Lack of rain on the Pampas in Argentina this year lowered estimates for the Argentine harvest of corn and soybeans. With that notable exception, prospects are good for grain consumers like the poultry industry; grain prices remain relatively low and stable.

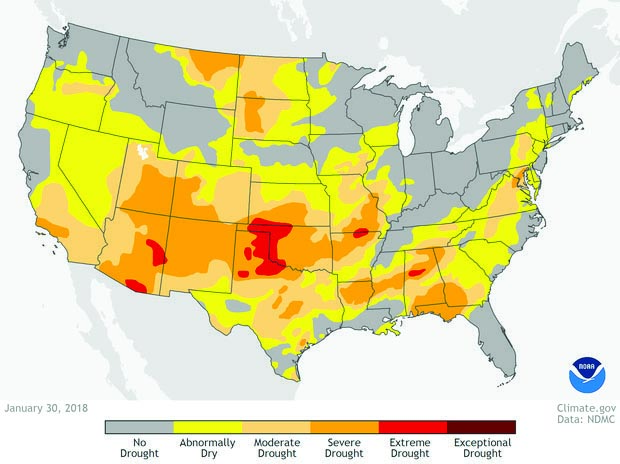

Unfortunately, low prices are providing a powerful incentive to consume grain by a world economy that is growing and demanding more meat. In addition, adverse weather conditions could break out in other areas. A drought in the US, for example, would have a powerful effect on prices. As can be seen on the latest drought monitor below, there are signs of a possible drought in the US Corn Belt. However, it is too early to determine how severe it might be or if it will develop at all.

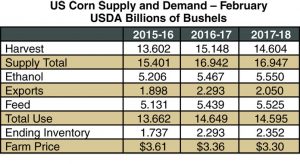

Corn

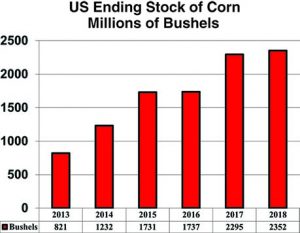

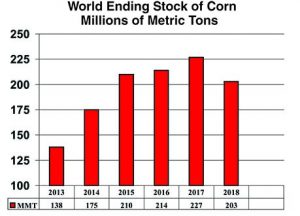

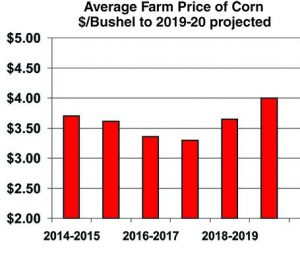

The February USDA World Agricultural Supply and Demand Estimates (WASDE) report projects a slightly higher ending supply of US corn this crop year. However, world-ending stock is starting to go in the other direction, dropping to a still substantial 203 million metric tons. It is important to take note of the change in trend from increasing world stocks to falling world stocks, which could signal the low point for  this price cycle. It is particularly worrisome to hear that China plans to produce large quantities of ethanol. With ending stock in 2018 being similar to 2017, the price this crop year is also likely to be similar or slightly below the price of the last crop year (crop years end on August 31). Corn prices are likely to reach their lowest average price of the price cycle in the current crop year. By crop year 2018-2019, prices may begin to rise in part due to a shift of acres from corn to soybeans in the US, a recovery in US exports and a lower level of corn production

this price cycle. It is particularly worrisome to hear that China plans to produce large quantities of ethanol. With ending stock in 2018 being similar to 2017, the price this crop year is also likely to be similar or slightly below the price of the last crop year (crop years end on August 31). Corn prices are likely to reach their lowest average price of the price cycle in the current crop year. By crop year 2018-2019, prices may begin to rise in part due to a shift of acres from corn to soybeans in the US, a recovery in US exports and a lower level of corn production  in South America. By 2019-2020, the average price could be close to $4.00 per bushel ($160 per metric ton).

in South America. By 2019-2020, the average price could be close to $4.00 per bushel ($160 per metric ton).

Soybeans

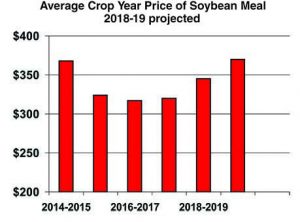

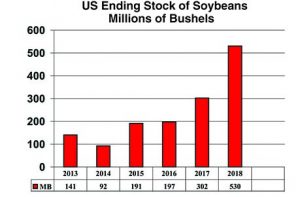

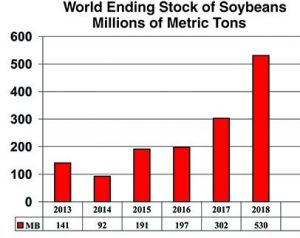

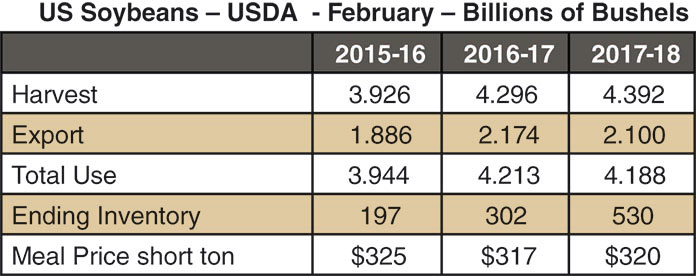

Compared to last crop year, the February USDA WASDE report shows that production is higher and ending stocks are significantly higher. World soybean stocks are also still rising. Soybean meal prices, like corn, are at the bottom of  their long-term cycle and can be expected to rise in the coming years.

