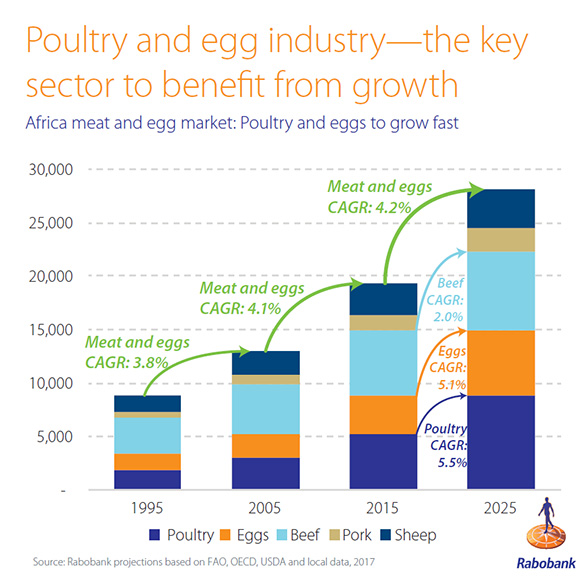

The year-on-year growth in the global poultry markets is set to continue: a demand growth of more than 60% is expected over the next 20 years. This leads to significant global investment streams in an industry that is evolving, from a national and regional basis to a more global platform. Most recent investments have focused on Europe, the Americas and Asia, driven by bullish market circumstances. Africa has attracted relatively limited investor interest. But this is changing.

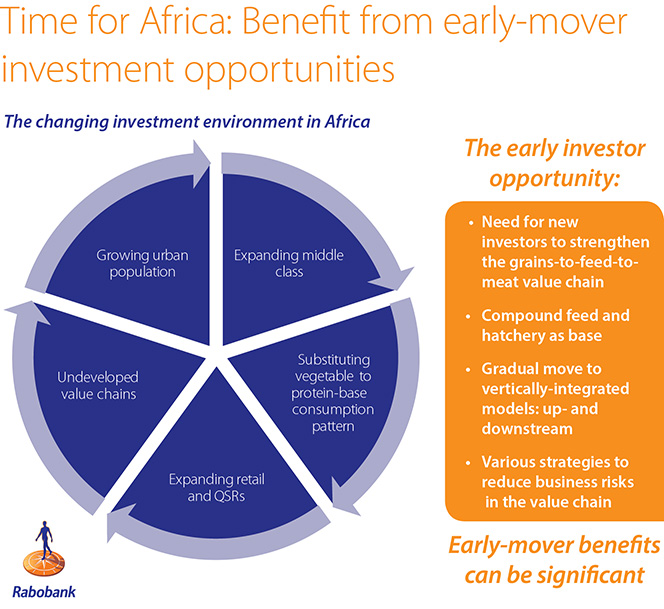

“Driven by a rising middle class and rapid urbanisation, a more modern poultry industry is taking shape in Africa”, according to Rabobank Senior Animal Protein Analyst Nan-Dirk Mulder. “The growing middle class is changing its consumption patterns, moving from vegetable-based consumption to a more protein-rich diet. In this shifting diet, poultry and eggs are the protein of choice for African consumers—as these protein sources are affordable and available, but also because consumers prefer the taste of chicken and eggs over other proteins. Poultry availability is supported by the short payback times for poultry and egg production, making poultry production easier to start up and expand.” Furthermore, many Sub-Saharan African countries like Nigeria, Angola, Zambia and Zimbabwe have the potential to further increase their feed ingredient supply, which could support a more competitive supply of poultry in these countries, as feed costs make up around 70 % of total costs.

“Driven by a rising middle class and rapid urbanisation, a more modern poultry industry is taking shape in Africa”, according to Rabobank Senior Animal Protein Analyst Nan-Dirk Mulder. “The growing middle class is changing its consumption patterns, moving from vegetable-based consumption to a more protein-rich diet. In this shifting diet, poultry and eggs are the protein of choice for African consumers—as these protein sources are affordable and available, but also because consumers prefer the taste of chicken and eggs over other proteins. Poultry availability is supported by the short payback times for poultry and egg production, making poultry production easier to start up and expand.” Furthermore, many Sub-Saharan African countries like Nigeria, Angola, Zambia and Zimbabwe have the potential to further increase their feed ingredient supply, which could support a more competitive supply of poultry in these countries, as feed costs make up around 70 % of total costs.

New investments

Supermarkets and quick-service restaurants have responded to the opportunity of a rising African middle class and are expanding across the continent, pulling new investments into the region.

Modern poultry supply chains are attracting investors—with companies usually starting with feed mills and hatcheries, and building from there. We see a trend of building a smarter poultry value chain, encompassing breeding, grow-out farms and processing facilities.

In some cases, companies are also investing in distribution, through butcher shops and restaurant chains. The African poultry and egg industry is in a fast growth mode, which offers various opportunities for international investors in several areas:

- Meat processing: Developing a modern poultry value chain

- Breeding: Establishing a modern breeding supply chain

- Equipment: Supplying the right equipment for the growing, more modern, industry

- Animal nutrition: Setting up feed mills to supply more modern compound feed, distributing premixes and additives

- Grains & oilseeds: Developing adequate supply for local feed manufacturing

However, capturing this African poultry investment opportunity is not easy. It requires a pioneering spirit, a good market and risk assessment, capable local partners and patience, as investment risks can be high. If done well, the rewards can be large, especially for companies that move early and are well prepared.

Regional overview

Southern Africa: The South African industry is well-positioned to benefit from the bullish industry in Sub-Saharan Africa, as many international retail and quick-service restaurant (QSR) investments in the region are of South African origin. This could provide the industry with a good sales platform. The poultry industry has already started this movement but the focus so far has been on the southern region, with countries like Zambia, Mozambique and Botswana, and less on Western and Eastern Africa. This is gradually changing though, and companies are moving further up north to capture untapped opportunities.

Eastern Africa: The industry in Eastern Africa is located in the fastest-growing markets of Sub-Saharan Africa, like Uganda, Kenya and Tanzania, and this should be a good basis for further growth, especially as the impact of imports from non-African countries has historically been limited. The Eastern African industry is expected to develop fast, and some countries like Uganda and Kenya have the potential to become a regional trade hub over the next few years.

Western Africa: The rising ambition of Western-African countries to become less dependent on trade is leading to additional growth opportunities for the industry. Nigeria and Senegal in particular have reduced their imports, which will impact the industry’s outlook, although some risk will be involved if strategies change. On the other hand, countries like Nigeria, Côte d’Ivoire and Ghana are some of the most bullish industries in the region, and this will lead to significant investments in the value chain. In addition, the countries share good conditions for feed grain production, an additional benefit for the poultry industry.

Central Africa: The poultry industries in Central African countries like Angola and the Democratic Republic of the Congo (DRC) have traditionally been very much import-driven — especially Angola, which is changing its strategy and has strong ambitions to move to significantly high self-sufficiency rates. The availability of local feed production is an important prerequisite for local investments in poultry farms, and Angola has significant upside potential here. DRC is also gradually moving to more local production, although its infrastructure is still lacking.

Source: Rabobank

Cover Photo: ©https://economicconfidential.com/