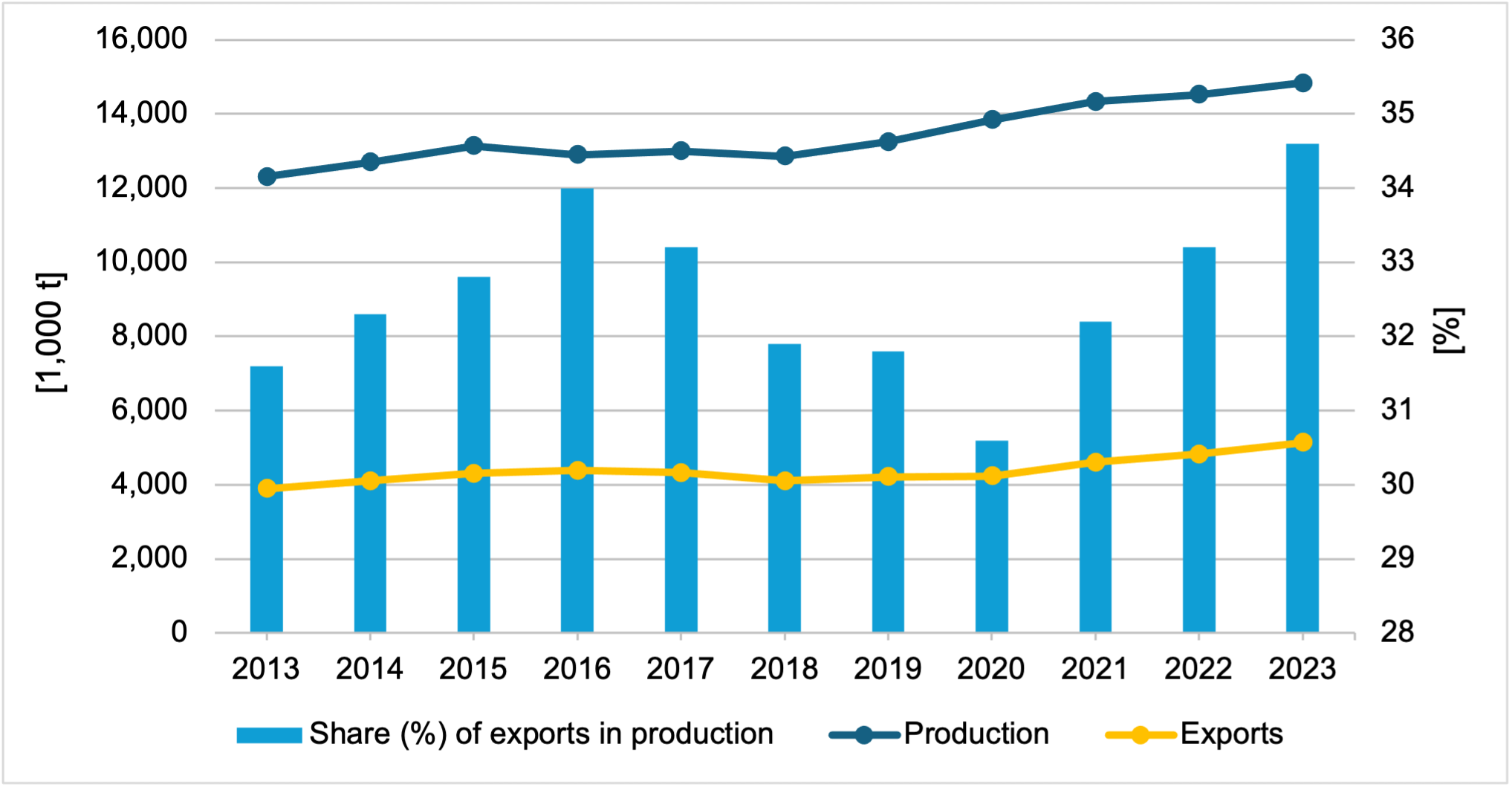

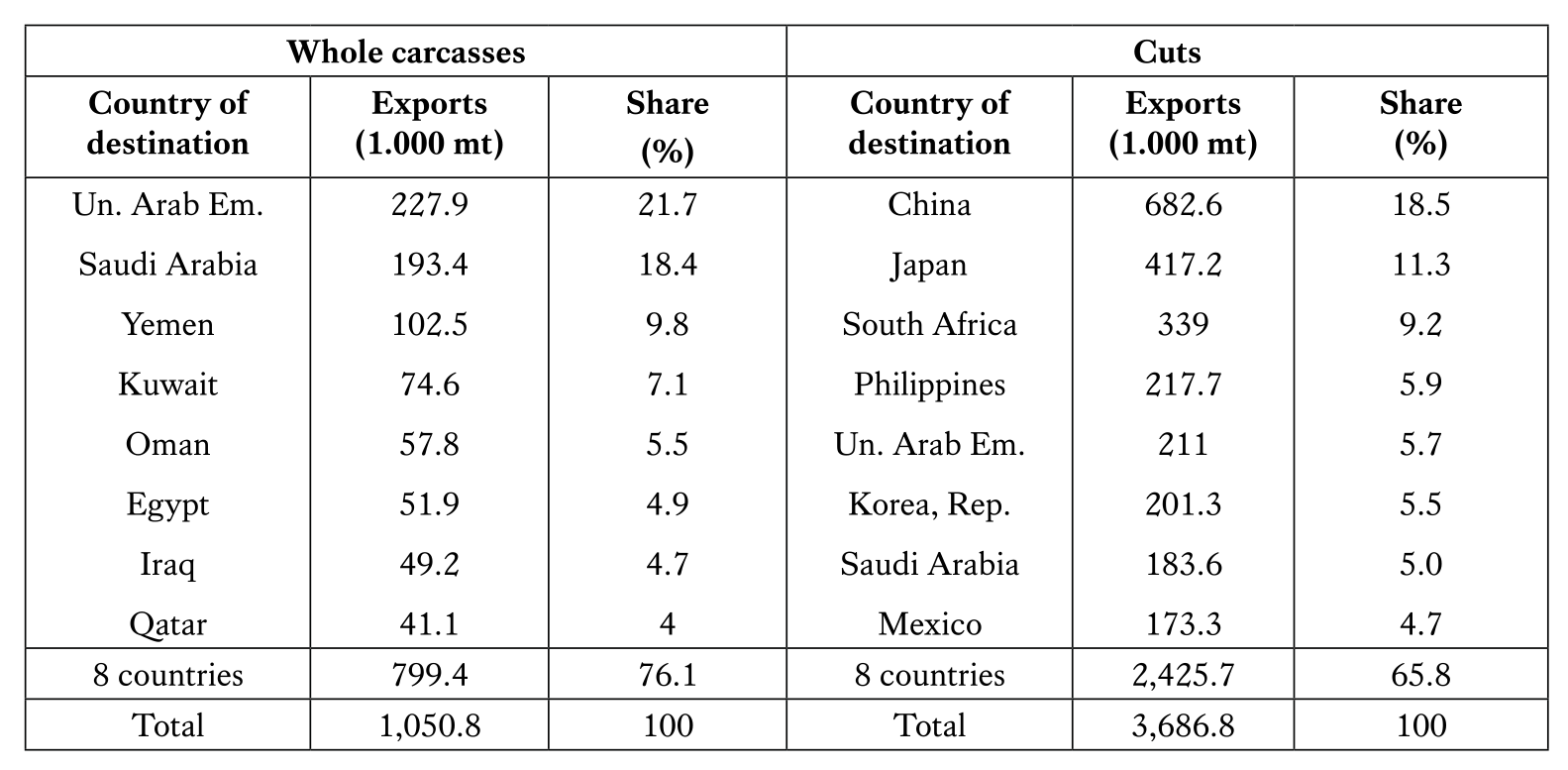

Export success with cuts and whole broilers

Brazil’s success on the global market for chicken meat is partly due to the composition of the product.

