Global chicken meat production is projected to grow by 24.4 mill. t or 22.3 % between 2014 and 2024. In contrast to egg production (see Zootecnica International, February 2018 issue), the future dynamics in chicken meat production can be analysed at country level, based on the OECD-FAO Agricultural Outlooks.

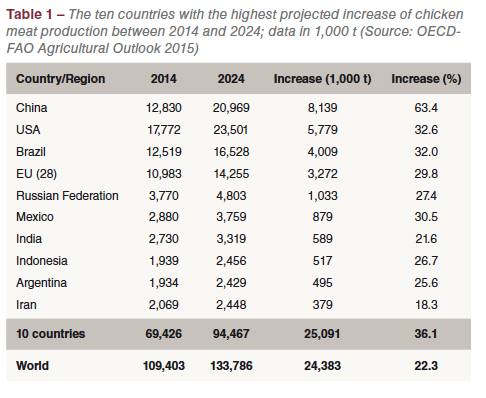

Unlike shell eggs, which are mainly traded only over short distances, deep frozen chicken meat is traded worldwide. Table 1 lists the ten countries with the highest projected growth of chicken meat production between 2014 and 2024.

Unlike shell eggs, which are mainly traded only over short distances, deep frozen chicken meat is traded worldwide. Table 1 lists the ten countries with the highest projected growth of chicken meat production between 2014 and 2024.

For the EU (28) no data at country level are available, as the OECD-FAO counts the EU as a single market.

China’s chicken meat production is projected to grow by 8.1 mill. t or 63.4 %, followed by the USA (32.6 %) and Brazil (32.0 %). It is worth mentioning that the absolute growth of the production volume in the USA is expected to be about 1.7 mill. t higher than that of Brazil. In the EU and the Russian Federation, the absolute growth is expected to reach volumes between 1.0 mill. t and 3.3 mill. t. The considerable growth in the EU will be mainly a result of high growth rates in Eastern Europe.

The data in Table 1 reflects the changes in the per capita consumption of chicken meat. The absolute growth of the production volume in the ten countries surpasses that of the global increase. This indicates that in several countries chicken meat production will decrease in the analysed time period.

The data in Table 1 reflects the changes in the per capita consumption of chicken meat. The absolute growth of the production volume in the ten countries surpasses that of the global increase. This indicates that in several countries chicken meat production will decrease in the analysed time period.

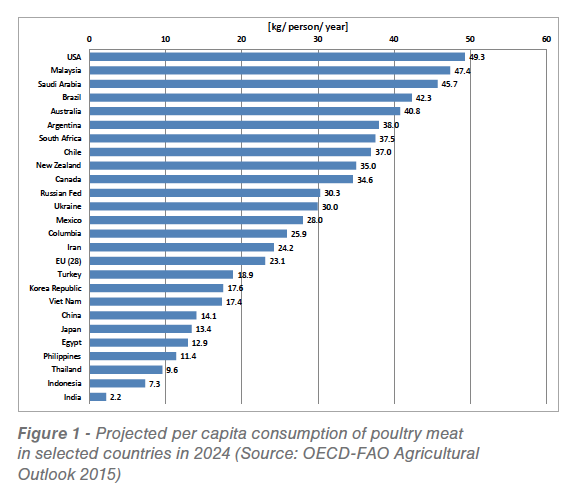

In Figure 1 the expected per capita consumption of poultry meat for selected countries is documented as no data is available for chicken meat alone. The graph shows the wide gap between the high consumption in the USA, Malaysia, Saudi Arabia, Brazil and Australia with more than 40 kg per person and year and the very low consumption in Thailand (9.6 kg), Indonesia (7.3 kg) and India (2.2 kg).

