The European poultry sector demonstrated a strong performance in 2024, marking a significant recovery in production and a steady growth in trade, despite persistent challenges from avian influenza (AI) outbreaks.

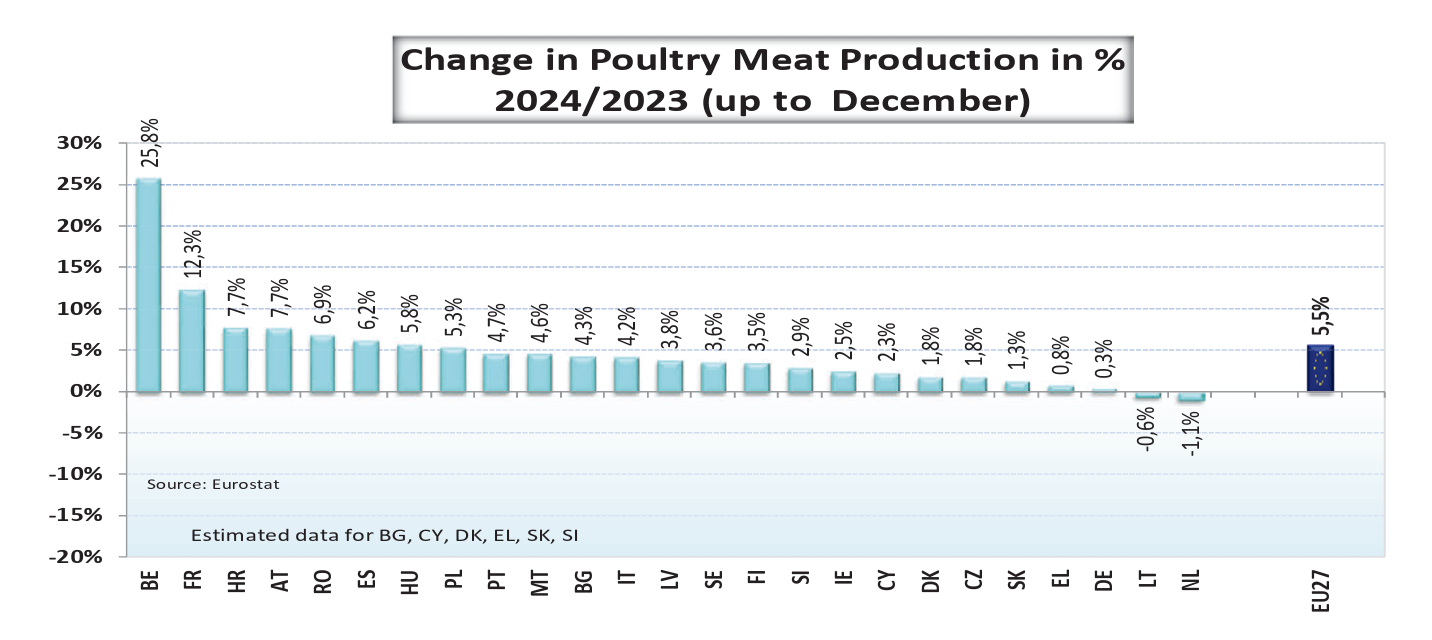

According to the latest EU market report (March 2025), poultry meat production rose by more than 5% compared to 2023. This growth was driven by substantial increases in several Member States, notably France, Romania, Spain, and Hungary. However, declines were reported in the Netherlands and Lithuania.