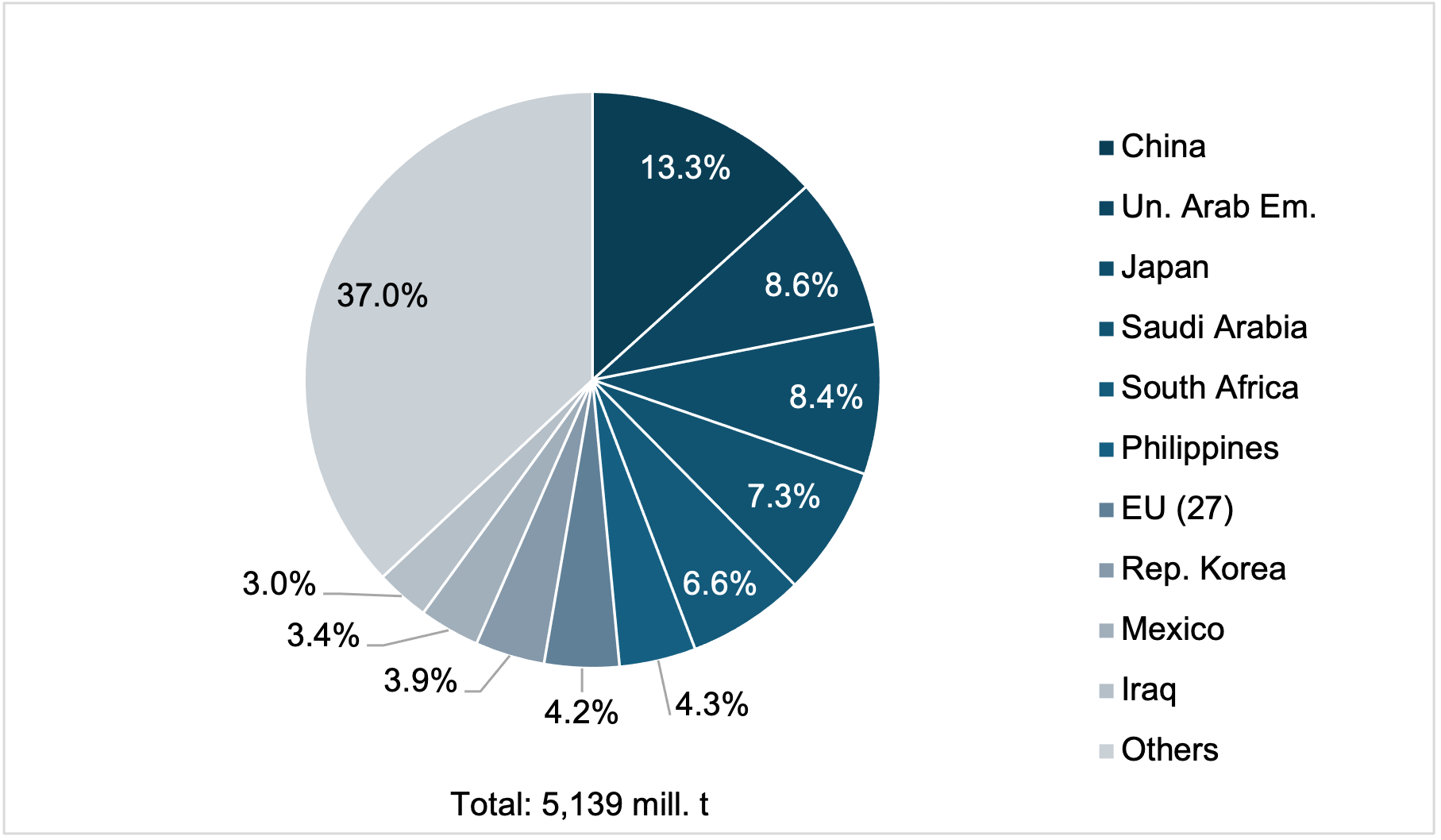

Figure 2 shows that while cuts were by far the most important export product with a share of 71.7%, whole carcasses still accounted for 20.4%. This differentiated Brazil from the USA, which only exported small quantities of whole carcasses. Demand for the latter was particularly strong in the countries of West Asia, especially on the Arabian Peninsula. Here, Brazilian companies dominated the market. In contrast, cuts were mainly exported to East and Southeast Asia as well as South Africa and Mexico (Table 3).

