Reports from South America indicate a robust harvest that will start in just a few weeks. A wild card is the trade tensions between the US and China. Soybean prices are likely to remain low for those allowed to purchase US grain without a tariff while higher prices will prevail in China.

With the Chinese 25% tariff in place, the production and trade of soybeans is shifting. Production will increase in South America and decrease in the US. US farmers will shift some production from soybeans to corn thereby reducing the price of corn. After a period of unusually low soybean prices over the next year, soybean prices are likely to rise worldwide.

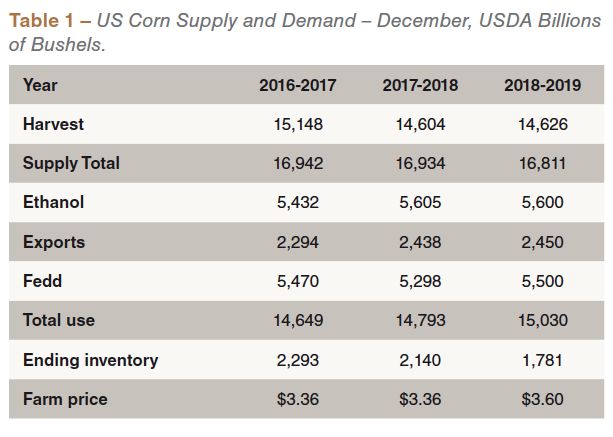

Despite the current beneficial grain price climate for most grain users, low prices will not last. Trade wars reduce efficiency and end up increasing prices in the long run, not only for those behind a tariff wall but for all grain users. In addition, grain prices appear to be at the bottom of a long-term cycle. The next move is therefore more likely to be up. Corn may move up in this crop year even as soybean continue to fall. However, by 2019-2020 it can be expected that both corn and soybean prices will be rising at the beginning of a long-term cycle upward in grain and commodity prices.

Corn

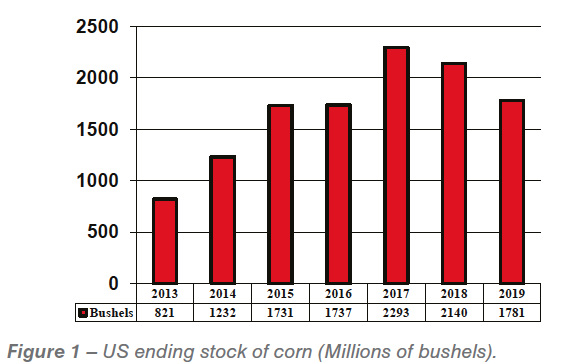

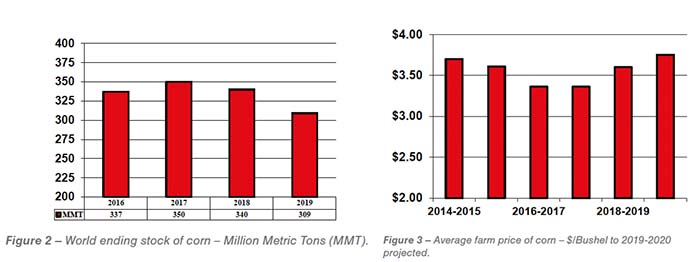

The December, the USDA World Agricultural Supply and Demand Estimates (WASDE) report projects a lower US and world ending corn stock in 2019. Falling world stocks normally signal the end of a period of low prices. However, the beginning of the next bull market may be delayed because of a possible slowdown in the world economy and the effects of the trade war. With farmers in the US shifting from soybeans to corn next year, corn prices may increase slowly, if at all, this crop year and next.

The December, the USDA World Agricultural Supply and Demand Estimates (WASDE) report projects a lower US and world ending corn stock in 2019. Falling world stocks normally signal the end of a period of low prices. However, the beginning of the next bull market may be delayed because of a possible slowdown in the world economy and the effects of the trade war. With farmers in the US shifting from soybeans to corn next year, corn prices may increase slowly, if at all, this crop year and next.

The USDA numbers for world ending corn stock for the last several years changed significantly after adjustments were made to the numbers from China. Hopefully, the adjusted numbers from China are now accurate since China is so important in the world ending stock numbers.

