According to the EU Agricultural Outlook 2025–2035, poultry and eggs are the only meat sectors in the European Union projected to expand in both production and consumption over the coming decade, despite persistent uncertainty linked to animal disease outbreaks and geopolitical factors.

Poultry meat production

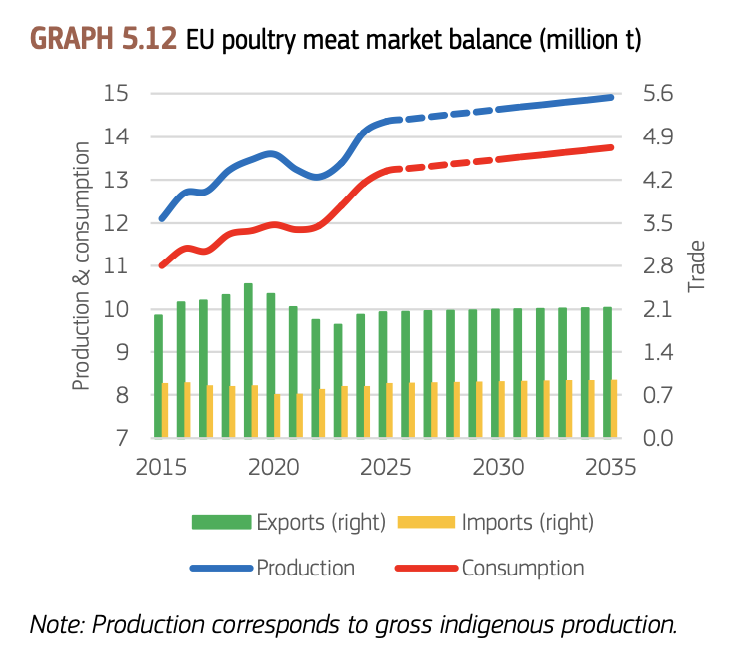

In 2025, EU poultry meat production is estimated to continue increasing slightly compared with 2024, supported by solid consumer demand and favourable feed cost and output price conditions. Over the period to 2035, EU poultry production is projected to rise by 965,000 tonnes, corresponding to an average annual growth rate of +0.7%.

The report notes that future production growth may be uneven across regions, as stricter environmental legislation and the transition towards more sustainable production systems could limit expansion in certain Member States. In addition, unlike previous years, highly pathogenic avian influenza (HPAI) is expected to remain present throughout the year rather than as a seasonal phenomenon, posing an ongoing challenge for the poultry sector.

Poultry consumption

EU poultry consumption is expected to continue increasing between 2025 and 2035. Per capita poultry consumption is projected to rise from 15.1 kg per year (2023–2025 average) to 16.5 kg per year by 2035. The outlook attributes this increase to consumer preferences for poultry as a convenient, affordable and widely perceived healthy protein source, as well as higher demand from food service and food processing sectors.

At the same time, overall EU meat consumption is projected to decline marginally over the outlook period, with a continued shift away from beef and pigmeat towards poultry.

