On June 23rd, 2016, the population of the United Kingdom (UK) decided to leave the EU. Even though it is not yet possible to predict what impacts this decision will have on the poultry industry of the UK, it surprises that there are hardly any scientific papers which deal with the embedding of egg and poultry meat production and trade in the EU; all the more when considering the role of the UK poultry industry in the EU. In 2015, the UK ranked in second place among the member countries with a production of 1.4 mill. t of broiler meat and in fifth place with a production volume of 10 billion eggs. This paper tries to fill the gap, focusing on the dynamics in production and trade between 2010 and 2015.

Patterns of laying hen husbandry and egg production in the UK

The banning of conventional cages in the EU from 2012 on had only minor impacts on the laying hen inventory. Because of the implementation of alternative housing systems, the laying hen flock declined by about one million birds between 2010 and 2013, but stabilised very soon at the former level (Table 1). The breeding stocks even increased.

The banning of conventional cages in the EU from 2012 on had only minor impacts on the laying hen inventory. Because of the implementation of alternative housing systems, the laying hen flock declined by about one million birds between 2010 and 2013, but stabilised very soon at the former level (Table 1). The breeding stocks even increased.

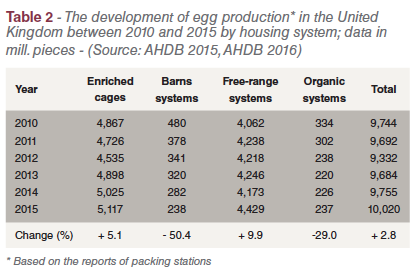

Table 2 shows that egg production increased by 280 mill. pieces in the analysed time period. Because of implementation of alternative housing systems, the production volume decreased, however, by 412 mill. pieces between 2010 and 2013. The contribution of the four housing systems is of particular interest. Enriched cages and free-range systems have

Table 2 shows that egg production increased by 280 mill. pieces in the analysed time period. Because of implementation of alternative housing systems, the production volume decreased, however, by 412 mill. pieces between 2010 and 2013. The contribution of the four housing systems is of particular interest. Enriched cages and free-range systems have  almost the same share and could expand their contribution. In contrast, barn systems and organic systems lost considerable shares. The dominance of enriched cages and free-range systems is on the one hand due to the decision of the food retailers to favour free-range eggs and on the other to the decision of the egg processing industry to prefer the cheaper eggs from enriched cages. If recent announcements of several food retailers and fast-food chains to only list or use cage-free eggs will be realised, the share of the housing systems will definitely change.

almost the same share and could expand their contribution. In contrast, barn systems and organic systems lost considerable shares. The dominance of enriched cages and free-range systems is on the one hand due to the decision of the food retailers to favour free-range eggs and on the other to the decision of the egg processing industry to prefer the cheaper eggs from enriched cages. If recent announcements of several food retailers and fast-food chains to only list or use cage-free eggs will be realised, the share of the housing systems will definitely change.

Low self-sufficiency required increasing imports

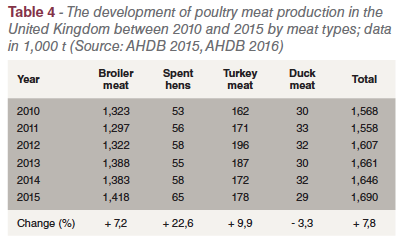

Table 3 documents the development of the supply balance with eggs of the UK between 2010 and 2015. Despite the increase of the egg production volume since 2011, the self-sufficiency- rate decreased from 88 % to 85 %. One reason is the growth of the per capita consumption from 182 eggs in 2010 to 184 eggs in 2014. The additional demand of 400 mill. eggs could not be compensated by the domestic production for it increased by only 156 mill. eggs or 1.6 %.

Table 3 documents the development of the supply balance with eggs of the UK between 2010 and 2015. Despite the increase of the egg production volume since 2011, the self-sufficiency- rate decreased from 88 % to 85 %. One reason is the growth of the per capita consumption from 182 eggs in 2010 to 184 eggs in 2014. The additional demand of 400 mill. eggs could not be compensated by the domestic production for it increased by only 156 mill. eggs or 1.6 %.

The result was a growth of the imports by 264 mill. eggs or 16.2 %. The highest import volume with almost 2 billion eggs was reached in 2012, a consequence of the changes in the housing systems. Egg exports are comparatively low in relation to the imports. Because of the growing imports, the negative trade balance increased by 24.2 % between 2010 and 2015. While the imports reached a volume of 1.53 billion eggs in 2010, they were as high as 1.89 billion pieces in 2014.

