It is estimated that with population growth and the increasing purchasing power of a growing middle-class in many developing and threshold countries meat consumption will also grow. In this overview, a projection for the future development of global meat production between 2016 and 2026 will be presented. It will focus on the dynamics in poultry meat production, the fastest growing meat type between 2006 and 2016, but will also look at the dynamics in pig meat production which in many countries is the main competitor for poultry meat.

Different dynamics at regional level and by meat type

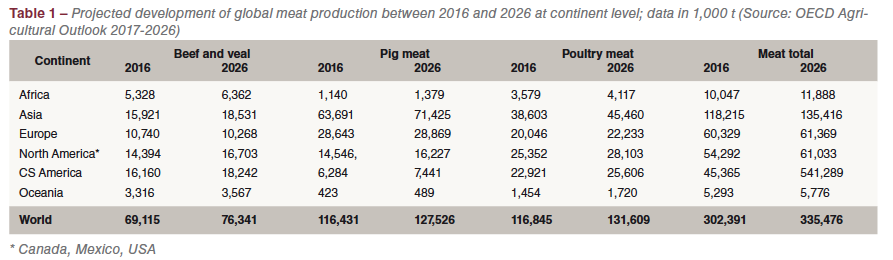

In Tables 1 and 2, the projected development of global meat production at continent level and by meat type is documented. Global meat production is expected to grow by 33 mill. t in the analysed time period and reach a volume of 302 mill. t.

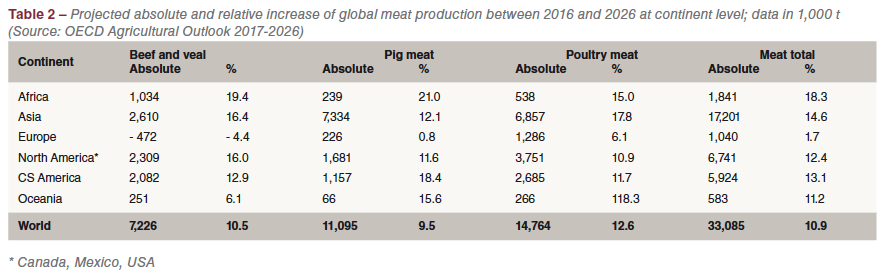

A comparison of the regional development reveals that Asia will contribute 17.2 mill. t or 52.0 % to the global growth, followed by North America with 20.4 % and Central and South America with 17.9 %. At the level of meat types remarkable differences can be observed (Figure 1). Poultry meat will share14.8 mill. t or 44.6 % in the global increase of meat production, followed by pig meat with 11. 1 mill. t or 33.5 % and beef and veal with 7.2 mill. t or 21.8 %.

A closer look at the regional development in poultry meat production shows that the regional differences are much smaller than in total meat. With a share of 46.4 % Asia is in a leading position, but the American double continent reaches 36.8 %. Meat production in Europe will increase much slower than in the other continents. While it is expected that beef and veal will even decrease by 4.4 %, and pig meat grow only by 0.8 %, poultry meat production will grow by 6.1%. This documents a shift in the per capita consumption from the expensive beef and veal to poultry meat. Pig meat, which already shows a high per capita consumption, will not change very much in the coming decade. The changing meat consumption of an aging population, a lower meat consumption of the younger age-classes and religious barriers are the main steering factors behind this trend. Poultry meat has the advantage that no religious barriers forbid its consumption and that it is dominating in fast food chains.

A closer look at the regional development in poultry meat production shows that the regional differences are much smaller than in total meat. With a share of 46.4 % Asia is in a leading position, but the American double continent reaches 36.8 %. Meat production in Europe will increase much slower than in the other continents. While it is expected that beef and veal will even decrease by 4.4 %, and pig meat grow only by 0.8 %, poultry meat production will grow by 6.1%. This documents a shift in the per capita consumption from the expensive beef and veal to poultry meat. Pig meat, which already shows a high per capita consumption, will not change very much in the coming decade. The changing meat consumption of an aging population, a lower meat consumption of the younger age-classes and religious barriers are the main steering factors behind this trend. Poultry meat has the advantage that no religious barriers forbid its consumption and that it is dominating in fast food chains.

Regional concentration of production will decrease

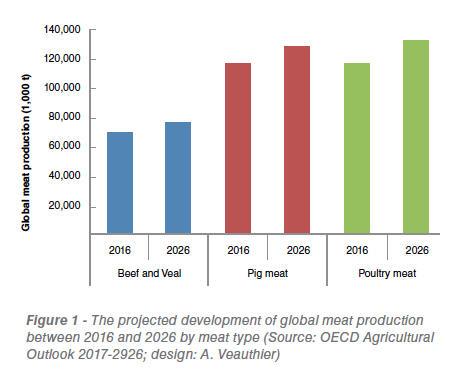

It is projected that the global production volume of poultry meat will increase by 14.8 mill. t or 12.6 % in the analysed time-period and that one of the ten leading countries, on the other hand, by only 11.9 %. The regional concentration in production will also decrease slightly from 72.4 % to 71.9 %. This indicates that poultry meat will be produced by an increasing number of countries, trying to meet the domestic demand. The composition of the ten leading countries will not change very much, but there will be some changes in the ranking. It is projected that Brazil will have surpassed the EU (28) by 2026. It is also expected that India and Mexico, as well as Indonesia and Iran, will change their ranks. The highest absolute growth of poultry meat production will be realized in China with 3.2 mill. t, followed by the USA and Brazil.

