Chicken is consumed in larger quantities than either beef or pork largely due to its relatively low fat and high protein content when compared to other animal proteins. In 2015, about 9 billion broiler chickens and 40 billion pounds of chicken meat were consumed in the United States (National Chicken Council). To keep up with this growing demand, the poultry industry has spent decades figuring out how to quickly, efficiently, and economically produce enough chicken meat and eggs.

Through improvements in breeding, nutrition, and management, todays’ chicken farmers are able to produce bigger birds faster than ever before while also improving feed conversion. Based on data provided by the National Chicken Council, chickens in 1955 were marketed at 70 days of age weighing 3.6 pounds, and required 3 pounds of feed per pound of gain. Sixty years later, a chicken could be grown to 6.2 pounds in 48 days with a feed conversion ratio of 1.89. Additionally, as these meat-type chickens have gotten heavier, their conformation has changed with an overall shift toward heavier breast yields. However, the market for chicken may be changing as consumers demand more than just affordable food.

With the supply of meat meeting or exceeding demand, consumers consider additional factors when making choices about their purchases. While some consumers simply look for the lowest price, others seek products with other attributes that add perceived value. Producers can capitalize on these attributes to set their product apart by marketing their chickens as natural, organic, antibiotic-free, free-range, etc.

When it comes to chicken meat and other animal products, consumers are increasingly concerned about the health and welfare of the animal before it reached their table. Animal activist groups have fueled that concern with propaganda designed to vilify the animal agriculture industry. As a result, changes have already been seen in the poultry industry with increasing demand for cage-free eggs. In fact, as of 2017, “every major restaurant, supermarket, and foodservice chain had pledged to ban cages from its egg supply”. It looks like broiler chickens may be next.

In March 2016, Whole Foods Market and Global Animal Partnership (GAP), a nonprofit organization that develops comprehensive farm animal welfare standards, announced their intention to switch to slower-growing meat-type chickens by 2024. This move would affect over 600 chicken farms currently using the GAP standard, which amounts to 277 million chickens annually (“Why Whole Foods Wants A Slower-Growing Chicken”). However, it will affect far more farms and chickens if it gains momentum like the cage-free movement has. As of early 2017, several other major retailers like Compass Group, Aramark, Sodexo, Panera, Chipotle, Shake Shack have made similar commitments to transition to slower-growing chickens in the name of animal welfare (“Two large foodservice companies commit to slower-growing broilers”, 2016, “Shake Shack Is Making a New Animal Welfare Promise” “Slow-growing broilers provide welfare goals for growers”).

These pledges are likely to increase in response to the video Compassion in World Farming released at the end of January 2017 claiming that up to 96% of chickens have muscular disorders like white striping and that these birds have 224% more fat (Compassion USA). These claims were based on information from a few recently published studies. While the data was taken out of context, that did not stop multiple news outlets from picking up the story over the next few weeks. It remains to be seen how this affects consumers, retailers, and producers moving forward.

Slow-growing broilers

GAP describes slow-growing broilers as those with the “genetic potential growth rate equal to or less than 50 grams per day averaged over the growth cycle (roughly 23% slower growth than conventional chickens).” This is significantly lower than the current industry average of 61 grams per day, which means birds will need to stay on the farm significantly longer to reach the same market weight (National Chicken Council). Currently, slow-growing broilers make up a tiny percentage of the market in the United States, but they have gained a foothold in parts of Europe. Slower-growing breeds making up 25-30% of Dutch broiler production, 15% of French broiler production, and 7% of production in the United Kingdom (“The expanding market for slow-growing broilers”).