As can be seen from Figure 3, China, Japan and the Republic of Korea accounted for over a quarter of total exports, with China being the unchallenged leader. It remains to be seen whether this will change in the coming years given the strong increase of China´s production (Windhorst, 2024). Some countries on the Arabian Peninsula have also invested heavily in chicken production; nevertheless, demand has increased faster than production in recent years. Rapidly growing international tourism in Qatar and the United Arab Emirates also played a role in this. As chicken meat is not subject to a religious ban on consumption, it dominated the menus.

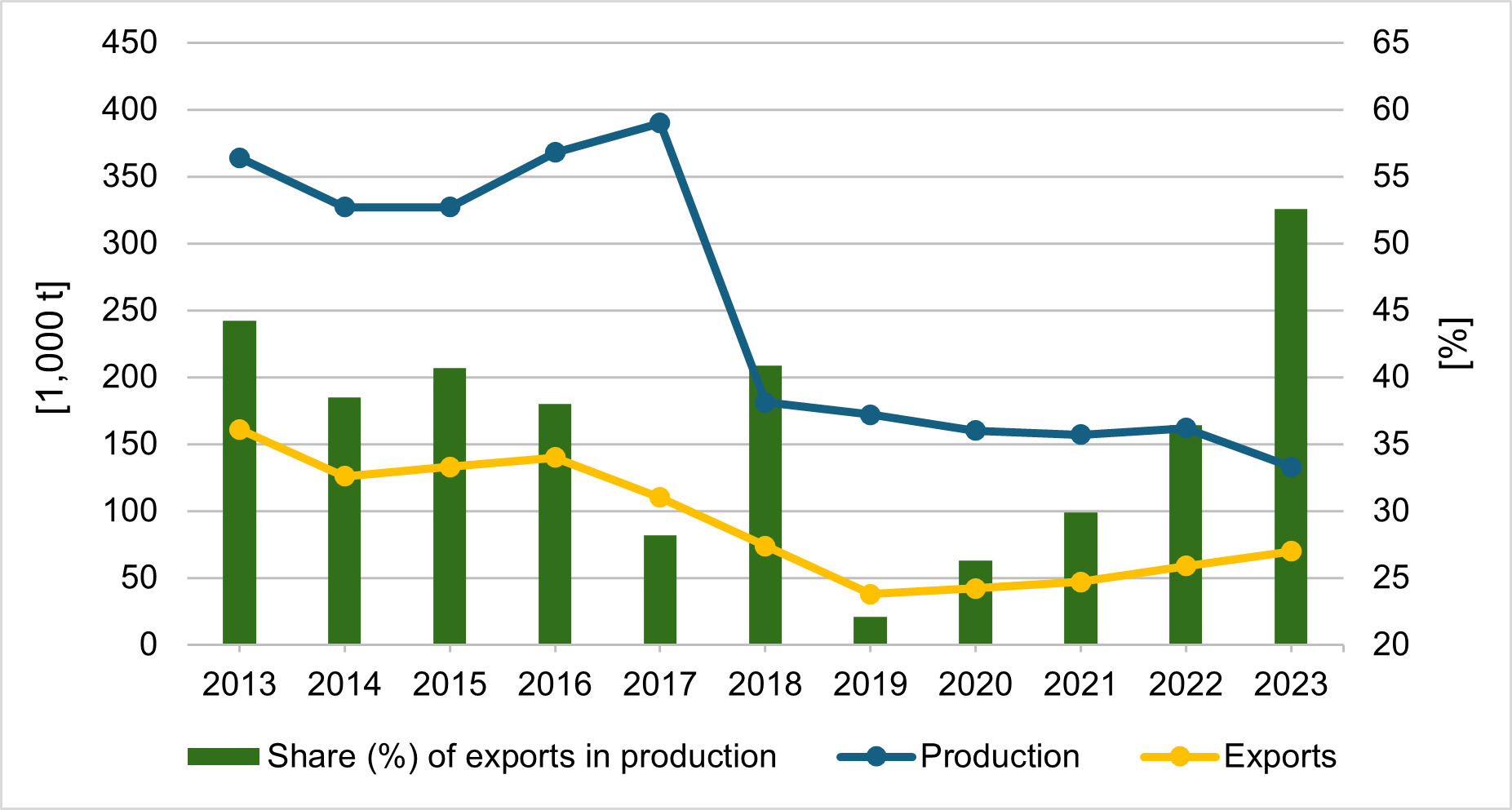

Turkey meat – sharp drop in production and trade

In contrast to the stable development in the production and export of broiler meat, there was a massive slump in turkey meat from 2017 onwards. Figure 4 shows that production increased between 2013 and 2017 and peaked at 390,000 mt. Production volumes then fell dramatically from 2018 onwards, reaching a low of just 133,000 mt in 2023, a drop of 66% since 2017. Turkey meat exports developed in parallel. This reached its highest level in 2016 at 140,000 mt, but then fell to just 38,000 mt by 2019, before recovering to 70,000 mt in the following years. The changes in the share of exports in production are remarkable. Here, the lowest value was reached in 2019 at 22.1%, rising to 52.6% by 2023. This increase is closely linked to the decline in per capita consumption from 0.6 kg to just 0.3 kg between 2020 and 2023.

