The USA is the leading broiler meat producer with a share of 12 % in the global production volume, followed by China with 9 % and Brazil with 8 %. With a contribution of 28.4 % to the global broiler meat export volume, the USA ranked second behind Brazil which shared 32.8 %.

In addition to a paper, which analysed the ongoing competition between these two countries in the global market (here), this paper will deal with the dynamics and patterns of the U.S. broiler industry.

Remarkable growth of production

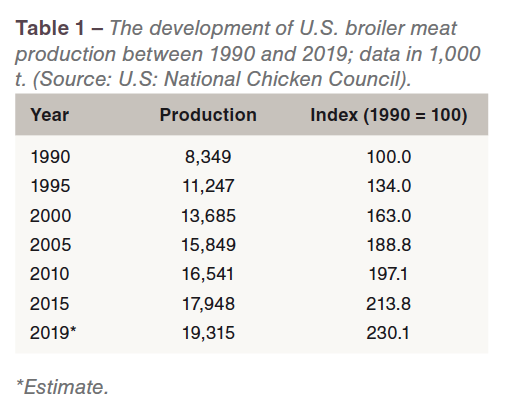

Between 1990 and 2018, broiler meat production in the USA increased from 8.3 mill. t to 17.9 mill. t or by 113.8 %. It is estimated that the remarkable dynamics will continue in 2019 and reach a new maximum with 19.3 mill. t (Table 1).The remarkable growth of the production reflects the development of the per capita consumption. Table 2 shows that it increased from 26.7 kg in 1990 to 40.0 kg in 2018 or by 49.8 %. The National Chicken Council estimates that it will grow by another 1.8 kg in 2019, which would result in a relative increase of 56.6 % since 1990. A closer look at the data reveals that it has not been a continuous growth. Between 2006 and 2014, the per capita consumption fluctuated between 37.6 kg and 39.0 kg. A minimum was reached in 2009 with only 35.9 kg. It was not before 2015 that the value surpassed that of 2006. A

Between 1990 and 2018, broiler meat production in the USA increased from 8.3 mill. t to 17.9 mill. t or by 113.8 %. It is estimated that the remarkable dynamics will continue in 2019 and reach a new maximum with 19.3 mill. t (Table 1).The remarkable growth of the production reflects the development of the per capita consumption. Table 2 shows that it increased from 26.7 kg in 1990 to 40.0 kg in 2018 or by 49.8 %. The National Chicken Council estimates that it will grow by another 1.8 kg in 2019, which would result in a relative increase of 56.6 % since 1990. A closer look at the data reveals that it has not been a continuous growth. Between 2006 and 2014, the per capita consumption fluctuated between 37.6 kg and 39.0 kg. A minimum was reached in 2009 with only 35.9 kg. It was not before 2015 that the value surpassed that of 2006. A  comparison with the dynamics in broiler meat production does not reflect the ups and downs. The increase of the export volume was able to compensate the decrease in the domestic demand. The data in Table 2 also documents the extraordinary role which broiler meat plays in total poultry meat consumption.

comparison with the dynamics in broiler meat production does not reflect the ups and downs. The increase of the export volume was able to compensate the decrease in the domestic demand. The data in Table 2 also documents the extraordinary role which broiler meat plays in total poultry meat consumption.

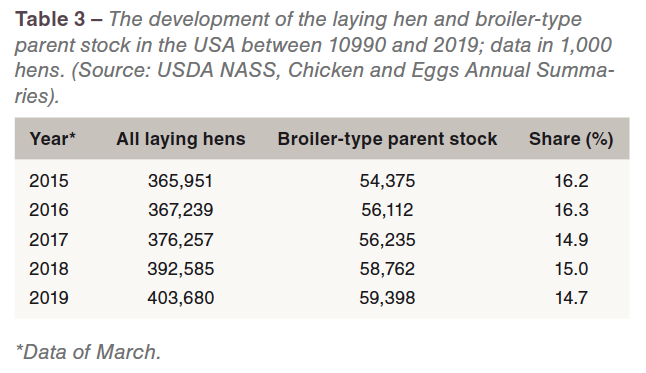

The fast increase of broiler meat production resulted in a continuous growth of the broiler-type parent stock. Between March 2015 and March 2019, the inventory increased by 5 mill. birds. The share in the total number of layers was, however, 1.5 % lower in 2015. The  decreasing share is a result of the transformation of the housing systems in laying hen husbandry. The share of cage-free systems in laying hen husbandry grew from about 6 % in 2015 to 18.4 % in March 2019. Almost 62 mill. hens were kept in cage-free systems.

decreasing share is a result of the transformation of the housing systems in laying hen husbandry. The share of cage-free systems in laying hen husbandry grew from about 6 % in 2015 to 18.4 % in March 2019. Almost 62 mill. hens were kept in cage-free systems.