Soybeans

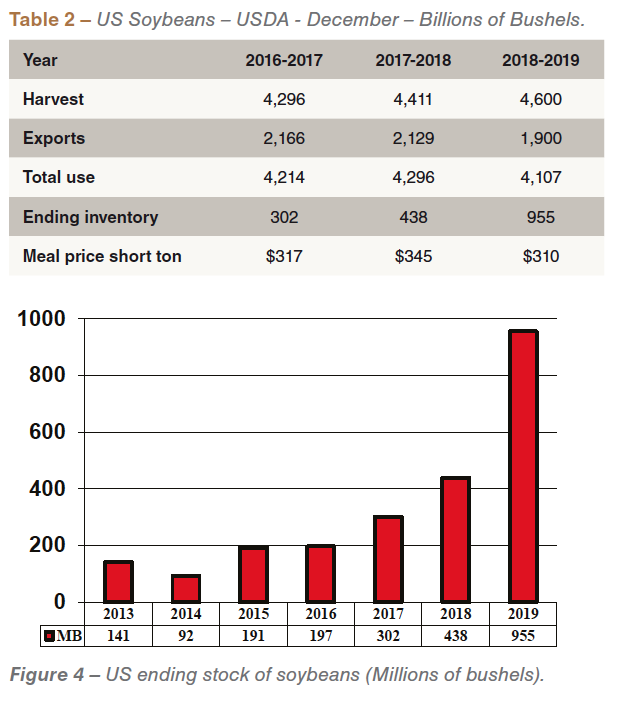

Ending stocks of soybeans are rising not falling. The December USDA WASDE report shows that both US and world soybean stocks are rising. Soybean meal prices rose last crop year due to the drought in Argentina and then plummeted because of the trade war between China and the US, combined with clearly abundant supplies worldwide.

With increased demand from China for South American soybeans this crop year and good weather, production will increase rapidly in that part of the world. US production is likely to fall in 2019-2020 as farmers shift from soybeans to corn. Soybean meal prices probably reached their lowest point with the harvest low this fall. However, prices will rise slowly from this point as soybeans, like corn, enter into a new long-term cycle of rising prices.

With increased demand from China for South American soybeans this crop year and good weather, production will increase rapidly in that part of the world. US production is likely to fall in 2019-2020 as farmers shift from soybeans to corn. Soybean meal prices probably reached their lowest point with the harvest low this fall. However, prices will rise slowly from this point as soybeans, like corn, enter into a new long-term cycle of rising prices.

US ending stocks rose an unusual amount due to the trade war with China. The effect of that increase is already reflected in the market price. Yet to be determined are the trade politics of 2019. China may purchase some US soybeans next year.

US Chicken Industry

US Chicken Industry

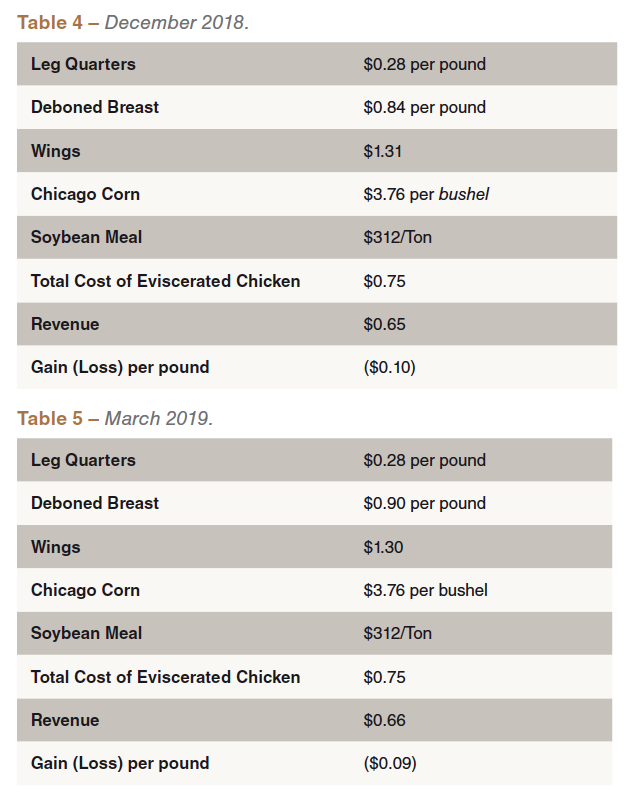

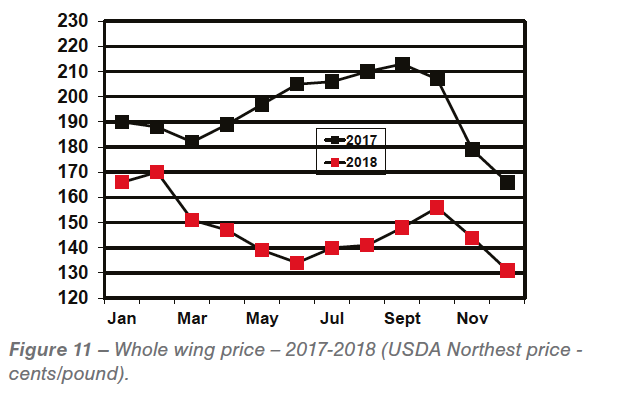

The domestic supply of meat in the US rose by 2.5 billion pounds in 2018, an amount that exceeded demand. A billion pounds of that was additional chicken production. The result for the chicken industry was a substantial drop in prices. After years of profitable production, the chicken industry is now operating at a loss that will continue at least through the winter and could last all next year.