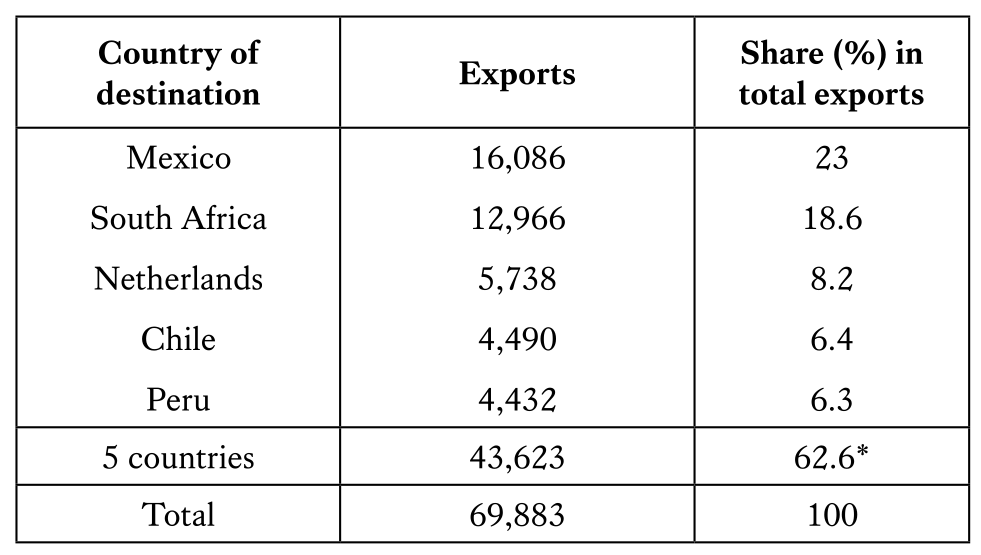

The exceptional dynamics is a consequence of the aforementioned Operation “Carne Fraca”. It had a much stronger impact on production, domestic consumption and exports than broiler meat. Between 2017 and 2019, the export volume fell from 110,000 mt to 38,000 mt, or by around two thirds. The leading export regions of Africa and Europe were particularly affected. Exports to the EU (27) decreased from 43,584 mt to just 8,027 mt between 2017 and 2019, with exports to the Netherlands alone, the main buyer country, falling from 31,848 mt to 7,221 mt or by 77.2% and to Germany from 3,228 mt to 248 mt or by 92.3%. Exports to Africa decreased from 36,315 mt to 19,484 mt or by 46.4%. Exports to South Africa fell by 57.0%, to Gabon by 80.0% and to Angola by 45.4%. It took several years for Brazilian turkey meat exporting companies to recover from this scandal, regain confidence and increase exports again. Here, the shortage of turkey meat as a result of the massive outbreaks of avian influenza in turkey flocks in the USA in the winter half-year 2022/23 played a role. Table 4 shows the five most important countries of destination in 2023.