Favourable feed conversion, no religious barriers and low price – the main steering factors behind the remarkable growth

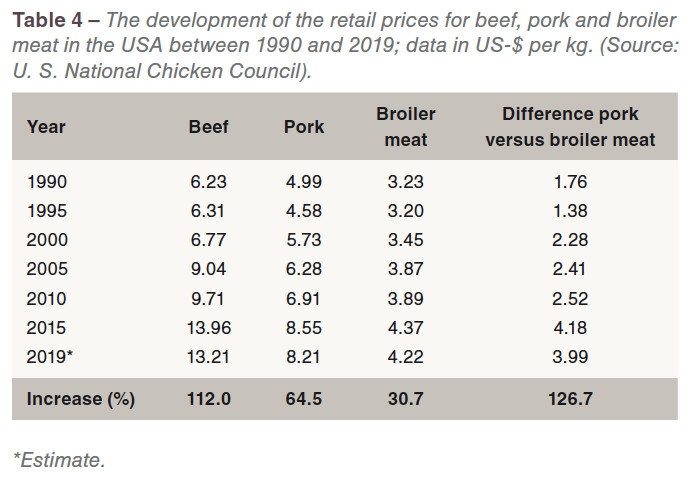

The remarkable growth of broiler meat production can be explained by several steering factors. In contrast to pork and beef production, only between 1.5 and 1.7 kg of feed is needed to produce one kg of broiler meat. The feed conversion rate for pork is about 1:2.8 and for beef 1:4, resulting in considerable higher production costs. A second important factor is that broiler meat consumption is permitted in all religions, which is not the case for pork and beef. This is not only an advantage for the domestic market, but also for exports. A third steering factor is the comparatively low price for broiler meat (Table 4). This also explains the extraordinary success of broiler meat in fast food chains. Compared to beef and pork, the retail price for broiler meat increased much slower.

The remarkable growth of broiler meat production can be explained by several steering factors. In contrast to pork and beef production, only between 1.5 and 1.7 kg of feed is needed to produce one kg of broiler meat. The feed conversion rate for pork is about 1:2.8 and for beef 1:4, resulting in considerable higher production costs. A second important factor is that broiler meat consumption is permitted in all religions, which is not the case for pork and beef. This is not only an advantage for the domestic market, but also for exports. A third steering factor is the comparatively low price for broiler meat (Table 4). This also explains the extraordinary success of broiler meat in fast food chains. Compared to beef and pork, the retail price for broiler meat increased much slower.

Southeastern and Mid-Atlantic States dominate broiler production

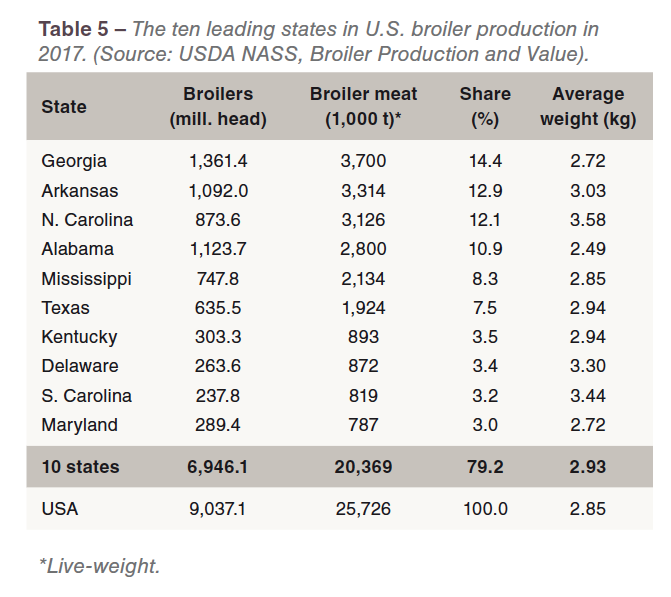

More than 9 billion broilers were produced in the United States in 2017. Production was heavily concentrated in the Southeastern and Mid-Atlantic States of the USA as can be seen from the data in Table 5. The four leading states shared 50.5 % in the total production volume, the leading 10 states 79.2 %. The concentration of broiler production in the Southeast has a long tradition. It is closely related to the demise of cotton production because of the high losses, which were caused by the cotton boll weevil. The former cotton belt dissolved. A cheap labour force, available land, favourable transportation rates for the shipping of feed from the Midwest to the Southeast by rail and the formation of vertically-integrated production chains were the main steering factors. Many of the leading broiler companies have their headquarters in the Southeast and the Mid-Atlantic States, for example Tyson, Pilgrim and Perdue. The table also documents the considerable differences in the average weight of the broilers at the end of the growing period. This depends on the policy of the contractor and the final product which they market. If they cut up the carcasses, heavy broilers are preferred, if they export to countries on the Arabian Peninsula, smaller whole birds are the main export product.

