Part 2 – Poultry meat production and trade

In two papers, the patterns and dynamics of the EU poultry industry are analysed. The first paper (Zootecnica international 12/2021) dealt with laying hen husbandry, egg production and egg trade. The second paper will document the patterns and dynamics of poultry meat production and trade.

Hans-Wilhelm Windhorst – The author is Professor emeritus at the University of Vechta and visiting Professor at the University of Veterinary Medicine, Hannover, Germany

In 2020, the 27 member countries of the EU shared 10.1% in global poultry meat production. They played a major role in poultry meat trade. Almost 35% of the globally traded poultry meat originated in one of the member countries, and 26.6% of the imported poultry meat had a member country as destination. Here, the intra-EU trade is included.

Continuous increase of production and consumption

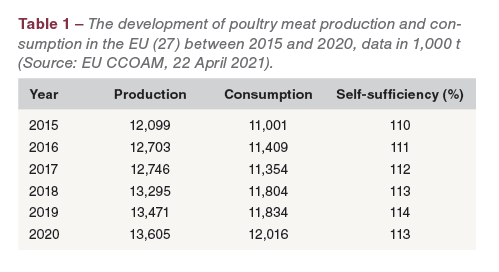

Between 2015 and 2020, poultry meat production increased from 12.1 mill. t to 13.6 mill. t or by 12.4% (Table 1, Figure 1). The self-sufficiency rate remained very stable over the whole period and reached its highest value with 114% in 2019.

Poultry meat consumption grew about 1 mill. t or by 9.2%. Despite the impacts of the Covid-19 pandemic consumption remained on a high level. For 2021, the CCOAM predicted an increase by 160,000 t in its update of April 2021. The high self-sufficiency permitted considerable export volumes as will be documented in a later chapter.

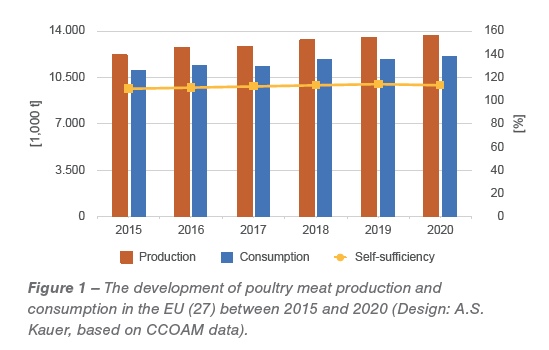

Figure 2 shows that 82% of the poultry meat which was produced in 2020 in the EU (27) was contributed by broiler meat, 14% by turkey meat and 3% by duck meat. All other meat types (goose, ostrich, guinea fowl) were of minor importance.

High regional concentration in broiler and turkey meat production

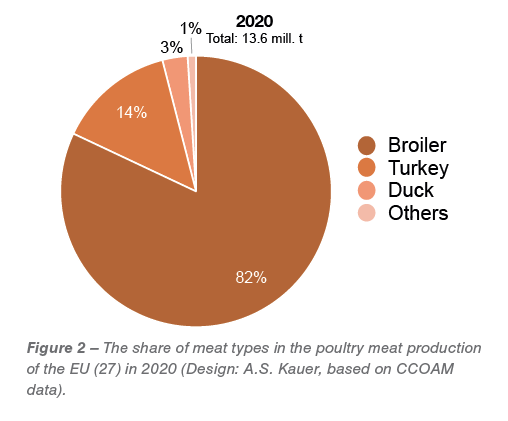

Poultry meat was produced in all 27 member countries of the EU. The regional concentration was, however, very high. Figure 3 documents that in 2020 74% of the total production volume was concentrated in only six countries, with one third in Poland and Spain alone. The dynamics in particular in Poland is remarkable. The production volume more than doubled between 2010 and 2020 and reached 2.7 mill. t. In Spain, production grew by almost 500,000 t in the same time-period.