Chicken production rose 2.6% in 2018 and the USDA expects production to rise by 1.5% next year. Given the recent severe price drop, the USDA estimate may be too high for next year. Production may not rise at all next year. How could that be possible since six new plants are expected to open next year? The answer to that puzzle is there may be at least one plant closed for every new plant opened. There are some aging processing plants in the US that are ripe for retirement.

Chicken production rose 2.6% in 2018 and the USDA expects production to rise by 1.5% next year. Given the recent severe price drop, the USDA estimate may be too high for next year. Production may not rise at all next year. How could that be possible since six new plants are expected to open next year? The answer to that puzzle is there may be at least one plant closed for every new plant opened. There are some aging processing plants in the US that are ripe for retirement.

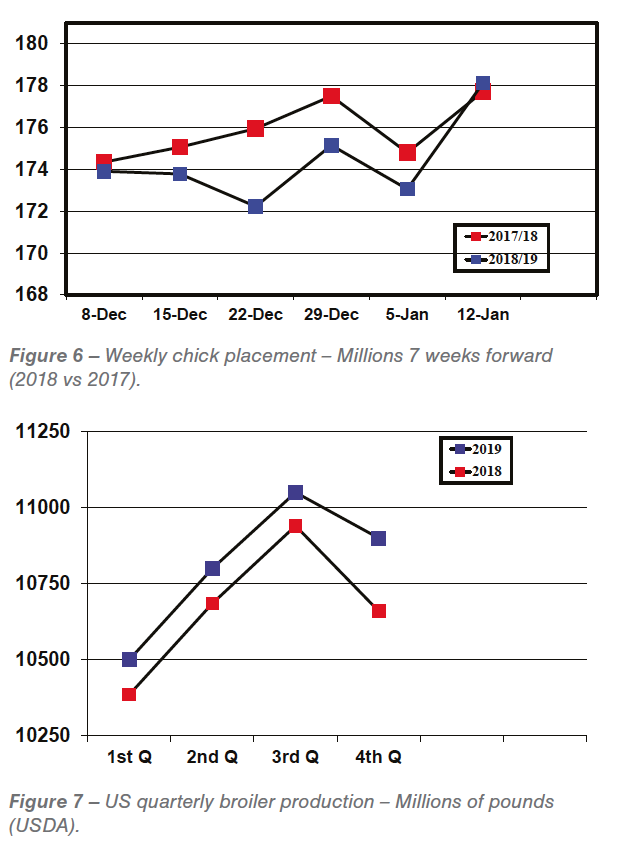

A clue to future supply can be found in the number of chicks being placed by the industry. The recent numbers clearly show that the industry has tapped the brakes on production. Current numbers of chicks placed are lower than year earlier numbers.

Falling grain prices this year helped the chicken industry but not enough to counteract the effects of an oversupply of chicken and increased competition from red meat. Total per capita red meat consumption has recently been rising faster than poultry consumption. This is logical given three factors:

Falling grain prices this year helped the chicken industry but not enough to counteract the effects of an oversupply of chicken and increased competition from red meat. Total per capita red meat consumption has recently been rising faster than poultry consumption. This is logical given three factors:

- low grain prices help poor feed converting animals;

- rising median income;

- the time lag for increased red meat production.

As all of these factors reverse in the coming years, poultry consumption will, if history is a guide, once again outperform red meat consumption. “Outperform” may mean staying the same while red meat consumption falls.

The US meat industry as a whole may be reaching market saturation. Consumption reached 220 pounds in 2006 and is now expected to exceed 220 pounds once again in 2019. That may be too much to sell profitably.

The US meat industry as a whole may be reaching market saturation. Consumption reached 220 pounds in 2006 and is now expected to exceed 220 pounds once again in 2019. That may be too much to sell profitably.

With a preliminary agreement on a new trade deal in North America, US chicken leg quarter exports to that country appear safe for the moment. Mexico is the number one destination for US chicken exports buying nearly one billion pounds of leg quarters per year.