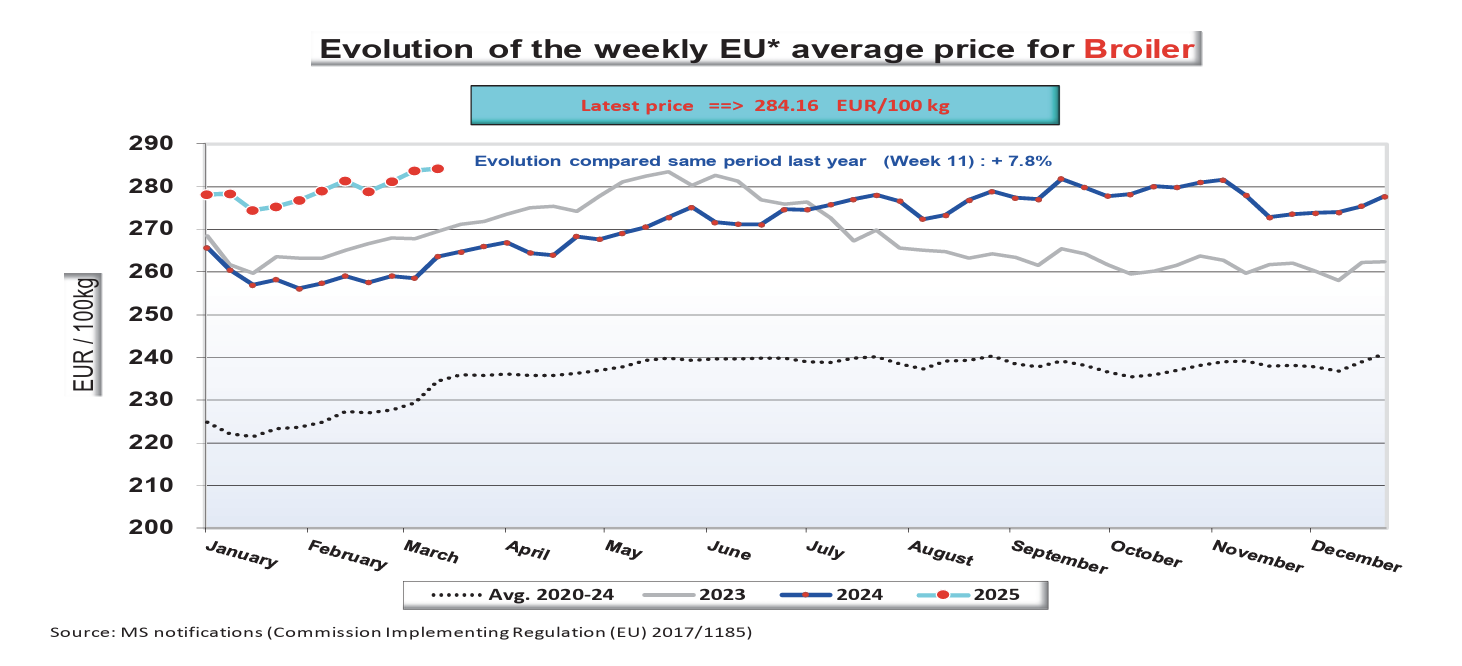

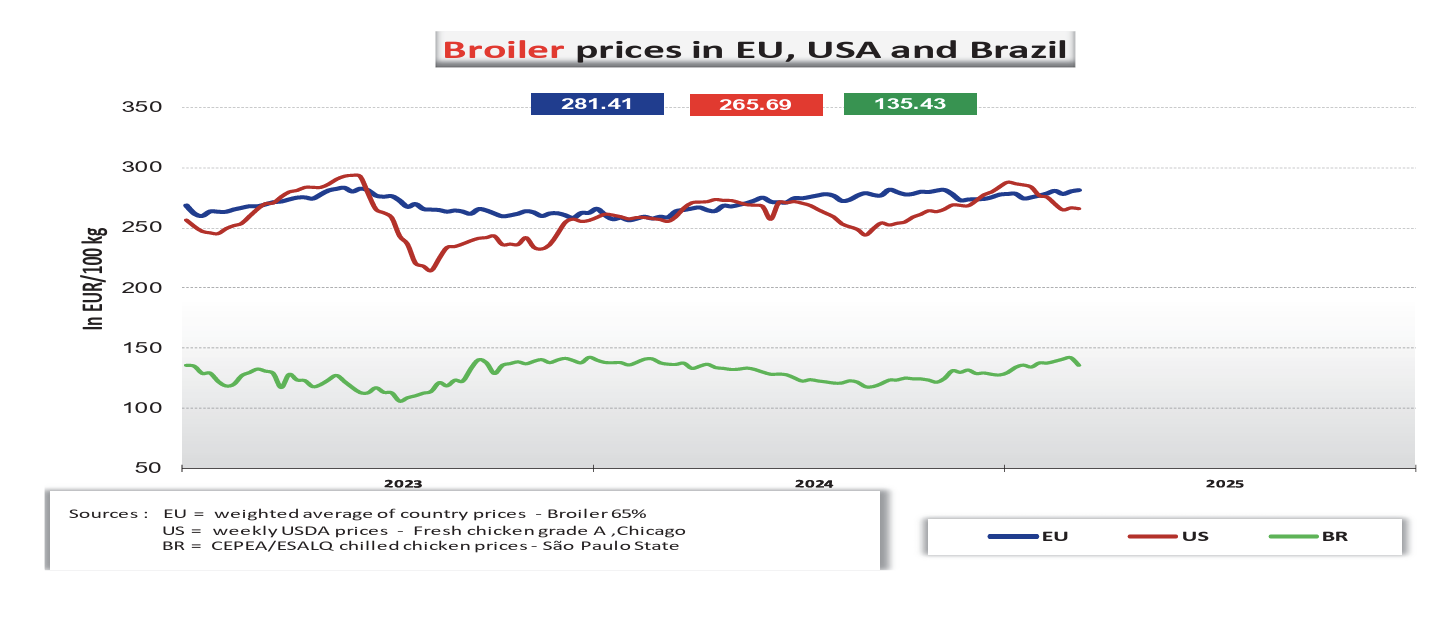

Price trends remained a focal point. After reaching record highs in mid-2023, broiler prices began to ease but picked up again by early 2025. As of week 11, the average EU broiler price stood at €284/100kg, 8% higher than the same period in the previous year. Chicken breast prices reached €586/100kg (+8% year-on-year), while leg quarters hit €260/100kg (+7% year-on-year). The increase in output prices, coupled with stabilised input costs, supported healthy producer margins.

Price trends remained a focal point. After reaching record highs in mid-2023, broiler prices began to ease but picked up again by early 2025. As of week 11, the average EU broiler price stood at €284/100kg, 8% higher than the same period in the previous year. Chicken breast prices reached €586/100kg (+8% year-on-year), while leg quarters hit €260/100kg (+7% year-on-year). The increase in output prices, coupled with stabilised input costs, supported healthy producer margins.

On the health front, the sector continued to battle avian influenza. Between October 2024 and March 2025, 383 outbreaks were recorded across 15 EU countries. Over 15 million birds were culled, with Hungary accounting for 53% of all outbreaks and significant losses reported in Poland and Italy. Duck and turkey farms were the most affected, though laying hens saw the highest numbers culled. The ongoing outbreaks have had a direct impact on trade, particularly due to third-country import bans and rejection of the EU’s regionalisation principle.

