Spain is one of the leading European countries in poultry production and trade. In 2020, it ranked in fourth place in poultry meat production and in third place in egg production. Over the past decade, it also became one of the major egg and poultry meat exporting countries. In two papers, the dynamics and patterns of the two sectors will be analysed, covering the decade between 2010 and 2020.

Hans-Wilhelm Windhorst – The author is Professor emeritus at the University of Vechta and visiting Professor at the University of Veterinary Medicine, Hannover, Germany

The role of the Spanish poultry meat industry in domestic agriculture and in the EU

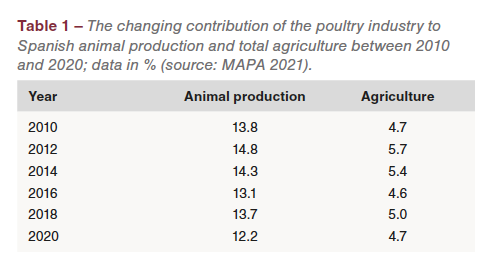

Poultry meat production plays an important role in the Spanish poultry industry and in agriculture (Table 1). A closer look at the development between 2010 and 2020 reveals that towards the end of the past decade, the contribution to total animal production and agriculture decreased. One reason for the declining value of poultry meat production is the fast growth of the swine industry, which in 2020 reached a share of 42.8% in animal production and of 16.4% in total agriculture; a second, the impacts of the Covid 19-pandemic.

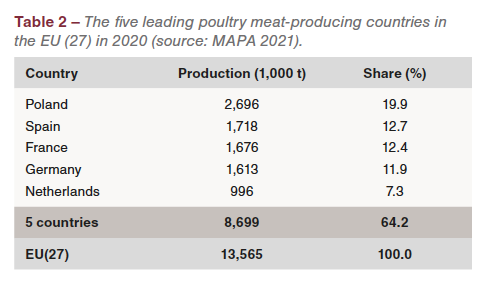

In 2020, Spain ranked in second place behind Poland in poultry meat production with a share of 12.7% in the EU (27) production volume (Table 2). In a later part of the paper, the extraordinary dynamics since 2010 will be documented.

Remarkable growth in poultry meat production

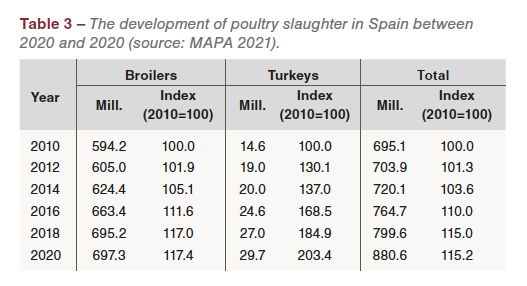

Poultry slaughter increased from 695 mill. birds in 2010 to 801 mill. in 2020 or by 15.2%. Table 3 documents that turkey slaughter more than doubled in the analysed decade while broiler slaughter grew by 17.4%. One has to consider, however, the difference in the slaughter weight. While the average slaughter weight of broilers was 2.0 kg in 2020, the average weight of a slaughtered turkey was 7.7 kg. The slaughter weight of broilers increased only slightly from 1.9 to 2.0 kg, while that of turkeys changed considerably. It increased from 8.9 kg to 9.2 kg between 2010 and 2012 and then constantly fell in the following years to only 7.7 kg in 2020. This is a result of the lower weight of toms and a higher share of hens.

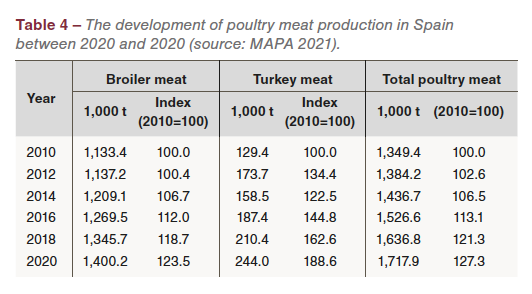

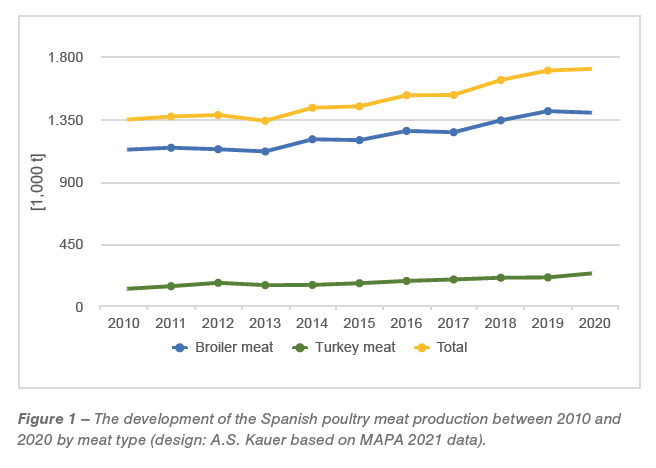

One has to consider, however, the difference in the slaughter weight. While the average slaughter weight of broilers was 2.0 kg in 2020, the average weight of a slaughtered turkey was 7.7 kg. The slaughter weight of broilers increased only slightly from 1.9 to 2.0 kg, while that of turkeys changed considerably. It increased from 8.9 kg to 9.2 kg between 2010 and 2012 and then constantly fell in the following years to only 7.7 kg in 2020. This is a result of the lower weight of toms and a higher share of hens.  Between 2010 and 2020, Spanish poultry meat production increased from 1.3 mill. t to 1.7 mill. t or by 27.3% (Table 4, Figure 1). To this growth, broiler meat contributed 267,000 t respectively 72.4% and turkey meat 115,000 t or 31.2%. As the production volume of other meat types decreased, the absolute growth of the two main meat types was higher than the total increase of poultry meat.

