This paper analyses the dynamics in Mexico’s egg and poultry meat industry and in poultry meat and egg imports between 2010 and 2020.

Hans-Wilhelm Windhorst – The author is Professor emeritus at the University of Vechta and visiting Professor at the University of Veterinary Medicine, Hannover, Germany

Mexico’s role in the global poultry industry is often underestimated. In 2019, it ranked in 6th place among the leading egg producing countries with a share of 3.5% in the global production volume. It contributed 2.9% to global chicken meat production, a share of 2.9% in the global production and rank 7 among the leading countries. In the global trade with broiler and turkey meat it ranked in first place, sharing 6.7% of the chicken meat imports and even 16.3% of the global turkey meat imports. Because of the high domestic production, egg imports were negligible.

Poultry products: the main protein source

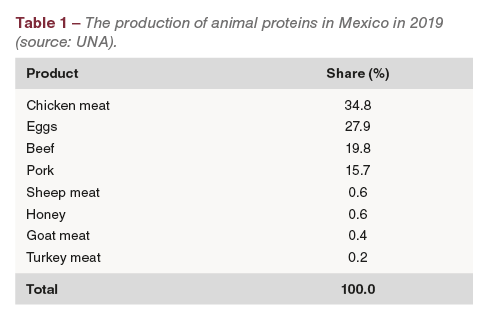

Poultry products are the main protein source for the Mexican population. In 2019, almost 63% of the animal protein production came from eggs and poultry meat (Table 1).

Poultry products are the main protein source for the Mexican population. In 2019, almost 63% of the animal protein production came from eggs and poultry meat (Table 1).

The preference of the consumers for poultry products has various reasons. Because of the favourable feed conversion, production costs of eggs and broiler meat are much lower than for beef and pork. Broiler meat and eggs can be used in a broad variety of meals and have a long tradition in Mexican nutrition. The consumer price is lower than for other meats and affordable even for low-income families.

Covid-19 interrupted the dynamical growth of chicken meat consumption

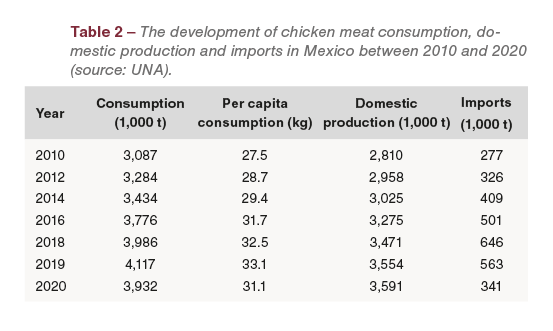

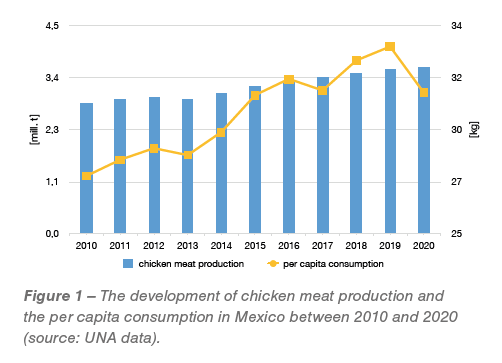

Between 2010 and 2019, chicken meat production increased from 2.8 mill. t to 3.6 mill. t or by 26.5% (Table 2, Figure 1). Consumption increased even faster and with 33.1 kg reached an all-time high in per capita consumption in 2019. As the demand was not be met by domestic production, high import volume were necessary. In 2020, about 80% of the chicken meat imports came from the USA, 15% from Brazil and the rest from Chile and Argentina.

Between 2010 and 2019, chicken meat production increased from 2.8 mill. t to 3.6 mill. t or by 26.5% (Table 2, Figure 1). Consumption increased even faster and with 33.1 kg reached an all-time high in per capita consumption in 2019. As the demand was not be met by domestic production, high import volume were necessary. In 2020, about 80% of the chicken meat imports came from the USA, 15% from Brazil and the rest from Chile and Argentina.

Between 2019 and 2020, chicken meat consumption fell by 185,000 t, the per capita consumption by 2 kg, resulting in a decrease of the imports by 222,000 t or 40% as the domestic production remained stable. The downward trend had various reasons. In 2019, an economic recession began and the country’s gross domestic product fell by 10%. In addition to lower incomes and a devaluation of the Peso, the Covid-19 pandemic worsened the economic situation. The sharp decline of tourism and the lockdown of hotels and restaurants caused the decline in consumption. Especially for low-income families, meat became very expensive. To secure their protein supply, consumers switched to eggs.

Between 2019 and 2020, chicken meat consumption fell by 185,000 t, the per capita consumption by 2 kg, resulting in a decrease of the imports by 222,000 t or 40% as the domestic production remained stable. The downward trend had various reasons. In 2019, an economic recession began and the country’s gross domestic product fell by 10%. In addition to lower incomes and a devaluation of the Peso, the Covid-19 pandemic worsened the economic situation. The sharp decline of tourism and the lockdown of hotels and restaurants caused the decline in consumption. Especially for low-income families, meat became very expensive. To secure their protein supply, consumers switched to eggs.