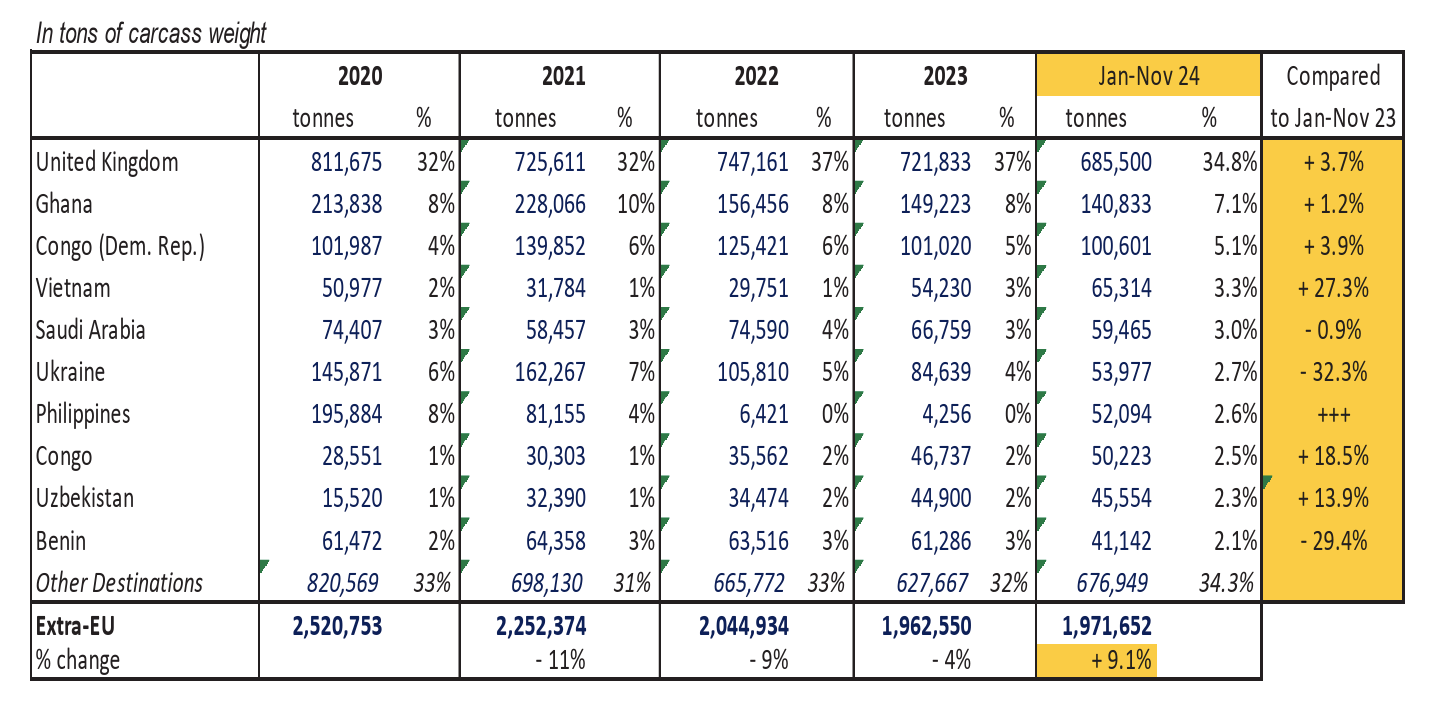

Despite these challenges, EU poultry exports to third countries rose by 9% in volume and 4% in value during the first eleven months of 2024. Key growth markets included the UK, Ghana, the Democratic Republic of Congo, and Vietnam. Exports to Saudi Arabia and Ukraine, however, saw notable declines.

