Chicken is the second most consumed meat in China, following pork, and accounts for approximately 20% of total meat consumption. It serves as a significant source of protein, though it is predominantly consumed fresh compared to other meats. The processing of chicken primarily focuses on whole chicken processing and sales, with limited availability of further processed products.

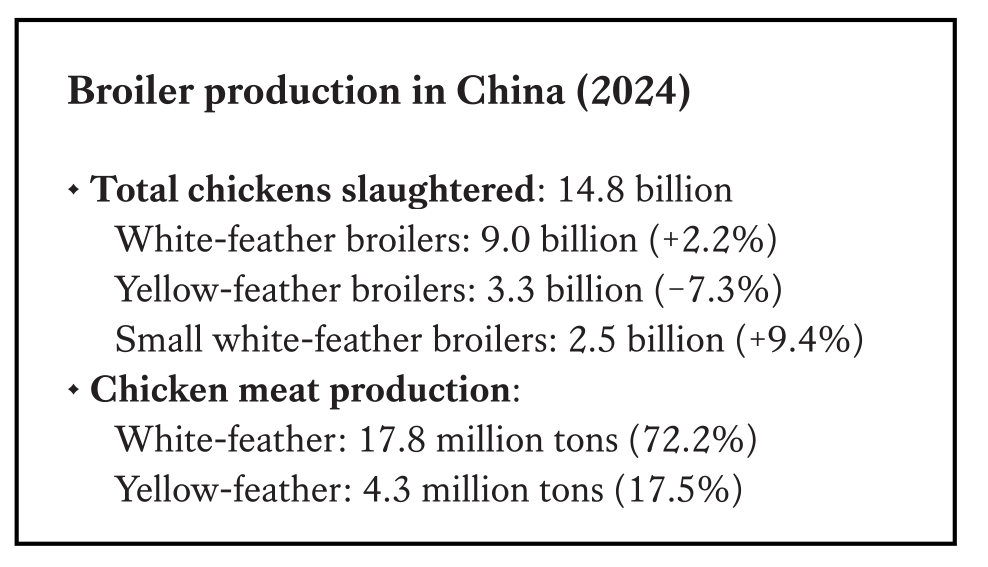

According to the Ministry of Agriculture of China, total broiler output reached a record high of 14.8 billion chickens in 2024. White-feather broilers accounted for 9.0 billion, reflecting a year-on-year increase of 2.2%. Yellow-feather broilers totaled 3.3 billion, representing a decline of 7.3%, while small white-feather broilers rose to 2.5 billion, marking an increase of 9.4%.

In terms of production volume, white-feather broilers continue to dominate the market, contributing 17.8 million tons of chicken meat, which accounts for 72.2% of total output. In contrast, yellow-feather broilers produced 4.3 million tons, representing 17.5%, indicating a decline in market share compared to previous years.

This shift highlights the growing preference for white-feather broilers, which are favored for their efficiency in large-scale industrial production. In contrast, the standardized production system for yellow-feathered broilers has lagged behind, encountering significant challenges such as high production costs and inconsistent performance.

White-feathered broiler chickens

Last year, the supply and demand for white-feathered broiler chickens were relatively balanced. However, chicken consumption growth was weak, leading to a decline in broiler chicken prices for two consecutive years. Most of the industry’s profits were concentrated in upstream breeding operations, while the slaughtering segment experienced losses.

Declining feed costs have alleviated profitability pressures. According to Aige Agriculture, the purchase price of broiler chickens was 7.8CNY per kilogram in 2024, representing a 13% decrease from 2023. Broiler farming turned unprofitable, with an average loss of 1.3CNY per chicken. The ex-factory price of chicken legs was 11.6CNY per kilogram, down 6% from 2023, while the ex-factory price of chicken breast was 8.6CNY per kilogram, a decline of 15% from the previous year. Additionally, the loss incurred from slaughtering a chicken was 0.08CNY.

In 2024, the prices for parent-generation breeder chicks and commercial-generation chicks were 57CNY per set and 3.26CNY per bird, respectively, reflecting a year-on-year decrease of 24% for parent-generation chicks and an increase of 5% for commercial-generation chicks. Farming parent-generation breeder chickens proved to be more profitable.

Leading companies consistently enhance their competitiveness

In 2024, the cost of raising white-feathered and yellow-feathered broilers decreased by 10% and 5.1%, respectively, compared to 2023. The decline in feed prices and the increase in chick prices are the two most significant factors affecting broiler farming costs. Recently, ten major poultry companies reported their net profits for 2024. Their performance has improved markedly compared to 2023, with only one company incurring losses while the others all achieved profitability. The largest profit was reported by Wen’s Foodstuffs’ chicken division, amounting to CNY2.2 billion (US$306.8 million).