As domestic demand declined from 2020 onwards, the leading companies increasingly focussed on exports. The most important target regions were America and Africa. They accounted for more than three quarters of total exports in 2023, with just over 15% going to EU member countries. Asia was of minor importance, as the consumption of turkey meat has no tradition there and is predominantly only offered in urban centres that play a role in tourism.

Cuts were mainly exported in 2023. Their share was 82.4%. The most important buyer countries were Mexico, the Netherlands, South Africa and Chile. Processed products accounted for 10.8% of exports. The Netherlands, Germany, Chile and South Africa were the most important destinations. Whole turkeys shared only 6.8% in the overall exports. They were mainly requested from Mexico and Singapore.

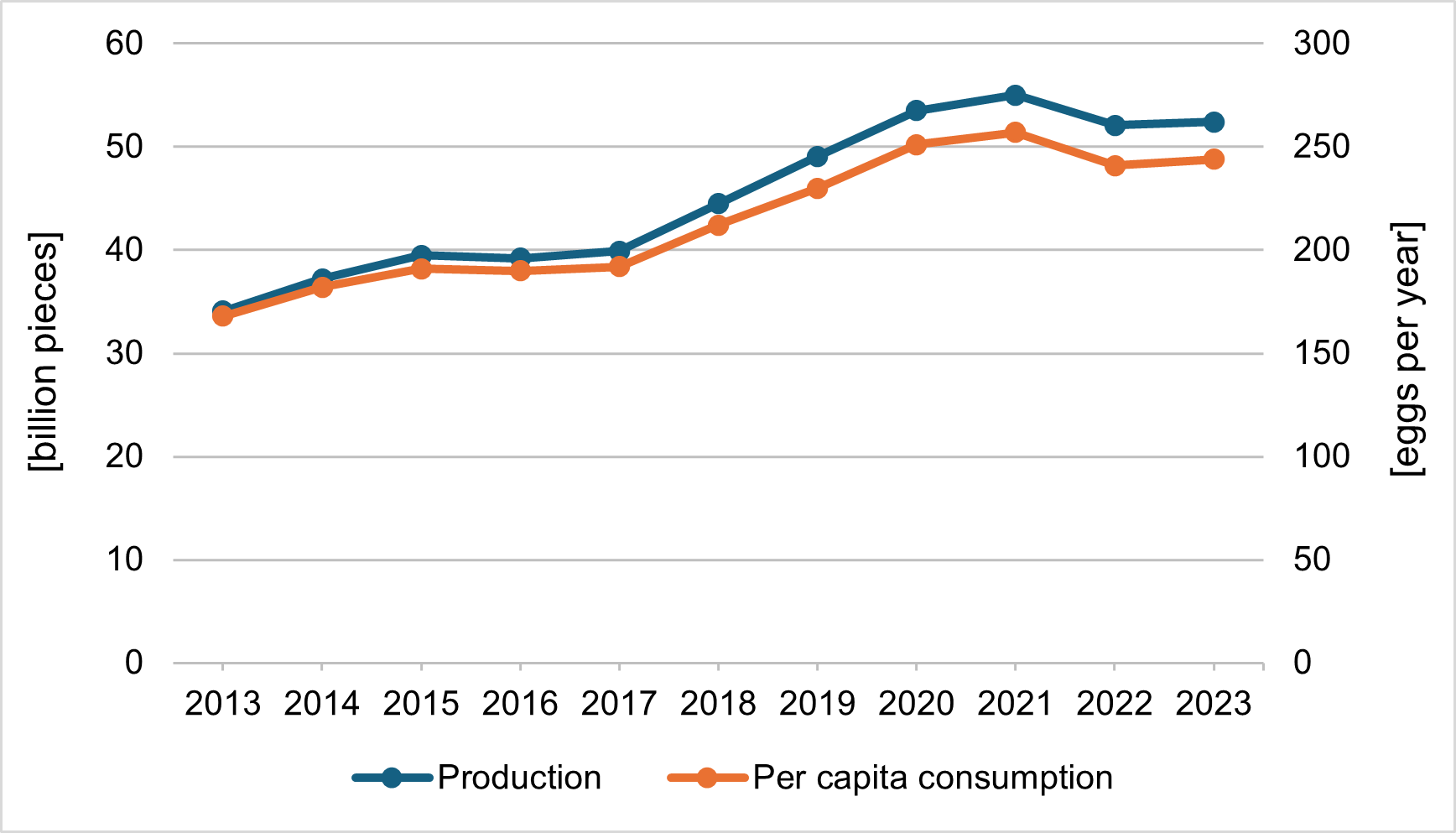

High growth rates in egg production and consumption

Brazilian egg production increased by 20.9 billion eggs, or 61.2%, between 2013 and 2021, when it peaked at 55 billion eggs. Figure 5 shows that production increased particularly rapidly between 2019 and 2021, but fell again in the following two years, levelling off at around 52 billion eggs. It is obvious that the Covid-19 pandemic played a decisive role in the rapid growth of the per capita consumption from 230 to 257 eggs between 2019 and 2021. The increased preparation of food in households was the decisive steering factor. When the wave of infections subsided and restaurants reopened, per capita consumption fell by 6.8% until 2023.

Exports were only of minor importance for Brazilian egg producers. In 2023, over 99% of the eggs produced were consumed domestically. In total, only 25,407 mt were exported, 65% of which as shell eggs and 35% as processed products (egg powder and liquid egg). The main buyers were Japan and Taiwan; processed products were mainly imported by Japan, the USA and Qatar. It is noteworthy that the export volume of hatching eggs, at 25,427 mt, was almost as high as that of eggs for human consumption. Mexico took slightly more than half, followed by Senegal, Paraguay and South Africa. The trade value of hatching eggs was more than twice as high as that of eggs for consumption. Overall, foreign trade in eggs was comparatively insignificant for the Brazilian egg industry.