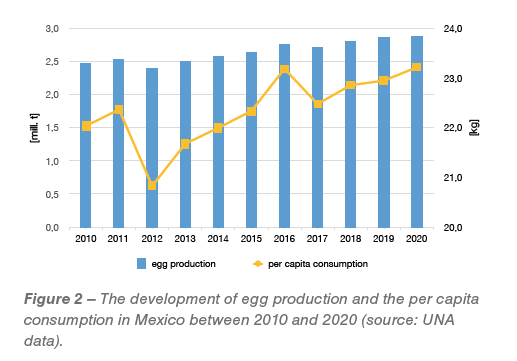

Continuous growth of egg production and consumption

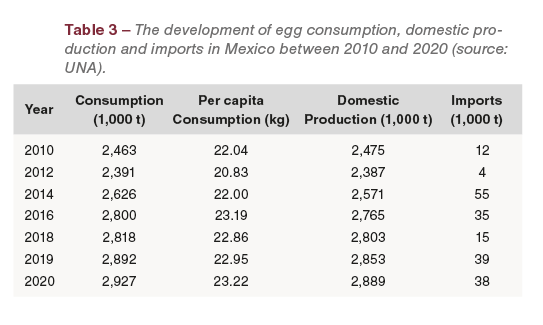

Mexico’s egg consumption grew continuously from 2.5 mill. t in 2010 to 2.9 mill. t in 2020 or by 18.8%, only interrupted by the Avian Influenza outbreaks in 2012. As the domestic production increased parallel to the growth in demand, egg imports were only of minor importance. Between 2018 and 2020, the per capita consumption of eggs increased by 0.36 kg, a consequence of the economic recession and the high meat prices (Table 3, Figure 2).

Mexico’s egg consumption grew continuously from 2.5 mill. t in 2010 to 2.9 mill. t in 2020 or by 18.8%, only interrupted by the Avian Influenza outbreaks in 2012. As the domestic production increased parallel to the growth in demand, egg imports were only of minor importance. Between 2018 and 2020, the per capita consumption of eggs increased by 0.36 kg, a consequence of the economic recession and the high meat prices (Table 3, Figure 2).

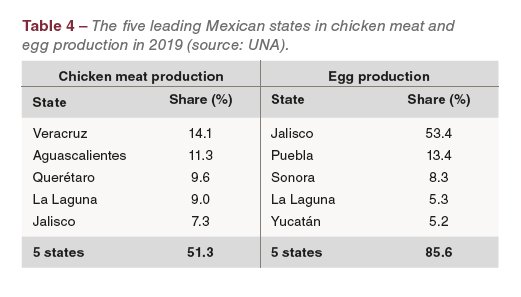

High regional concentration of production

Chicken meat and egg production are regionally concentrated to a high degree. Table 4 documents that the concentration is higher in egg than in chicken meat production. The spatial pattern has advantages and risks. Shorter distances between the chicken houses, feed mills, packing plants and further processing facilities are and advantage, lowering the transportation costs. On the other hand, the concentration of chicken barns can be a risk, as the dissemination of the Avian Influenza virus in 2012 showed.  To control a further spread of the highly infectious virus and to reduce economic losses, breeding and layer herds were and are vaccinated. As broiler flocks were and are not vaccinated, they are a permanent risk for the poultry industry in the centres of production. The spatial shift of egg production from the state of Jalisco to other states would definitely reduce the risk of outbreaks, but this would demand high financial investments, which seem not to be available because of the economic recession.

To control a further spread of the highly infectious virus and to reduce economic losses, breeding and layer herds were and are vaccinated. As broiler flocks were and are not vaccinated, they are a permanent risk for the poultry industry in the centres of production. The spatial shift of egg production from the state of Jalisco to other states would definitely reduce the risk of outbreaks, but this would demand high financial investments, which seem not to be available because of the economic recession.

Summary and perspectives

Mexico is one of the leading countries in egg and chicken meat production and the leading importing country for broiler and turkey meat. Over the past decade, chicken meat and egg production increased continuously. Avian Influenza outbreaks in 2012 interrupted the growth of egg production for a short period, but did not affect the poultry meat sector. Chicken meat and eggs are the main protein source for the population. This is reflected in the high per capita consumption. While Mexico is almost self-sufficient in egg supply, considerable amounts of broiler meat are imported, mainly from the USA and Brazil. The Covid-19 pandemic and the economic recession caused a decline in chicken meat consumption in 2020 and resulted in lower imports. A permanent risk for the highly concentrated poultry industry is the Avian Influenza virus. Despite the vaccination of breeding and layer herds, the virus is endemic in certain states. The lasting Covid-19 pandemic will affect the poultry industry, especially chicken meat production, also in 2021.

Data sources and suggestions for further reading