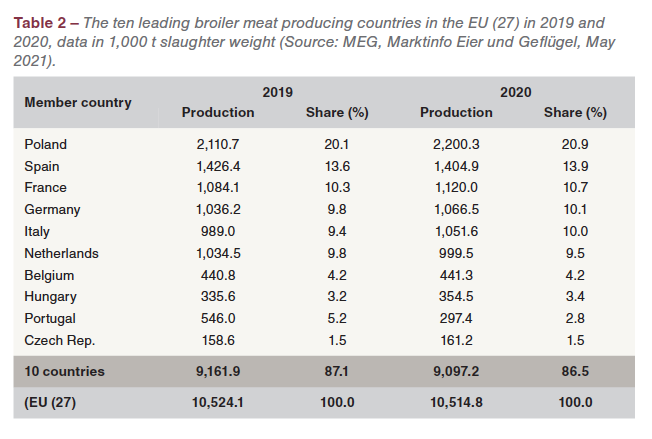

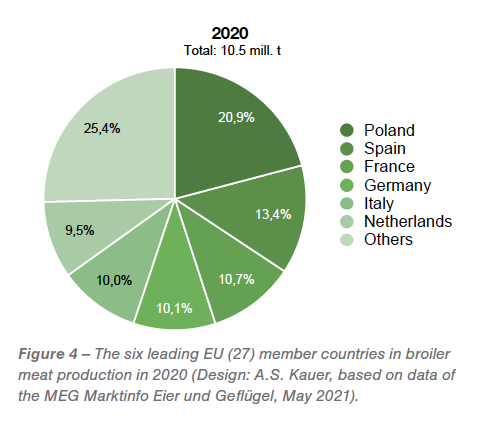

Because of the importance of broiler and turkey meat, these meat types will be analysed in more detail.  In Table 2, the ten leading broiler meat producing countries are listed for 2019 and 2020. The total production volume of the ten countries decreased by 64,700 t, that of the EU (27) by 9,300 t. A closer look at the dynamics at country level reveals some remarkable changes. The production volumes fell in Spain, the Netherlands and Portugal. In the other seven countries, production remained either fairly stable or increased. Worth noting are the decrease of about 250,000 t in Portugal and by 35,000 t in the Netherlands. On the other hand, production grew by 90,000 t in Poland and 63,000 t in Italy. The dynamics also changed the contribution of the single countries to the overall broiler meat production in the EU (27). The regional concentration in both years was very high with 87.1% respectively 86.5%. In 2020, the six leading countries contributed 74.6% to the total EU (27) production volume (Figure 4).

In Table 2, the ten leading broiler meat producing countries are listed for 2019 and 2020. The total production volume of the ten countries decreased by 64,700 t, that of the EU (27) by 9,300 t. A closer look at the dynamics at country level reveals some remarkable changes. The production volumes fell in Spain, the Netherlands and Portugal. In the other seven countries, production remained either fairly stable or increased. Worth noting are the decrease of about 250,000 t in Portugal and by 35,000 t in the Netherlands. On the other hand, production grew by 90,000 t in Poland and 63,000 t in Italy. The dynamics also changed the contribution of the single countries to the overall broiler meat production in the EU (27). The regional concentration in both years was very high with 87.1% respectively 86.5%. In 2020, the six leading countries contributed 74.6% to the total EU (27) production volume (Figure 4).

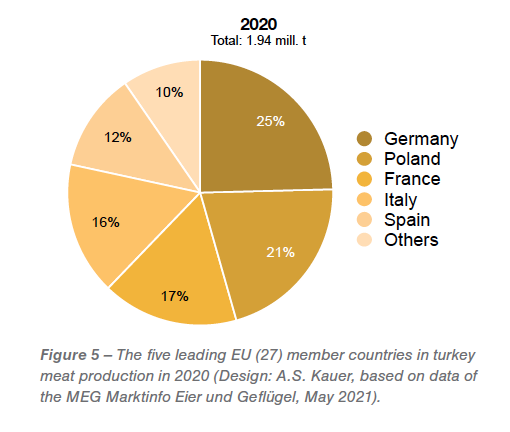

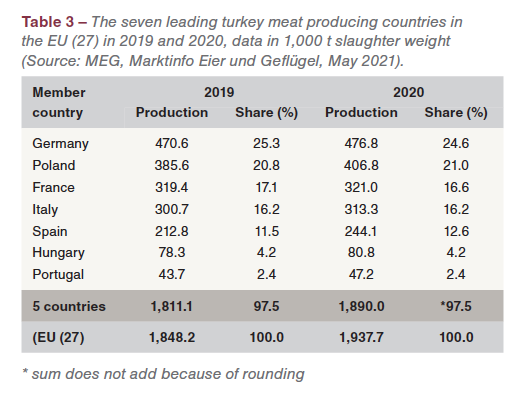

The regional concentration in turkey meat production was even higher than in broiler meat. Not all member countries produced turkey meat in 2020. The five leading countries together shared 90.4% in the total production volume, with Germany in an unchallenged top position, contributing of 24.6% (Figure 5).  In Table 3, the production volume of the seven leading countries is compared for 2019 and 2020. The data shows that, in contrast to broiler meat, the production volume grew by 89,500 t or by 4.8%. The highest absolute growth showed Spain with 32,000 t, followed by Poland with 21,000 t and Italy with 13,000 t. In all seven countries, which are listed in Table 3, turkey meat production increased, but the share in the total production volume decreased in Germany and France. The regional concentration remained extremely high with 97.5%.