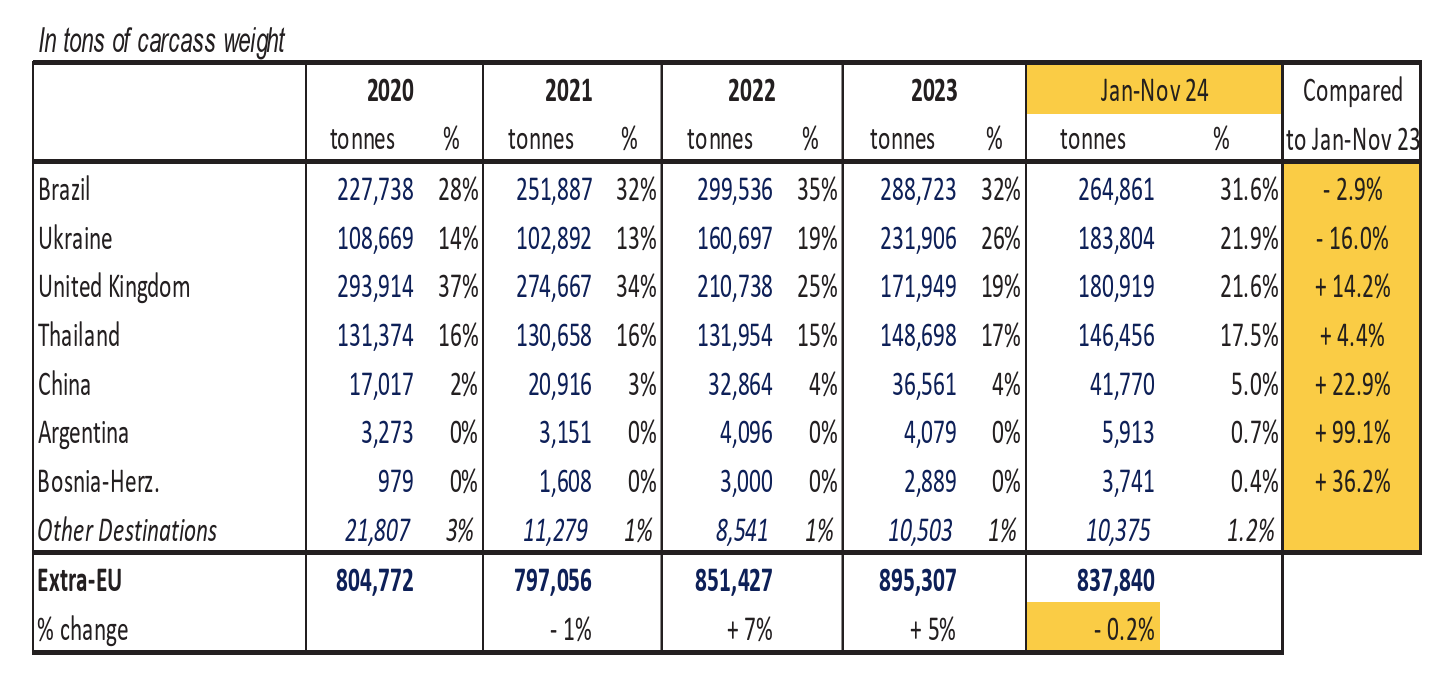

On the import side, volumes remained nearly flat (-0.2%), while the value increased slightly (+2%). Imports from Brazil and Ukraine decreased, while those from the UK and Thailand showed growth. Ukraine continued to enjoy duty-free, quota-free access under the Autonomous Trade Measures Regulation, with a safeguard clause in place for poultry products exceeding 57,101 tonnes in early 2025. By mid-March, 49% of this threshold had already been used.

On the import side, volumes remained nearly flat (-0.2%), while the value increased slightly (+2%). Imports from Brazil and Ukraine decreased, while those from the UK and Thailand showed growth. Ukraine continued to enjoy duty-free, quota-free access under the Autonomous Trade Measures Regulation, with a safeguard clause in place for poultry products exceeding 57,101 tonnes in early 2025. By mid-March, 49% of this threshold had already been used.

Internationally, price competitiveness remains an issue. In March 2025, the Brazilian broiler price averaged €135/100kg—less than half of the EU’s average—while the US price was €266/100kg. Brazilian exports increased to key markets like the UAE, Japan, and Saudi Arabia but saw sharp declines to China. Meanwhile, US poultry exports dropped by 9% in volume, with significant reductions to China and Taiwan.

Internationally, price competitiveness remains an issue. In March 2025, the Brazilian broiler price averaged €135/100kg—less than half of the EU’s average—while the US price was €266/100kg. Brazilian exports increased to key markets like the UAE, Japan, and Saudi Arabia but saw sharp declines to China. Meanwhile, US poultry exports dropped by 9% in volume, with significant reductions to China and Taiwan.

As the sector enters Q2 of 2025, EU poultry operators are navigating a complex landscape marked by production gains, disease pressures, evolving trade dynamics, and competitive pricing on the global stage. Strategic adaptation to these multifaceted forces will be essential to maintain profitability and market stability.

As the sector enters Q2 of 2025, EU poultry operators are navigating a complex landscape marked by production gains, disease pressures, evolving trade dynamics, and competitive pricing on the global stage. Strategic adaptation to these multifaceted forces will be essential to maintain profitability and market stability.

Source: agriculture.ec.europa.eu