More than 9 billion broilers were produced in the United States in 2017. Production was heavily concentrated in the Southeastern and Mid-Atlantic States of the USA as can be seen from the data in Table 5. The four leading states shared 50.5 % in the total production volume, the leading 10 states 79.2 %. The concentration of broiler production in the Southeast has a long tradition. It is closely related to the demise of cotton production because of the high losses, which were caused by the cotton boll weevil. The former cotton belt dissolved. A cheap labour force, available land, favourable transportation rates for the shipping of feed from the Midwest to the Southeast by rail and the formation of vertically-integrated production chains were the main steering factors. Many of the leading broiler companies have their headquarters in the Southeast and the Mid-Atlantic States, for example Tyson, Pilgrim and Perdue. The table also documents the considerable differences in the average weight of the broilers at the end of the growing period. This depends on the policy of the contractor and the final product which they market. If they cut up the carcasses, heavy broilers are preferred, if they export to countries on the Arabian Peninsula, smaller whole birds are the main export product.

Slow recovery of broiler meat exports

The outbreaks of the Avian Influenza virus in the Midwest in 2015 had far reaching impacts on U. S. poultry exports even though no broiler farm was affected. In addition, the export ban of the Russian Federation on poultry product imports from the USA, Canada and the EU also affected the export volume and the trade pattern.

The outbreaks of the Avian Influenza virus in the Midwest in 2015 had far reaching impacts on U. S. poultry exports even though no broiler farm was affected. In addition, the export ban of the Russian Federation on poultry product imports from the USA, Canada and the EU also affected the export volume and the trade pattern.

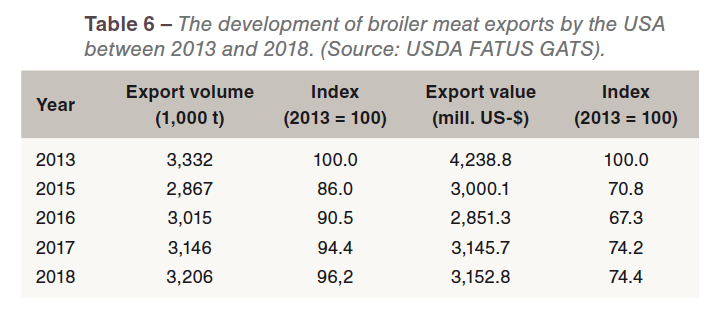

The data in Table 6 shows the slow recovery from the drastic decrease of the export volume in 2015. Despite the recent increase, exports in 2018 were still about 126,000 t or 3.8 % lower than in 2013 when a peak with 3.33 mill. t. was reached. An even sharper decrease showed the export value. It was still 25.6 % lower in 2018 than in 2013. The oversupply on the global market led to lasting low broiler meat prices.