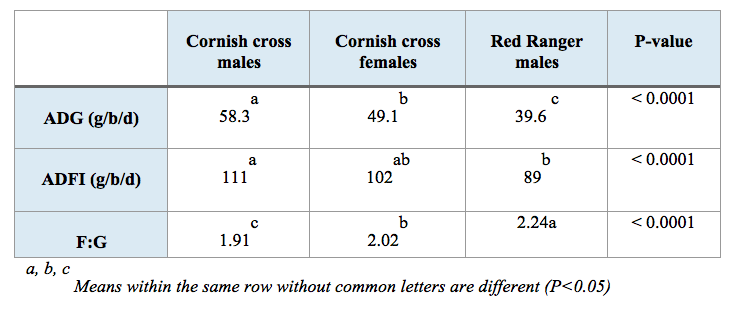

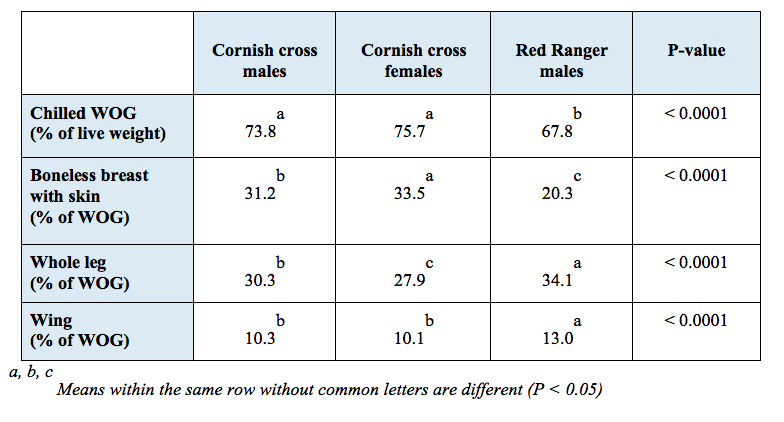

One of the slow-growing broilers available in the United States is the Red Ranger, which is a red-feathered bird that is expected to reach 1.4 to 1.8 kilograms by 8 weeks of age. The Red Ranger is described as having a 70% dressed-weight yield with breast in natural proportion to leg meat. As part of my dissertation work, Cornish Cross males, Cornish Cross females, and Red Ranger males were reared on a self-selection diet with four feed choices: a protein concentrate (39% CP) and three grain (cracked corn, pearl millet, and rolled naked oats). Red Ranger males had significantly lower average daily gain and poorer feed conversion ratios than either Cornish Cross males or females (Table 1). Additionally, the Red Ranger males had significantly lower chilled WOG yields and lower boneless skinless breast yields than either the Cornish Cross males or females (Table 2).

Economic implications of slow-growing broilers

While GAP’s announcement suggests the only difference between a slow-growing broiler like the Red Ranger and the fast-growing broilers used commercially is 23% slower growth, this fails to account for the implications of the other differences. Most notably, the poorer feed conversion, lower WOG yields, and lower breast meat yields.

Assuming that birds will be marketed as whole carcasses, consideration must be paid to the Red Ranger’s slower growth rate, poorer feed conversion, and lower WOG yield. Red Rangers have lower WOG yields than Cornish Cross which results in needing 9% more birds to achieve the same weight of whole carcasses. The slower growth rate requires birds to be housed 45% longer.

To account for the combination of more birds and longer rearing time, 50% more houses. The poorer feed conversion of the Red Ranger results in 28% more feed needing to be provided. Finally, the lower WOG yield results in 36% more offal produced per carcass.

However, it is worth noting that most chicken meat is marketed as cut-up parts with the white meat being most valuable cut. Therefore, the cut-up part yields must also be considered. The Cornish Cross carcass is over 30% breast meat while the Red Ranger carcass is only 20% breast meat. Therefore, 68% more birds would be required to produce the same amount of breast meat from Red Rangers.

To account for the increased number of birds ands and longer grow-out, 128% more houses would need to be built and 97% more feed would be needed. Also of note, there would be 73% more legs, 94% more wings, and 95% more offal to market or dispose of if Red Rangers were used to meet the demand for breast meat.

This data supports the findings of another recent study by Elanco Animal Health, which utilized a simulation model to estimate the impact of slow-growing broilers on feed, land, water utilization, waste production, and cost.

The findings of that study suggested an additional 1.5 billion birds would be needed annually to replace just one-third of broiler chickens in the United States with slower growing breeds which would greatly increase the amount of feed, land, and water needed while also increasing manure output.

The impact primarily reflected the increased length of grow-out, additional space requirements, poorer feed conversion and lower yields of the slow-growing birds. Ultimately, that switch would cost the industry $9 billion and could threaten national food security (“National Chicken Council Calls for Balance between Animal Care, Environmental, Economic Impact in Chicken Production,” 2017).

Making a profit on slow-growing broilers

Slow-growing broilers have the potential to greatly increase the costs while decreasing marketable outputs. Therefore, using slow-growing broilers to replace fast-growing broilers in a conventional system is unlikely to result in substantial profit. However, when used in the right production system and marketed to the right consumer, slow-growing broilers can be raised profitably.

Producers interested in raising slow-growing broilers should focus on premium markets. The consumers who are interested in other premium labels such as organic, free-range, pasture poultry, etc. are more likely than the average customer to pay the premium slow-growing broilers will require to be profitable. Additionally, research suggests slow-growing broilers may be better suited to free range and pasture poultry systems than their fast-growing counterparts. Rack et al. (2009) found that fast-growing broilers on pasture demonstrated poor growth performance when compared to fast-growing broilers raised indoors. On the other hand, while slow-growing broilers had poor growth performance when compared to fast-growing broilers, slow-growing broilers on pasture did not experience reduced performance when compared to slow-growing broilers raised indoors. Moreover, Fanatico et al. (2005) has shown that slow-growing birds spent more time outside and were generally more active than fast-growing birds. Fanatico et al. (2008) found slow-growing birds demonstrate better gait scores and lower incidence of tibial dyschondroplasia.

Based on the data presented previously, slow-growing broilers should be marketed as whole birds rather than cut-up. While these birds will still require more feed and more time in the house than fast-growing broilers would, the increases are not as extreme, which makes the cost easier to recapture.

The difference in body conformation between fast- and slow-growing broilers could serve as a helpful differentiation between conventional and alternative systems on the retail shelf. This differentiation could have the added benefit of improving brand recognition for producers using slow-growing broilers.

Finally, as with other products, it is important to remember that consumer psychology is important. As suggested by the research by Napolitano et al. (2013), consumer preference for chicken breast may be more affected by information on production than by the sensory properties of the product. Therefore, providing information on product labels that suggests better production practices may increase consumer preference for these products, which in turn enables these products to command a premium price.

References are available on request.

From the Proceedings of the 2017 Midwest Poultry Convention