The Japanese poultry sector continues to show resilience this year, despite rising production costs and repeated outbreaks of avian influenza.

This winter, Japan faced one of the most severe bird flu outbreaks in recent decades, resulting in the culling of up to 6 million birds and a sharp rise in poultry and egg prices. Although the situation has since stabilized, farmers remain under heavy pressure from the risk of new outbreaks and persistently high costs. Avian influenza is now regarded as one of the industry’s biggest threats, constraining growth even as demand for poultry products remains strong. With Japan’s rapidly aging population and shifting household structures, chicken meat and portioned products have become increasingly popular with consumers.

Development of the sector

Compared with other developed countries, Japan’s poultry industry developed relatively late, largely due to its agrarian structure dominated by large landholdings until the end of World War II. The traditionally low efficiency of Japan’s agricultural sector, including poultry, has long necessitated strong government support. Even today, domestic food and agricultural products remain more expensive than imports, in part because of higher production costs.

The 2011 earthquake and tsunami caused a sharp drop in poultry output, though the industry rebounded by 2012–2013. Since the early 2020s, both poultry and egg production have been on the rise, supported by steady demand for affordable, healthy protein despite the challenge of rising feed prices.

Bird flu threat and high costs

According to a recent study by IMARC Group and the Japan Poultry Association, 2024 was a relatively strong year: egg production reached 2.48 million tons, up 2.2% from the previous year, alongside higher poultry output. However, prospects for 2025 remain uncertain, given the continuing threat of avian influenza and the likelihood of further outbreaks.

The number of poultry farms in Japan has declined in recent years. Today, there are about 1,620 farms nationwide, housing a total of 129 million birds. Large-scale farms with more than 50,000 chickens account for only 3% of operations but produce 33.5% of national output. Key production areas include Kagoshima, Chiba, and Ibaraki prefectures.

Analysts warn that rising costs are likely to accelerate consolidation, with smaller producers being squeezed out by larger competitors.

The need for reform

The Japanese government has acknowledged the challenges facing the sector and is planning reforms to improve efficiency and stem the loss of farmers. There is also growing emphasis on animal welfare, reflecting increasing social awareness of production conditions.

Toshiaki Saito, president of the Japan Poultry Association, stressed the urgency of these measures:

“The ever-rising cost of raw materials, especially feed, has severely reduced profitability. After the large-scale outbreak of highly pathogenic avian influenza in 2022, we are now facing a similar situation. Producers have suffered heavy losses from culling at affected farms, and supplies of eggs and poultry meat have yet to return to pre-outbreak levels.”

Government support measures

The government has announced additional measures against avian influenza, including wider vaccination of poultry flocks starting this autumn. Financial support will also be expanded, with subsidies directed toward both disease prevention and improved compensation schemes in case of future outbreaks. Several of these measures have already been approved by the Ministry of Agriculture, Forestry and Fisheries.

Outlook: bright prospects ahead

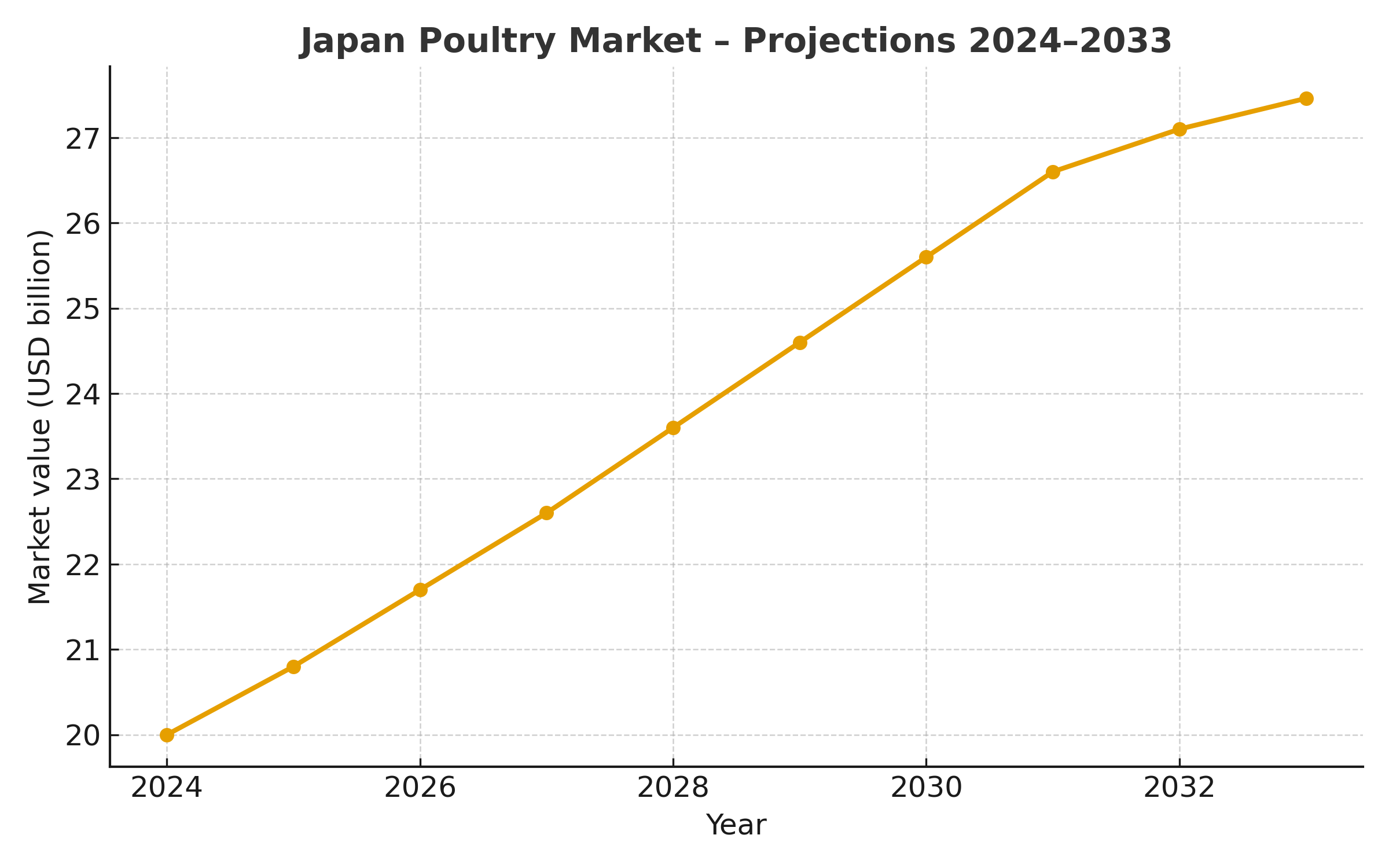

Despite ongoing challenges, analysts remain optimistic about the sector’s long-term outlook. IMARC Group projects that Japan’s poultry market will grow from about USD 20 billion in 2024 to USD 27.46 billion by 2033, with an average annual growth rate of around 4%.

To maintain quality while boosting output, farmers are increasingly adopting advanced technologies such as automation, precision feed management, and improved breeding practices. These innovations, combined with sustained government support, are expected to ensure a sustainable and competitive future for Japan’s poultry industry.