Summary and outlook

The previous analysis documented the remarkable dynamics of the Brazilian poultry industry between 2013 and 2023. Very high absolute and relative growth rates were achieved in the production of broiler meat and eggs, at least until 2021. With the end of the Covid-19 pandemic, production declined slightly. While exports of broiler meat reached a new high of over 5 million mt in 2023, exports of eggs were comparatively insignificant. The production and export of turkey meat developed in a completely different way. Following a peak in production in 2017, both production and exports collapsed by 2019. This decline was caused by a meat scandal that was uncovered in 2017. Numerous countries stopped importing turkey meat and it took several years for exports to increase again. However, production volumes continued to decline, not least due to the falling per capita consumption. While the production and export of broiler meat will continue to develop dynamically in the coming years due to increasing demand on the global market, the perspectives for the turkey industry are less optimistic because of the declining domestic consumption. The dynamics in egg production will be determined by the development in per capita consumption.

Data sources and supplementary literature

ABPA (ed.). Relatório Annual 2020. São Paulo.

ABPA (ed.). Relatório Annual 2024. São Paulo.

Windhorst, H.-W. (2019). The dynamics of global poultry meat trade between 2006 and 2016 at continent and country level. Zootecnica International, 41(3), 26–31.

Windhorst, H.-W. (2021). The Champions League of the egg producing countries. Zootecnica International, 43(1), 26–29.

Windhorst, H.-W. (2022). Patterns and dynamics of global egg and poultry meat trade. Part 2: Poultry meat trade. Zootecnica International, 44(3), 24–27.

Windhorst, H.-W. (2023). Patterns and dynamics of global turkey meat production and trade. Part 2: Turkey meat trade. Zootecnica International, 45(3), 22–26.

Windhorst, H.-W. (2024). Was it the decade of Asia? The dynamics and patterns of global meat and egg production between 2012 and 2022. Zootecnica International, 45(5), 26–31.