In Table 3, the production volume of the seven leading countries is compared for 2019 and 2020. The data shows that, in contrast to broiler meat, the production volume grew by 89,500 t or by 4.8%. The highest absolute growth showed Spain with 32,000 t, followed by Poland with 21,000 t and Italy with 13,000 t. In all seven countries, which are listed in Table 3, turkey meat production increased, but the share in the total production volume decreased in Germany and France. The regional concentration remained extremely high with 97.5%.

It is worth noting that only six countries dominated poultry meat production in the EU (27) in 2020. This reflects, with the exception of the Netherlands, their population.

High export surplus in poultry meat trade

Because of the high balance surplus between production and consumption, the EU (27) was able to export considerable amounts of poultry meat. Between 2019 and 2020, the export volume fell from 1.79 mill. t to 1.71 mill. t or by 5.5%. For 2021, the CCOAM predicted a further decrease by 8%, a result of the lasting Covid-19 pandemic and Avian Influenza outbreaks in several EU (27) member countries, in particular in Poland and Germany.

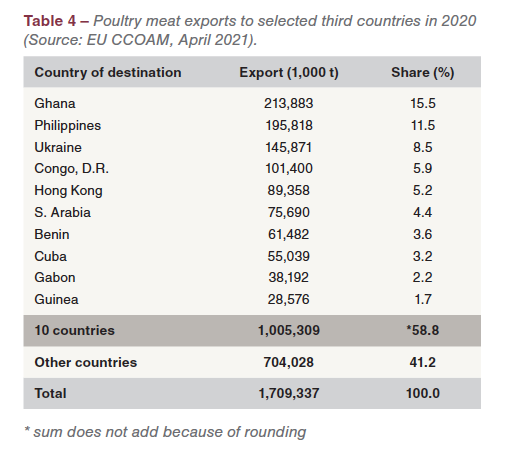

Table 4 shows that 1 mill. t or 58.8% of the total export volume were exported to ten countries, and 51.0% to only six countries. Five of the countries were located in Africa and three in Asia. Saudi Arabia re-exported about 25% of its imports to the United Arab Emirates, Kuwait and the Dem. Rep. of Congo; Benin about 25% of its imports to Nigeria, Hong Kong about 70% of its imports to Taiwan, China, Vietnam and the Rep. of Korea.

Table 4 shows that 1 mill. t or 58.8% of the total export volume were exported to ten countries, and 51.0% to only six countries. Five of the countries were located in Africa and three in Asia. Saudi Arabia re-exported about 25% of its imports to the United Arab Emirates, Kuwait and the Dem. Rep. of Congo; Benin about 25% of its imports to Nigeria, Hong Kong about 70% of its imports to Taiwan, China, Vietnam and the Rep. of Korea.

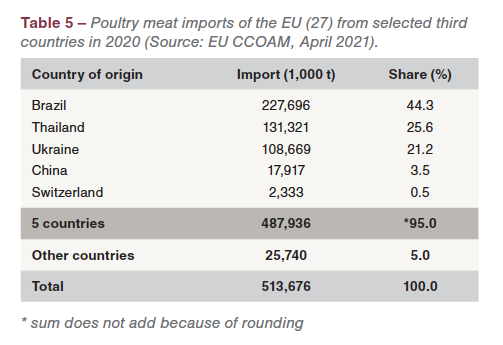

Because of the high self-sufficiency, poultry meat imports were much lower than exports. In 2020, about 513,000 t were imported, of which 44.3% came from Brazil, 25.6% from Thailand and 21.2% from Ukraine. Imports from other third countries were only of minor importance (Table 5). EU (27) member countries mainly imported deep-frozen high-value breast filets, from Thailand pre-cooked.

Summary and perspectives

The preceding analysis documented the considerable increase of poultry meat production and consumption in the EU (27) despite the Covid-19 pandemic. The regional concentration of broiler and turkey meat production was very high. Only six countries shared 75% in broiler meat production and five countries 90% in turkey meat production. Because of the high self-sufficiency, the EU (27) was able to export 1.7 mill. t of poultry meat. Nevertheless, 510,000 t of mainly high-value products were imported from third countries. Because of the lasting Covid-19 pandemic, production and consumption may reach a plateau or even decrease in 2021, in contrast to the CCOAM perspective. Exports will decrease considerably in 2021 and will not stabilise before the pandemic comes to a halt and the outbreaks of the Avian Influenza virus can be stopped.

Data source and suggestion for further reading