In October 2019, FAO published a complete data set for global egg trade in 2017 at country level. This allows an overview on the patterns of global egg trade at country and continent level. Even though only 2.1 mill. t or 2.7% of global egg production were traded, egg trade was an important economic factor for many countries either for exports or imports. In this paper, it will be analysed which countries were leading in egg exports resp. imports. The final chapter presents egg trade flows for selected countries.

High regional concentration in egg production

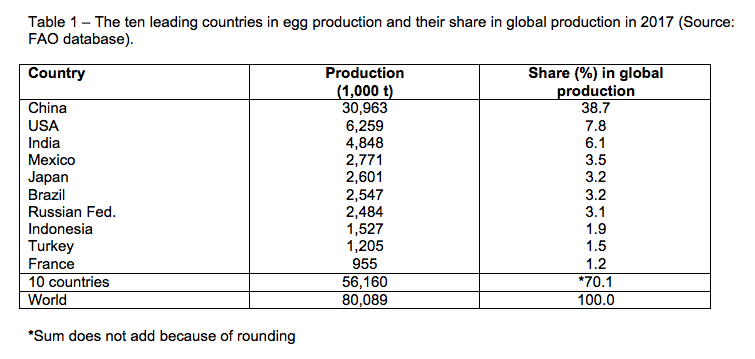

In Table 1, the ten leading countries in egg production in 2017 are listed. The data shows that the regional concentration in egg production was very high. The ten leading countries shared over 70% of the global production volume, China alone 38.7%. Even though the date reported by China can be challenged, the dominating role of this country is obvious. The five Asian countries, as listed in Table 1, contributed 51.4% to global production. Besides the Russian Federation, a European country according to FAO, only France ranked in tenth place as a second European country in with a share of 1.2%.

European countries were leading in global egg trade

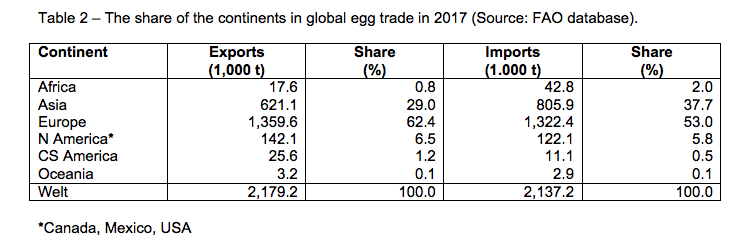

In 2007, European countries contributed 63.2% to the global egg exports and 67.0% to imports. While the contribution to exports did not change very much, the share in import volume fell to 53.0%. This documents that obviously considerable changes in the egg demand occurred in the decade between 2007 and 2017 outside Europe. Table 2 documents the share of the continents in global egg trade in 2017.

From the data in Table 2 it becomes obvious that eggs were mainly traded in Europe and Asia. In 2017, the two continents together shared over 90% in exports as well as in imports. Only North American countries gained considerable shares with 6.5% resp. 5.8%. Oceania and Central and South America only played a minor role in global egg trade. The considerable increase of egg imports by Asian countries is worth noting. Between 2007 and 2017, their share grew from 25.2% to 37.7%. In contrast, their contribution to exports changed only from 27.3% to 29.0%. This does not mean, however, that single countries could not increase their exports considerably.

High regional concentration in egg exports

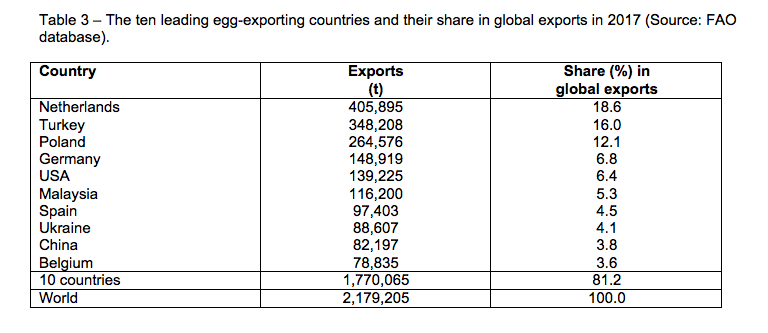

Of the 2.1 mill. t of eggs which were traded in 2017, 1.8 mill. t or 81.2% were contributed by only ten countries. As can be seen from Table 3, the Netherlands, Turkey and Poland ranked in the top three positions. Together they share 46.7% in the global export volume. §

Global egg exports increased by 765,000 t or 54.1% between 2007 and 2017. This documents the considerable growth of egg demand as a protein source in human nutrition. Turkey (+301,500 t), Poland (+158,300 t) and the Netherlands (+60,200 t) showed a remarkable increase in their export volumes. Despite the low self-sufficiency rate of less than 70%, Germany exported almost 58,000 t more in 2017 than in 2007. The considerable growth of the egg exports by Turkey and Poland is a result of high financial investments in modern housing systems, the change to hybrid hens, the use of high-quality feed and an experienced veterinary service.