Imports

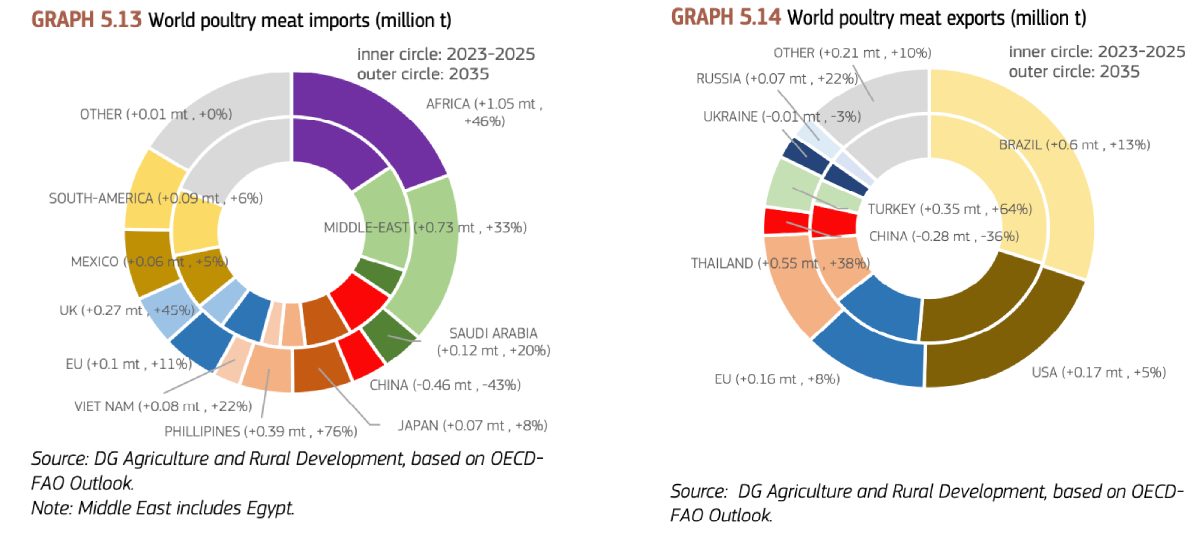

To meet rising demand, EU poultry meat imports are projected to increase by +1.1% per year, reaching approximately 955,000 tonnes by 2035. Imports are supported by relatively higher poultry prices in the EU compared with world markets. In 2025, increased imports from Brazil, the United Kingdom and Thailand were already observed.

Exports

Global import demand for poultry meat is expected to increase by 2.5 million tonnes by 2035, driven mainly by growth in the Middle East, Africa and Asia. Following a period of decline, EU poultry exports are projected to regain momentum, growing at an average rate of +0.8% per year to reach more than 2.1 million tonnes by 2035.

Exports to the United Kingdom are expected to remain strong, while shipments to Africa, Asia and the Middle East are projected to increase. However, the EU’s share of global poultry exports is expected to remain broadly stable at around 12.5%, as competition from lower-cost producers such as Brazil, the United States, Thailand and Ukraine intensifies.

Prices

Prices

EU poultry prices reached historically high levels in 2025. The average EU price for chicken broiler carcasses exceeded EUR 3,000 per tonne for the first time, reflecting tight supply and strong demand. Over the longer term, EU poultry prices are projected to increase gradually to around EUR 2,850 per tonne by 2035, in line with sustained EU demand and developments on world markets

Egg sector outlook

Egg production

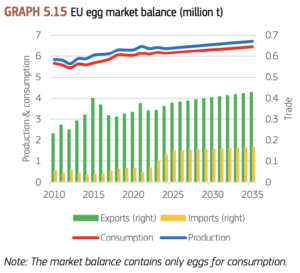

Between 2015 and 2025, EU egg production grew by an average of +0.8% per year. Over the 2025–2035 outlook period, egg production is projected to continue increasing, but at a slower average annual rate of +0.5%.

This moderation reflects forecasts of declining population growth and potential supply challenges linked to HPAI. Productivity gains in the egg sector may come from automation, digitalisation and genetic progress, including improvements in laying persistence and hen longevity. However, these gains could be partly offset in the short term by the implementation of animal welfare policies and the gradual phase-out of the killing of day-old male chicks, with in-ovo sexing increasingly adopted as a welfare-friendly alternative rather than as a practice being discontinued.

Egg consumption

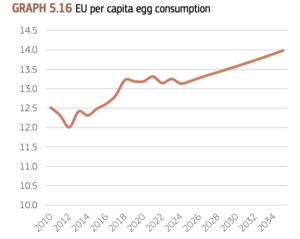

EU per capita egg consumption is projected to grow by +0.5% per year, reaching 14 kg per capita by 2035. Consumption trends are driven by the ease of preparation of eggs, their role as a relatively affordable source of protein, increased health awareness among consumers, and an ageing population, as older consumers tend to consume more eggs.

Demand from the egg processing industry is also expected to remain strong, particularly for eggs used as ingredients in bakery products, desserts, sauces and ice cream. With rising incomes, demand for organic and free-range eggs is projected to increase.

Egg imports

Due to the perishability of eggs, the EU sources most imports from neighbouring countries, mainly Ukraine and the United Kingdom. Over the past three years, imports from Ukraine increased significantly, accounting for around 60% of total EU egg imports in 2023 and 2024. EU egg imports are projected to grow by +2.7% per year over the coming decade, assuming imports from Ukraine remain at levels similar to those observed in 2025.

Egg exports

Global egg consumption is expected to grow by 13% between 2025 and 2035, particularly in India and emerging markets in South-East Asia such as Vietnam and Indonesia. While global egg trade remains limited—representing around 1.5% of total global production due to transport costs, perishability and HPAI restrictions—the expansion of egg processing in emerging markets could support future trade opportunities.

In 2025, EU egg exports are expected to increase by +5% in volume compared with 2024. Over the longer term, EU egg exports are projected to grow by around +1.7% per year, supported by demand in neighbouring countries and exports of albumin, particularly to Japan.

Source

European Commission – EU Agricultural Outlook 2025–2035 (DG Agriculture and Rural Development, based on OECD-FAO Outlook)