Main countries of origin for the imports in 2014 were the Netherlands, Denmark, France and Germany. They contributed more than 98 % to the total imports. Ireland, the Netherlands and Germany shared 98 % in the egg exports of the UK. These data alone shows the involvement of the UK in the trade flows with eggs in the UK.

Considerable growth of poultry meat production and consumption

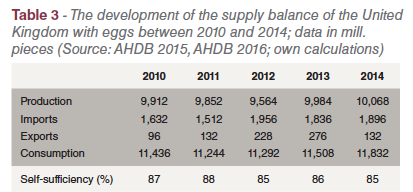

With a production volume of 1.7 mill. t, the UK ranked in second place behind Poland among the poultry meat producing countries of the EU in 2015. Between 2010 and 2015, poultry meat production grew by 122,000 t or 7.8 %. To this growth broiler meat contributed 95,000 t or 77.9 %.

The share of broiler meat in total poultry meat production reached 83.9 % in 2015, turkey meat contributed 10.5 %, all other poultry meat types shared only 5.6 %. The dominance of broiler meat is reflected in the high per capita consumption of 22.9 kg, 4.5 kg more than the EU average. In the analysed time period, the per capita consumption of poultry meat increased by 3.6 kg or 11.3 %. This resulted in a growth of the domestic demand by 308,000 t or 15.4 %. Imports had to be increased considerably because of the much lower growth of the domestic production by only 152,000 t.

Poultry meat trade is focused on EU member countries

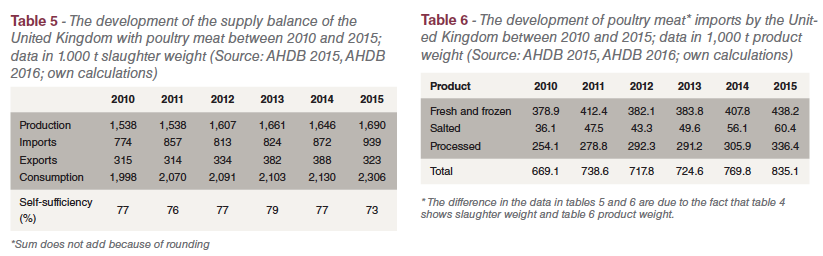

Between 2010 and 2015, poultry meat imports by the UK increased by 166,000 t or 24.8 % (Table 5). High growth rates were reached between 2010 and 2011 and also between 2014 and 2015. Fresh and frozen meat shared 52.5 % in the total import volume, processed meat 40.3 % (Table 6).

Between 2010 and 2015, poultry meat imports by the UK increased by 166,000 t or 24.8 % (Table 5). High growth rates were reached between 2010 and 2011 and also between 2014 and 2015. Fresh and frozen meat shared 52.5 % in the total import volume, processed meat 40.3 % (Table 6).

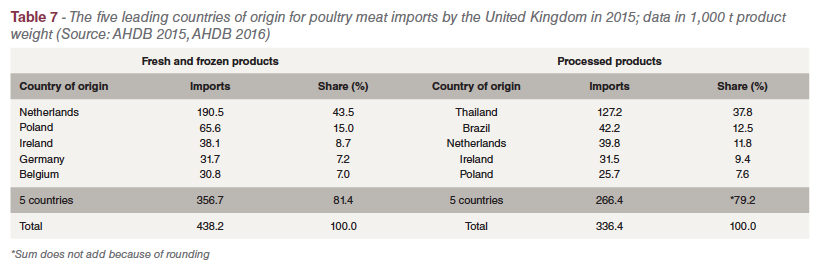

A detailed analysis of the trade flow shows that EU member countries played a dominating role in the imports of fresh and frozen meat (Table 7). The five leading countries alone contributed 81.4 % to the total import volume. A different picture shows the imports of processed poultry meat. In 2015, Thailand and Brazil ranked in the first two places. Together they shared 50.3 % of the imports. If the exit negotiations would lead to the result that EU member countries would be treated as “third countries”, imports of fresh and frozen poultry meat from EU member countries would become more expensive; for processed meat, the impacts would be less important.