their long-term cycle and can be expected to rise in the coming years.

Chicken industry production

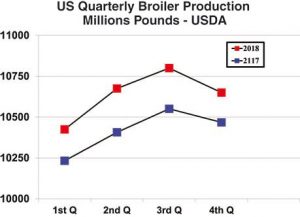

The USDA expects US production of chicken meat to increase 2.2% this year. Around 2% is probably the new long term average growth rate for this increasingly mature market that is closing in on 100 pounds per-capita consumption. In sharp contrast, red meat producers are increasing production by 5% in 2018 after increasing 3.3% in 2017. These  increases are likely to be unsustainable and could be the cause of a major headache in the meat industry down the road.

increases are likely to be unsustainable and could be the cause of a major headache in the meat industry down the road.

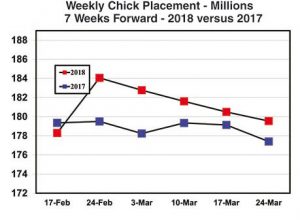

The graph below shows weekly chick placement in millions moved forward 7 weeks to estimate chickens processed. Using this method of estimation, process numbers are running just under 2% over last year. With a small increase in average weight, the total projected  production increase of 2.2% this year appears correct. If current expansion plans are carried out and weights begin to increase, production could accelerate in 2019. However, any production growth exceeding 2.5% per year is likely to be temporary.

production increase of 2.2% this year appears correct. If current expansion plans are carried out and weights begin to increase, production could accelerate in 2019. However, any production growth exceeding 2.5% per year is likely to be temporary.

The combination of low grain prices, modest supply growth and moderate competition from red meats brought high profitability to chicken production last year. This year, increased  competition from red meats could begin to erode profitability toward the end of the year. If rapid red meat production increases continue into 2019 without a counterbalancing increase in exports, prices and profitability for all meat production may prove to be disappointing.

competition from red meats could begin to erode profitability toward the end of the year. If rapid red meat production increases continue into 2019 without a counterbalancing increase in exports, prices and profitability for all meat production may prove to be disappointing.

A possible “black swan” event would be a trade dispute with Mexico. Mexico is the number one destination for US chicken exports, buying more than one billion pounds of leg quarter per year. Any disruption in trade with Mexico would have severe consequences for the US chicken industry.

Chicken prices will begin to feel the pressure from the increased production of red meats this year. Last year there was only one billion additional pounds of red meat available for  domestic use. This year another two billion pounds is expected. So far, demand appears to be keeping up with the supply of both poultry and red meat. This is due in part to rising median income. When grain prices start rising again and/or the growth in median income slows down, supply of all meat could very well outpace demand.

domestic use. This year another two billion pounds is expected. So far, demand appears to be keeping up with the supply of both poultry and red meat. This is due in part to rising median income. When grain prices start rising again and/or the growth in median income slows down, supply of all meat could very well outpace demand.

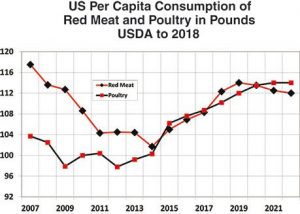

It is interesting to note that total per capita red meat consumption has recently been rising  faster than poultry consumption. This is logical given three factors; 1) low grain prices; 2) rising median income and 3) the time lag for increased red meat production. When these factors change, poultry consumption will once again outperform red meat consumption. “Outperform” may mean rising slowly while red meat consumption falls.

faster than poultry consumption. This is logical given three factors; 1) low grain prices; 2) rising median income and 3) the time lag for increased red meat production. When these factors change, poultry consumption will once again outperform red meat consumption. “Outperform” may mean rising slowly while red meat consumption falls.

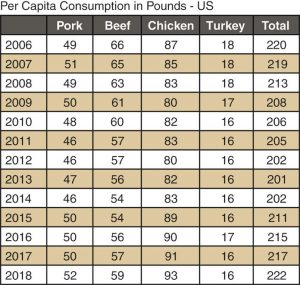

When will the US meat industry as a whole reach market saturation? The level of  consumption in 2018, 222 pounds, might be within 10% or 20% of the upper limit for red meat and poultry consumption in the US. Only time will tell for sure but there is logically some upper limit to per capita consumption.

consumption in 2018, 222 pounds, might be within 10% or 20% of the upper limit for red meat and poultry consumption in the US. Only time will tell for sure but there is logically some upper limit to per capita consumption.