Only four countries shared more than half of the egg imports

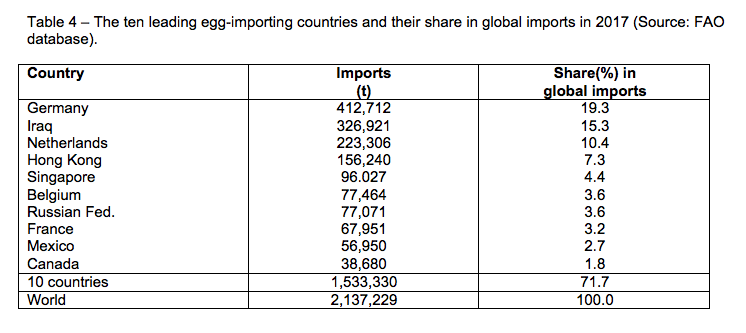

Global egg imports grew by 722,500 t or 51.1% between 2007 and 2017. Of the total import volume, the four leading countries shared 52.3%, more than one third by Germany and Iraq alone.

The data in Table 4 shows that Germany imported almost every fifth egg that reached the global market. Despite a considerable increase in domestic production, imports grew by about 100,000 t because of the increase of the per capita consumption from 209 to 235 eggs in the analysed decade. The extraordinary growth of the imports by Iraq are a result of the war and the almost complete destruction of the domestic egg industry. The considerable growth of Mexico´s egg imports is the result of several outbreaks of the Avian Influenza virus.

The fact that Germany ranks among the leading export and import countries is a result of the ownership of large egg farms by Dutch entrepreneurs in Eastern Germany. They ship eggs back to the Netherlands. This trade shows up as exports from Germany and imports by the Netherlands.

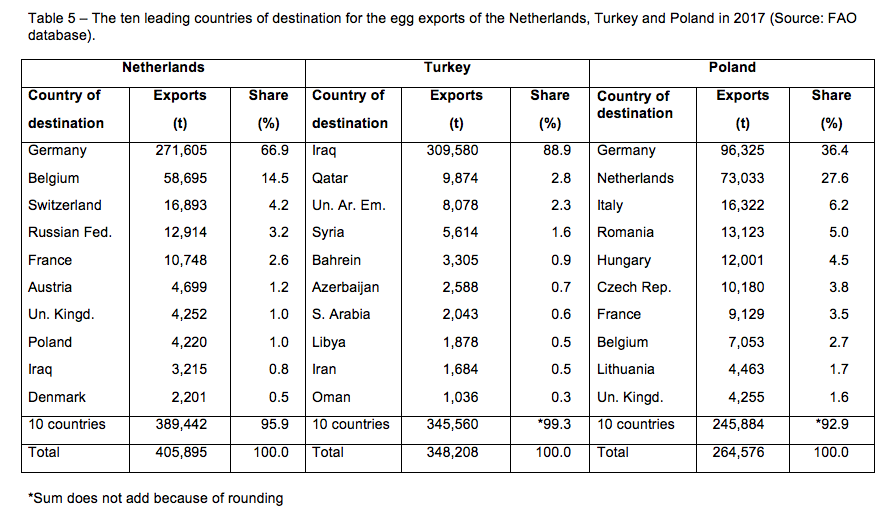

Egg-exporting countries focus on a few countries of destination

In 2017, the three leading exporting countries shared 46.7% of the global export volume. A detailed analysis of their trade flows shows that their exports were directed to only a few countries of destination (Table 5). Of the Dutch egg exports in 2017, 66.9% were directed to Germany and 14.5% to Belgium. Germany´s low self-sufficiency rate and the close neighbourhood were the main steering factors behind the close trade relations.

Turkey´s egg exports were even stronger concentrated on only one country of destination. Almost 89% went to Iraq. As mentioned, this was a result of the almost complete destruction of Iraq´s poultry industry during the Iraq war.