A detailed analysis of the trade flow shows that EU member countries played a dominating role in the imports of fresh and frozen meat (Table 7). The five leading countries alone contributed 81.4 % to the total import volume. A different picture shows the imports of processed poultry meat. In 2015, Thailand and Brazil ranked in the first two places. Together they shared 50.3 % of the imports. If the exit negotiations would lead to the result that EU member countries would be treated as “third countries”, imports of fresh and frozen poultry meat from EU member countries would become more expensive; for processed meat, the impacts would be less important.

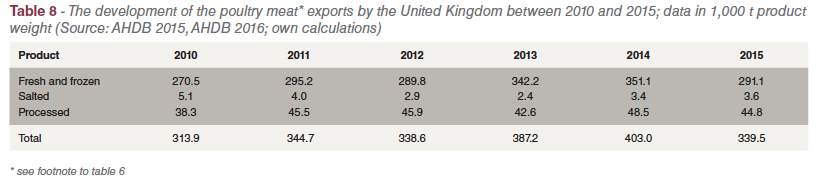

Despite the high imports, the UK is exporting a considerable amount of poultry meat. From the data in Table 8 one can see that the export volume grew by 26,000 t between 2010 and 2015. It decreased, however, by 63,500 t or 15.8 % between 2014 and 2015. This is mainly due to the considerable decline of the fresh and frozen meat exports. In 2015, they shared 85.7 % of the total exports, processed meat only 13.2 %.

Despite the high imports, the UK is exporting a considerable amount of poultry meat. From the data in Table 8 one can see that the export volume grew by 26,000 t between 2010 and 2015. It decreased, however, by 63,500 t or 15.8 % between 2014 and 2015. This is mainly due to the considerable decline of the fresh and frozen meat exports. In 2015, they shared 85.7 % of the total exports, processed meat only 13.2 %.

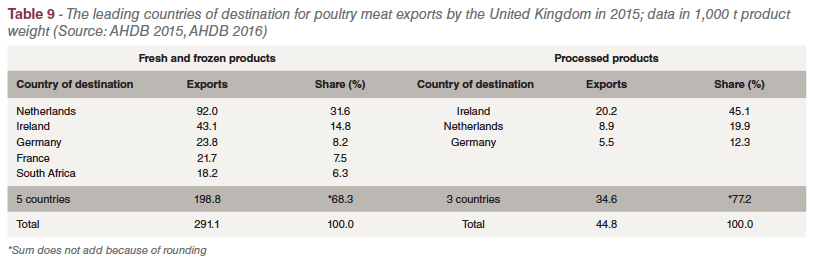

EU member countries are also the main trade partners regarding poultry meat exports. Table 9 shows that the Netherlands, Ireland and Germany were the leading countries of destination in 2015. The three countries shared 57 % in the total export volume. What was already mentioned when analysing the imports, is also true for the exports. Poultry meat from the UK will become more expensive for the importing countries and therefore less attractive.

EU member countries are also the main trade partners regarding poultry meat exports. Table 9 shows that the Netherlands, Ireland and Germany were the leading countries of destination in 2015. The three countries shared 57 % in the total export volume. What was already mentioned when analysing the imports, is also true for the exports. Poultry meat from the UK will become more expensive for the importing countries and therefore less attractive.

Summary and perspectives

The preceding analysis could show that the UK has been one of the leading countries in poultry production and trade within the EU so far. In egg production, a remarkable development occurred regarding the housing systems for laying hens. Enriched cages and free-range systems have almost the same share in production; barn and organic systems lost in importance between 2010 and 2015. A self-sufficiency rate of only 85 % required considerable imports of shell eggs and egg products. The main trading partners have been EU member countries.

Despite a considerable growth of poultry meat production, the self-sufficiency rate decreased to 73 % in the analysed time period, mainly due to the growth in per capita consumption. Growing imports of fresh and frozen products as well as of processed products were the result. In 2015, they reached a volume of 835,000 t. While fresh and frozen products were mainly imported from EU member countries, Thailand and Brazil were the leading countries of origin for processed products.

Poultry meat exports reached a volume of 335,000 t in 2015. Here, too, EU member countries were the main trade partners. The close dependency of the UK in poultry products trade with EU member countries is obvious. The decision to leave the EU will have considerable impacts on the poultry industry of the UK, whatever the results of the bilateral negotiations will be (see Harris 2016, van Berkum et al. 2016). This will not affect the imports and exports of eggs and poultry meat, but also the trade with feed components, vaccines, breeding stock and hatching eggs. Higher costs for imported products and a decreasing competition regarding exports will be the direct consequences. The coming years will show how the UK poultry industry will react to these challenges.

Data sources and additional literature are available on request.