China’s large-scale white-feather broiler enterprises plan to invest over CNY30 billion within the next three years. This investment will primarily focus on full-industry chain projects that integrate breeding, slaughtering, and deep processing, with additional emphasis on the breeding chicken sub-sector. In 2024, investment in the white-feathered broiler chicken industry exceeded CNY10 billion.

Ongoing projects are progressing, with planned investments in slaughtering capacity exceeding 1 billion chickens. The proportion of investment in deep processing is expected to rise to 35%, and high-end manufacturing initiatives, such as specialized production lines for pre-prepared meals, will emerge. Additionally, domestic substitution at the genetics source level will accelerate, and the research and development investments of the three major breeding companies will continue to rise, with the number of grandparent chickens in production surpassing 1.3 million sets. From the perspective of investment entities, funding in the white-feathered broiler industry is mainly concentrated among leading companies.

Shengnong development

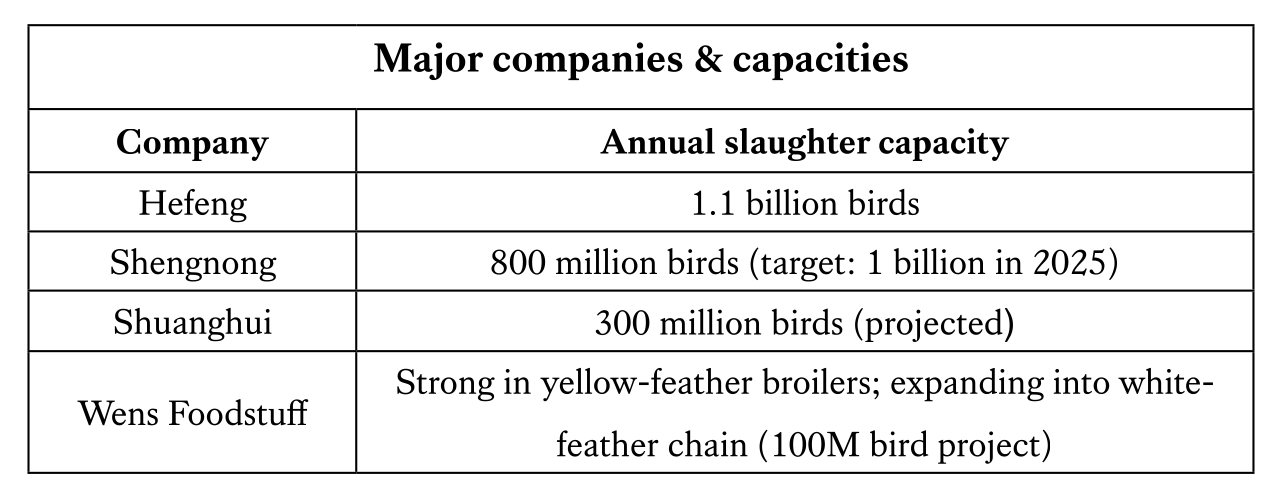

Shengnong Development’s tenth food factory commenced production in July 2024, increasing its annual deep food processing capacity by 60,000 tons. In December 2024, the company successfully acquired 100% of the shares of Sun Valley. It is estimated that the slaughtering capacity has reached approximately 800 million chickens, with a target of achieving 1 billion chickens by 2025.

Hefeng animal husbandry

The broiler business of Hefeng is primarily situated in the northern provinces of Henan, Hebei, and Shandong. The overall production and sales scale of the broiler slaughtering and processing division continues to grow. With the successful establishment of three new modern facilities, including Hebei Taihang, the company’s total annual slaughtering capacity – under its control and investment – exceeds 1.1 billion chickens. In 2024, the total number of poultry slaughtered by the company surpassed 1 billion.

Shuanghui

Shuanghui has expanded its broiler breeding and slaughtering capacity. The company continues to strengthen the synergistic advantages of its industrial chain while promoting diversified development within the meat industry. With the gradual commissioning of new poultry industry projects, including Xihua, Fuxin Zhangwu, and Luohe Second Industrial Park, the annual broiler production capacity is projected to reach 300 million.