Poland´s exports were more diversified, but here, too, the two leading countries of destination shared 64.0% of the total export volume. A comparison of the spatial patterns of Poland´s and Turkey´s exports reveals that they tried to avoid competition. While Poland focused on EU member countries, the pattern of the former COMECON was, however, still visible, Turkey exported eggs almost completely into adjacent Islamic countries.

Poland´s egg exports were more diversified, but here, too, the two leading countries of destination shared 64.0% of the total export volume. A comparison of the spatial patterns of Poland´s and Turkey´s exports reveals that they tried to avoid completion. While Poland focused on EU member countries, the pattern of the former COMECON was, however, still visible, Turkey exported almost completely to adjacent Islamic countries.

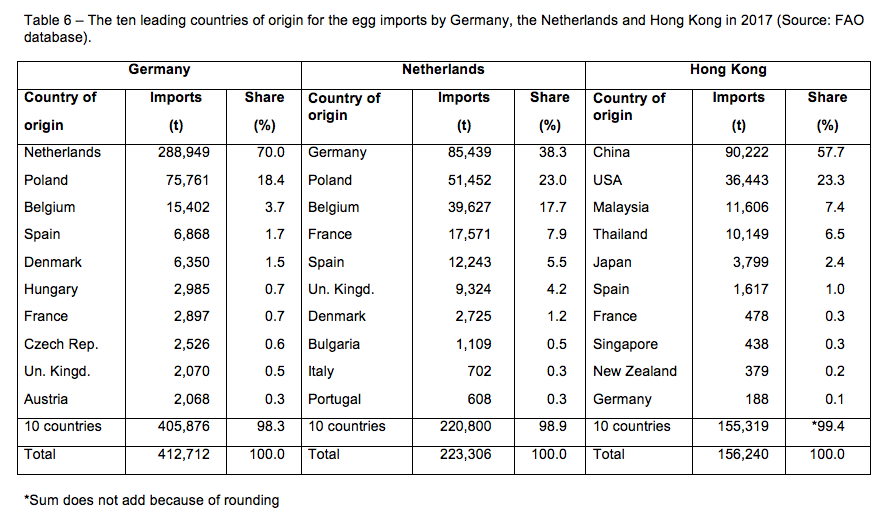

Spatial patterns of leading importing countries differ considerably

Table 6 shows the main countries of origin for the egg imports by Germany, the Netherlands and Hong Kong. Hong Kong was chosen as not detailed data for Iraq are available. Germany has not been able for decades to meet the egg demand by domestic production. This resulted in close trade relations with the Netherlands. Both countries are highly dependent on these relations as two thirds of the Dutch egg exports are directed to Germany and 70% of Germany´s egg imports stem from Dutch producers. Poland has become of increasing importance for Germany´s imports. In 2017, already 18.4% of the imports eggs came from Poland. The ten leading egg- importing countries are all members of the EU, which documents the importance of the intra-EU trade.

The Netherlands imported 223.300 t of shell eggs in 2017; 79.0% of the import volume came from Germany. Poland has also become an important country of origin for the Netherlands over the past years. The fact, that the ten leading countries of origin for the Dutch imports are members of the EU again stresses the extraordinary role of the intra-EU trade with eggs.

In FAO statistics, data for Hong Kong is published besides data for China mainland and Taiwan. With an import volume of 156,240 t, 7.3% of the global imports, Hong Kong plays a major role in global egg trade. The fact that shell eggs cannot be deep-frozen explains the spatial pattern of Hong Kong´s imports. From the USA eggs for further processing and hatching eggs are imported. European countries are only of minor importance as countries of origin.

Summary and perspectives

The preceding analysis could show that despite the fact that only 2.7% of the global egg production was traded in 2017, exports resp. imports were of great economic importance for many countries. Europe has been the leading continent for egg trade over several decades and its position is still unchallenged, even though Asian countries gained shares in egg imports. The leading egg-exporting countries in 2017 were the Netherlands, Turkey and Poland. Especially Turkey and Poland have shown a remarkable increase of their export volumes since 2007. Germany´s position as the leading egg-importing country is also unchallenged. Iraq, the Netherlands and Hong Kong ranked as numbers two to four. Most of the eggs were traded between member countries of the EU and between countries in Eastern and South-Eastern Asia.

It can be expected that Europe will also be the leading continent in egg trade in the next decade; trade between Asian countries will, however, gain in importance because of the increasing demand in several developing and threshold countries.