The low poultry meat consumption in Indonesia in contrast to many other Islamic countries is surprising, especially in comparison with Saudi Arabia. The low per capita consumption in India is a result as well of the low purchasing power of the population as of the high percentage of vegetarians and vegans because of religious barriers. It can be expected that the projected per capita consumption in Indonesia, Northern Africa and Western Asia will perhaps be surpassed by the real growth rates.

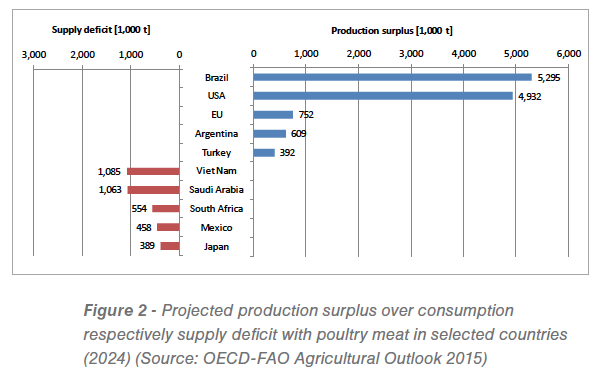

Figure 2 shows the countries with the highest expected production surplus over consumption respectively with the highest supply deficit. A production surplus over consumption of 5.3 mill. t is projected for Brazil and of 4.9 mill. t for the USA. The dominating position of Brazil and the USA as the main poultry meat exporting countries is obvious. They will dominate chicken meat trade also in 2030. But also the EU (28), Argentina and Turkey will play a major role in global poultry meat trade.

Figure 2 shows the countries with the highest expected production surplus over consumption respectively with the highest supply deficit. A production surplus over consumption of 5.3 mill. t is projected for Brazil and of 4.9 mill. t for the USA. The dominating position of Brazil and the USA as the main poultry meat exporting countries is obvious. They will dominate chicken meat trade also in 2030. But also the EU (28), Argentina and Turkey will play a major role in global poultry meat trade.

On the other hand, Vietnam and Saudi Arabia will have to import more than 1 mill. t of poultry meat to meet the domestic demand. The same is true for South Africa, Mexico and Japan, although their import volumes will be considerably lower.

In contrast to shell eggs, deep frozen poultry meat can be traded over long distances. Between 11 % and 12 % of the global chicken meat production is traded. Least and less developed countries, but also some threshold and industrialised countries import considerable volumes of chicken meat. The traded quantities differ, however, and also the products. While EU member countries mainly import chicken breast filets either from other member countries or from Brazil and Thailand, low value products (wings, legs, claws) are in particular imported by some threshold and less developed countries.

Acknowledgements

The Author would like to thank his colleagues Dr. Aline Veauthier and Miss Désirée Heijne for preparing the graphs of this paper

Data sources, references and additional literature

AMI (ed.): Marktbilanz Vieh und Fleisch 2016. Bonn 2016.

Brazilian Association of Animal Protein (ABPA): Annual Report. Sao Paula 2016.

FAO database: faostat3.fao.org.

OECD-FAO Agricultural Outlook 2015. Paris 2015: OECD Publishing.

http://dx.doi.org/10.1787/agr_outlook-2015-en

OECD Statistics: http://stats.oecd.org.

US National Chicken Council: www.nationalchickencouncil.org.

Windhorst, H.-W.: Global Egg Production and Dynamics – Past, Present and Future of a Remarkable Success Story. London: International Egg Commission 2014. 35 p.

Windhorst, H.-W.: The role of developing and newly industrialised countries in global egg industry. In: Annual Review 2015. London: International Egg Commission 2015, p. 4-13.

Windhorst, H.-W.: The projected development of global meat production until 2024. Part 1: Poultry meat: Poultry continues with triumphant success. In: Fleischwirtschaft International 31 (2016), no. 3, p. 30-34

Windhorst, H.-W.: Asia´s Role in the Global Poultry Industry. London: International Egg Commission 2016. 31 p.

The papers are abridged versions of a special report which the Author prepared for the International Egg Commission (IEC)