Wens foodstuff

Wens Foodstuff, the largest yellow-feathered broiler breeding enterprise, has expanded into the white-feathered broiler market. The company’s investment in Guannan’s 100 million broiler chicken full industry chain project is progressing rapidly.

Also, Fengsheng Group, Chengda Food, Xixiang, Zhonghe Food, Xinhesheng, Xiantan, Daxiang, and other local leading enterprises continue to expand and increase their market share. Additionally, Yisheng, Zhongxin Food, Shandong Dingli, and Minhe have deployed breeder chickens and invested in chick production capacity exceeding 200 million.

In terms of investment regions, the majority of white-feathered broiler investment projects are concentrated in the northern region, which includes Liaoning, Shandong, Henan, Inner Mongolia, Jilin, and Heilongjiang. In contrast, there are fewer investment projects in the southern region, such as Shengnong’s projects in Fujian, Wen’s projects in Jiangsu, Chengda’s projects in Hubei, and Xixiang’s projects in Anhui.

It is projected that the new capacity for slaughtering white-feathered broiler chickens will surpass 1 billion by 2024-2025.

The white-feathered broiler chicken industry is confronted with the challenge of overcapacity, and companies that possess advantages in branding, distribution channels, management, and scale will be more competitive. The trend of mergers and reorganizations among large enterprises has intensified, leading to an increase in industry concentration.

Declining imports and rising exports

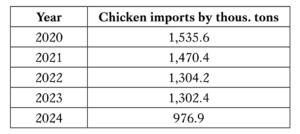

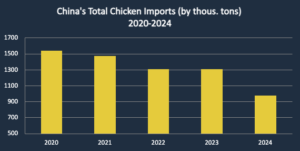

According to the General Administration of Customs, China’s total chicken imports reached 976,900 tons in 2024, representing a year-on-year decrease of 27.5%. This is the first time the volume has dropped below 1 million tons since 2020, and imports have declined for five consecutive years. The primary factors contributing to this decline include growth in domestic production, stagnant consumption, and currency pressures, particularly the depreciation of the Chinese yuan against the US dollar.

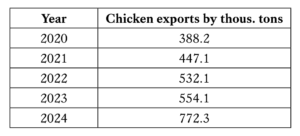

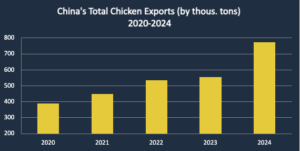

In 2024, China’s total chicken exports reached 770,300 tons, representing a year-on-year increase of 39%. The exports were distributed across 96 countries and regions. Japan (185,400 tons) and Hong Kong (182,300 tons) accounted for 24.1% and 23.7% of the total exports, respectively.

Key challenges and priorities

China’s ongoing dependence on imported genetic stock for white-feather broilers continues to be a strategic concern. Imports of grandparent stock reached 1.5 million sets, reflecting a 17.3% increase from 2023. Despite advancements in domestic breeding, reliance on foreign genetics remains significant. Currently, the country’s three domestic white-feather broiler breeds – Shengze 901, Guangming 2, and Wode 188 – account for only 28% of the market, leaving the industry 72% dependent on foreign sources. The report warns that China has not yet achieved a level of self-sufficiency that would protect against potential disruptions in imports.

To ensure stability, industry experts advocate for the expansion of domestic breeding programs, the improvement of marketing strategies, and the leveraging of global trade opportunities. Xin Xiangfei, a researcher at the Institute of Agricultural Economics and Development, the Chinese Academy of Agricultural Sciences and an expert in industrial economics at the National Broiler Industry Technology System, said that China’s broiler industry has five major problems:

- insufficient market consumption

- high dependence on foreign genetic sources

- increased pressure on disease prevention and control

- a disaster prevention, mitigation, and relief system in need of improvement

- the construction of a modern production system that needs to be accelerated.

In response to the aforementioned challenges, Xin Xiangfei advised that China should prioritize upgrading of domestic broiler varieties while promoting their application. In addition, he recommended expanding the pilot areas for subsidies related to domestic white-feathered broiler varieties and increasing the subsidy amounts to increase the market share of these domestic varieties.

Finally, he proposed enhancing scientific and technological innovation to conserve grain, reduce consumption, lower costs, and increase efficiency and implementing a “going overseas” development strategy to expand the international opportunities.

Overall, the supply of chicken exceeds demand in China. The domestic development trend of the chicken industry exhibits diverse characteristics, including large-scale breeding, intensive land use, standardized slaughtering, and brand management. Accordingly, the industry should make concerted efforts to further develop sustainable and modern production systems.