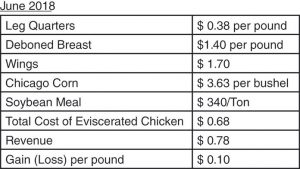

Deboned Breast

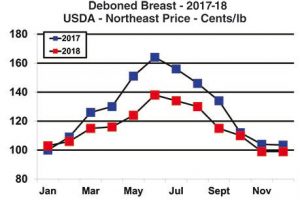

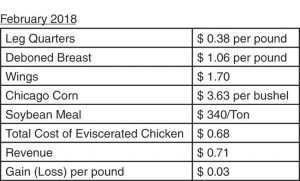

Prices for deboned breast meat are expected to be lower this year compared to last. There will be more supply on offer. In 2017, the  weights of the largest birds were somewhat restricted due to breast myopathies. This year, weights should begin to rise again. In addition, competition from competing meats will begin to have an effect. Despite the somewhat lower price for deboned breast, the US industry should once again be highly profitable this year.

weights of the largest birds were somewhat restricted due to breast myopathies. This year, weights should begin to rise again. In addition, competition from competing meats will begin to have an effect. Despite the somewhat lower price for deboned breast, the US industry should once again be highly profitable this year.

Leg quarters

The highest price for leg quarters in 2017 was 43 cents Northeast Price (There is a range in  prices for leg quarters with many leg quarters sold at a price lower than the published Northeast price). This year the peak can be expected to reach a similar level if a trade war with Mexico can be avoided. However, if the US exits the North American Free Trade Agreement (NAFTA), leg quarter prices could tumble.

prices for leg quarters with many leg quarters sold at a price lower than the published Northeast price). This year the peak can be expected to reach a similar level if a trade war with Mexico can be avoided. However, if the US exits the North American Free Trade Agreement (NAFTA), leg quarter prices could tumble.

Wings

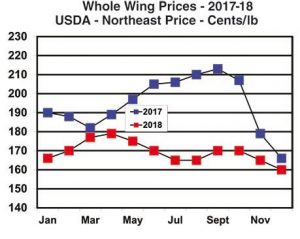

The price of wings defied gravity when they rose counter-seasonally last summer. As the price difference between deboned breast and wings became ever wider, there was the inevitable substitution of “boneless wings” (deboned breast meat) for bone-in wings. As that trend gathered speed, wing prices fell back down to earth in a surprisingly short period of time. This year prices may be less surprising; falling in the summer and rising in the autumn.

The price of wings defied gravity when they rose counter-seasonally last summer. As the price difference between deboned breast and wings became ever wider, there was the inevitable substitution of “boneless wings” (deboned breast meat) for bone-in wings. As that trend gathered speed, wing prices fell back down to earth in a surprisingly short period of time. This year prices may be less surprising; falling in the summer and rising in the autumn.

The production of chicken in the US was highly profitable last year but profitability may erode late in 2018 as competing meats begin to have an effect on prices.

The production of chicken in the US was highly profitable last year but profitability may erode late in 2018 as competing meats begin to have an effect on prices.

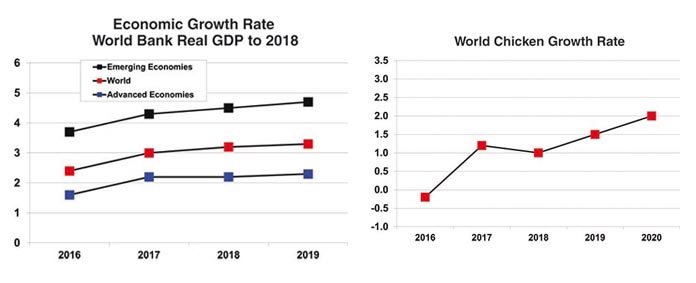

World chicken growth rate

World economic growth and per capita income are both rising substantially. That would normally result in a rapid growth in world  chicken production. However, chicken production fell last year and is now rising at only 1% per year. The reason is China. China’s production is down over 2 million metric tons over the last three years due to Avian Influenza, limited availability of genetics, weak prices and soft demand (caused to a great extent by fears about Avian Influenza). Surely by 2019 conditions will finally improve in China and the world chicken growth rate will once again bemore closely aligned with world economic growth.

chicken production. However, chicken production fell last year and is now rising at only 1% per year. The reason is China. China’s production is down over 2 million metric tons over the last three years due to Avian Influenza, limited availability of genetics, weak prices and soft demand (caused to a great extent by fears about Avian Influenza). Surely by 2019 conditions will finally improve in China and the world chicken growth rate will once again bemore closely aligned with world economic growth.