While the gap between the production volumes of the USA and Brazil will become wider by almost 900,000 t, that between the USA and China will shrink from 3.4 mill. t to only 867,000 t. It is expected that, because of the rising per capita consumption of poultry meat in the urban agglomerations of China and the favourable feed conversion rate, China will foster broiler growing, but also that of ducks and geese. Brazil will be able to strengthen its position in the global broiler meat market even though production will grow faster in the USA. The highest relative growth will be found in India and Indonesia. A fast growing population, higher incomes in the middle class and a preference for poultry meat, in particular in the younger population, will besides religious barriers be the main driving forces behind the fast growth. It is remarkable that of the ten leading countries (here the EU is counted as one country) seven are threshold countries. They will also in the coming decade play an important role in the dynamics of the global poultry meat industry.

Wide differences in the per capita consumption of poultry meat

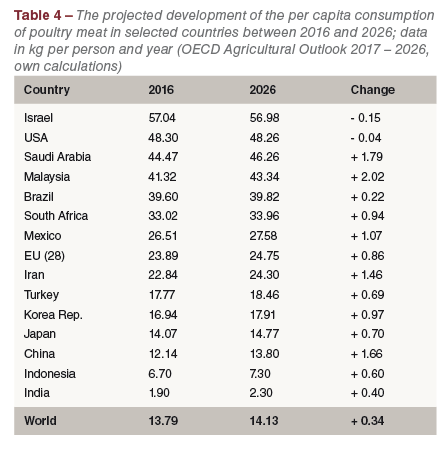

It is projected that global per capita consumption of poultry meat will grow by 0.34 kg between 2016 and 2026 and reach a value of 14.13 kg. The data in Table 4 shows the wide differences between the consumption in selected countries.

It is projected that global per capita consumption of poultry meat will grow by 0.34 kg between 2016 and 2026 and reach a value of 14.13 kg. The data in Table 4 shows the wide differences between the consumption in selected countries.

Israel will be in a leading position with almost 57 kg, followed by the USA, South Africa and Malaysia. For Israel and the USA, a lower value is expected for 2026 than in 2016. This is due to the already very high consumption.

A considerable growth of the per capita consumption is in contrast projected for Malaysia, Saudi Arabia, China and Iran. Because of the high population, the expected increase in China will either result in a considerable growth of the domestic production volume or higher imports. Very low will be poultry meat consumption in India with only 2.3 kg and Indonesia with 7.3 kg. In particular, the low value for Indonesia is surprising in comparison to Saudi Arabia and Iran despite the high percentage of the Islamic population.

What about the competition of pig meat?

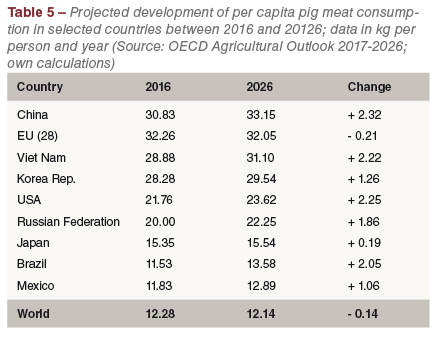

In several countries with a high per capita consumption of poultry meat, pig meat is also a favoured meat. In contrast to poultry meat, the average global per capita consumption is, however, expected to decrease from 12.28 kg to 12.14 kg. In some countries pig meat may lose shares in others it may further increase. The data in Table 5 shows that in the USA and the EU (28) pig meat consumption will decline while in China, Vietnam, the Russian Federation and Korea it will further grow. It is worth mentioning that in China and Korea the per capita consumption will surpass that of the EU (28). It is also of interest that in China, Korea, Japan and the EU (28) the per capita consumption of pig meat is higher than that of poultry meat while in the USA and Brazil poultry meat reaches much higher values than pig meat. The differences can be explained by long traditions of favoured food, religious barriers, production costs and political strategies. It can be expected that the pattern in these countries will not change in short term.

In several countries with a high per capita consumption of poultry meat, pig meat is also a favoured meat. In contrast to poultry meat, the average global per capita consumption is, however, expected to decrease from 12.28 kg to 12.14 kg. In some countries pig meat may lose shares in others it may further increase. The data in Table 5 shows that in the USA and the EU (28) pig meat consumption will decline while in China, Vietnam, the Russian Federation and Korea it will further grow. It is worth mentioning that in China and Korea the per capita consumption will surpass that of the EU (28). It is also of interest that in China, Korea, Japan and the EU (28) the per capita consumption of pig meat is higher than that of poultry meat while in the USA and Brazil poultry meat reaches much higher values than pig meat. The differences can be explained by long traditions of favoured food, religious barriers, production costs and political strategies. It can be expected that the pattern in these countries will not change in short term.

Summary and perspectives

Between 2016 and 2026, global meat production increased by 33 mill. t or 10.9 % and reached a volume of 302 mill. t. Poultry meat is expected to remain the fastest growing meat type in the coming decade and contribute almost 45 % to the global growth of meat production. Asia will strengthen its leading position and share over 40 % of the global production volume in 2026.

The regional concentration of poultry meat production is very high. In 2026, the ten leading countries will contribute almost 72 % to the total growth of the production volume, the three leading countries (USA, China and Brazil) 45.8 %.

The per capita consumption will differ considerably between countries. In Israel almost 57 kg will be consumed in 2026, in India only 2.3 kg. Tradition, religious barriers, purchasing power of the consumers and strategies in economic policy will be the main steering factors. This is also the case when comparing the per capita consumption of poultry and pig meat.

Data source

OECD Agricultural Outlook 2016-2026. www.stats.oecd.org