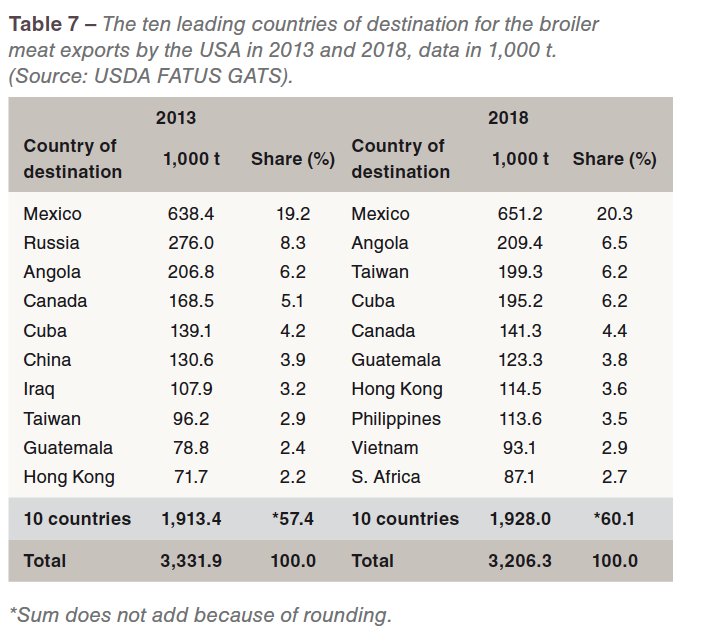

Table 7 lists the ten leading countries of destination of the broiler meat exports in 2013 and 2018. In 2013, a maximum was reached with 3.3 mill. t. Mexico was the main market with a share of 19.2 %, Canada ranked in fourth place. Together the two NAFTA members shared 24.3 % in the total export volume. Russia ranked in second place with imports of 276,000 t. In 2018, exports to Russia were no longer possible because of the import ban. China´s imports in 2018 were negligible with only 55 t. The political tensions between the two countries have severely reduced the imports of animal products from the USA. The loss of these markets was mainly compensated by higher exports to Taiwan (+ 103,000 t), Vietnam (+ 49,000 t), Cuba (+ 46,000 t), Guatemala (+ 44,000 t), Hong Kong (+ 43,000 t) and the Philippines (+ 40,000 t). The importance of exports to Mexico for the U.S. broiler companies explains their activities regarding a new free trade contract, replacing NAFTA.

Table 7 lists the ten leading countries of destination of the broiler meat exports in 2013 and 2018. In 2013, a maximum was reached with 3.3 mill. t. Mexico was the main market with a share of 19.2 %, Canada ranked in fourth place. Together the two NAFTA members shared 24.3 % in the total export volume. Russia ranked in second place with imports of 276,000 t. In 2018, exports to Russia were no longer possible because of the import ban. China´s imports in 2018 were negligible with only 55 t. The political tensions between the two countries have severely reduced the imports of animal products from the USA. The loss of these markets was mainly compensated by higher exports to Taiwan (+ 103,000 t), Vietnam (+ 49,000 t), Cuba (+ 46,000 t), Guatemala (+ 44,000 t), Hong Kong (+ 43,000 t) and the Philippines (+ 40,000 t). The importance of exports to Mexico for the U.S. broiler companies explains their activities regarding a new free trade contract, replacing NAFTA.

As the new USMCA, which was signed by President Trump in November 2018, has not yet been approved by the U.S. Congress, broiler meat trade between the three member countries is handled under the old NAFTA regulations.

Perspectives

In its long-term projections, the USDA estimated in March 2019 that broiler meat production in the USA will grow from 19.1 mill. t to 21.2 mill. t or by 11.3 % between 2018 and 2028. In the same decade, the export volume is predicted to increase from 3.1 mill. t to 3.5 mill. t or by 11.8 %.

The export volume of Brazil, the main competitor on the global broiler meat market, is expected to grow from 4.2 mill. t to 4.9 mill. t in the same time period. The gap between the U. S. and Brazilian exports will widen from 0.5 mill. t in 2018 to 1.4 mill. t in 2028. The dynamics in Brazil´s broiler meat production and exports will, however, only be possible if the country will be able to control the salmonella problem and regain trust in it meat industry. Because of the expected increase in global poultry meat consumption, perspectives for both countries in broiler meat exports are excellent.

Data sources, references and suggestions for further reading

S. national Chicken Council. https://www.nationalchickencouncil.org.

United States Department of Agriculture: Agricultural Projections to 2028.

https://www.ers.usda.gov/publications/pub-details/?pubid=92599.

USDA NASS, Broiler Production and Value Summary May 2019.

https://www.nass.usda.gov/Publications/Todays_Reports/reports/plva0519.pdf.

USDA NASS: Chicken and Eggs, Annual Summary 2018.

https://downloads.usda.library.cornell.edu/usda-esmis/files/1v53jw96n/m326m852c/dz010x51j/ckegan19.pdf.

USDA Trade Statistics. https://apps.fas.usda.gov/Gats/default.aspx.

Windhorst, H. -W.: Brazil: considerable increase of broiler meat and egg production. Part 1:Production. In: Zootecnica international 39 (2017), no. 7/8, p. 20-23.

Windhorst, H.-W.: The dynamics of global poultry meat trade between 2006 and 2016 at continent and country level. In: Zootecnica international 41 (2019), no.3, p. 26-31.

Windhorst, H.-W.: The dynamics of global poultry meat trade between 2006 and 2016 at Country Development Group Level. In: Zootecnica international 41 (2019), no. 4, p. 36-41.

Windhorst, H.-W.: Brazil and USA: Ongoing competition on the global chicken meat market. In In: Zootecnica international 41 (2019), no. 6, p. 16-19.