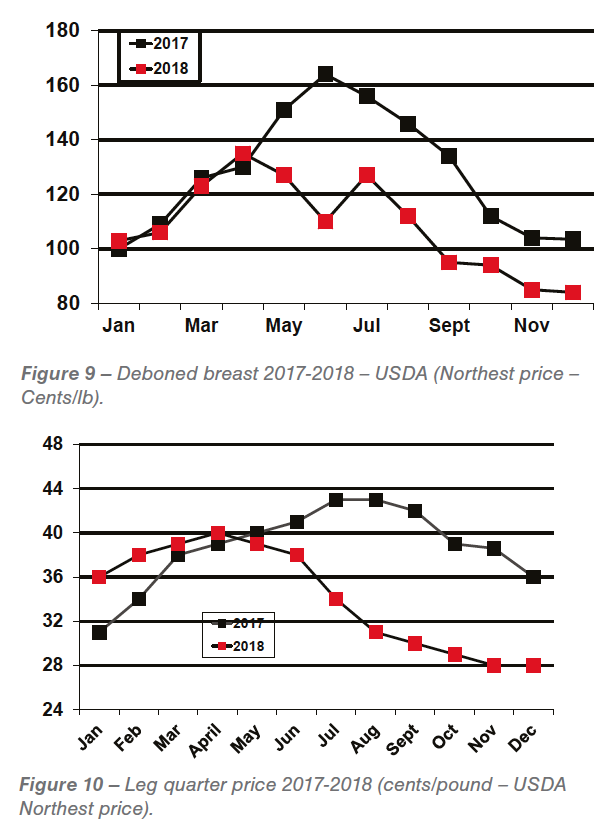

Deboned Breast

The seasonal peak for skinless boneless breast (SBB) came early his year and was disappointing. Now SBB has fallen to just 80 cents per pound (Northeast Price). The issue appears to be too much SBB and red meat combined with a surprising lack of food service demand. The price has dropped so much recently that it has fallen below the world price.

For decades, US SBB was much, higher than world prices, sometimes double world prices; now it is lower. Such a price for SBB combined with unusually low prices for leg quarters results in heavy losses for the US chicken industry.

For decades, US SBB was much, higher than world prices, sometimes double world prices; now it is lower. Such a price for SBB combined with unusually low prices for leg quarters results in heavy losses for the US chicken industry.

World Chicken Growth Rate

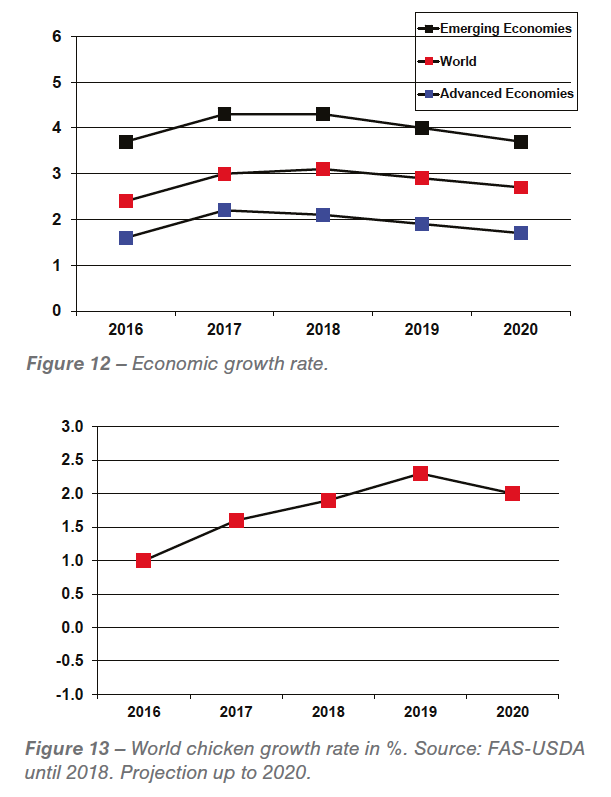

World economic growth and per capita  income were both rising recently. Along with that increase in world growth, world chicken production increased as well. However, it is becoming more likely that world economic growth will decline in the next few years. Declining world economic growth would eventually restrict the ability of the world chicken industry to grow.

income were both rising recently. Along with that increase in world growth, world chicken production increased as well. However, it is becoming more likely that world economic growth will decline in the next few years. Declining world economic growth would eventually restrict the ability of the world chicken industry to grow.

The long-term world chicken production growth appears to be 2%. The USDA expects world growth to slightly exceed 2% in 2019. However, if the world economy falters and/or grain prices increase, the growth rate could decline somewhat in 2020.

Source: Aviagen