Between 2010 and 2020, Spanish poultry meat production increased from 1.3 mill. t to 1.7 mill. t or by 27.3% (Table 4, Figure 1). To this growth, broiler meat contributed 267,000 t respectively 72.4% and turkey meat 115,000 t or 31.2%. As the production volume of other meat types decreased, the absolute growth of the two main meat types was higher than the total increase of poultry meat.  It is worth noting that the relative growth of broiler meat production was higher than that of broiler slaughter, resulting from the growth in the average slaughter weight. The opposite was the case with turkey meat, resulting from the decreasing average slaughter weight. To the total production volume of poultry meat, broilers contributed 81.5%, turkeys 14.2%. The share of ducks and geese was only of minor importance.

It is worth noting that the relative growth of broiler meat production was higher than that of broiler slaughter, resulting from the growth in the average slaughter weight. The opposite was the case with turkey meat, resulting from the decreasing average slaughter weight. To the total production volume of poultry meat, broilers contributed 81.5%, turkeys 14.2%. The share of ducks and geese was only of minor importance.

High sectoral regional concentration in poultry meat production

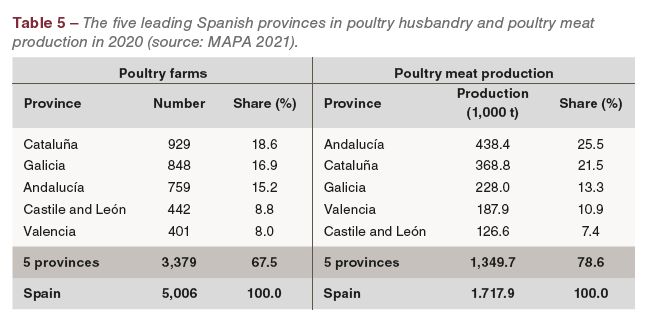

The number of poultry farms fell from 5,345 in 2010 to 4,986 in 2020 or by 6.7%. Parallel to the sectoral concentration, poultry meat production increased by 27.3% documenting the growth of the average poultry farm.  Table 5 documents the regional concentration of poultry farms and of poultry production. A comparison of the data shows that the spatial patterns of the distribution of the poultry farms and the amount of meat production differed. Most of the farms were located in Cataluña while Andalucía had the highest share in meat production. The regional concentration in production was considerably higher than that of poultry farms. Obviously, the average farm size is higher in Andalucía, Cataluña and Valencia than in Galicia and Castile and León.

Table 5 documents the regional concentration of poultry farms and of poultry production. A comparison of the data shows that the spatial patterns of the distribution of the poultry farms and the amount of meat production differed. Most of the farms were located in Cataluña while Andalucía had the highest share in meat production. The regional concentration in production was considerably higher than that of poultry farms. Obviously, the average farm size is higher in Andalucía, Cataluña and Valencia than in Galicia and Castile and León.

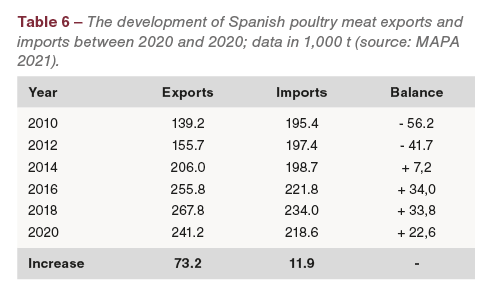

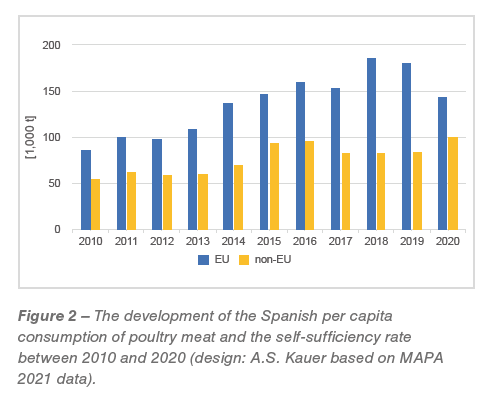

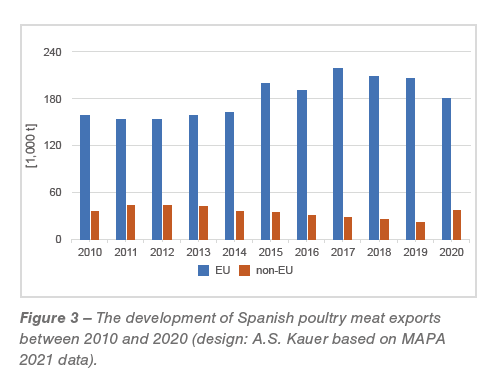

From deficit to surplus – remarkable changes in poultry meat tradeA comparison of the development of poultry meat exports and imports reveals a remarkable dynamics, exports increased considerably while the import volume declined. Despite a growing per capita consumption, from 2014 onwards, foreign trade with poultry meat showed a positive balance (Figure 2, Table 6). While the exports grew by 102,000 t or by 73.2%, imports increased by only 23,200 t or 11.9%.

Even though the exports focused on EU member countries, non-EU countries became more important. In 2020, 59.1% of the exports had an EU (27) member country as a destination and 40.9% a non-EU country. In contrast, 73.9% of the poultry meat imports came from an EU (27) member country and only 26.1% from a non-EU country.

Even though the exports focused on EU member countries, non-EU countries became more important. In 2020, 59.1% of the exports had an EU (27) member country as a destination and 40.9% a non-EU country. In contrast, 73.9% of the poultry meat imports came from an EU (27) member country and only 26.1% from a non-EU country.

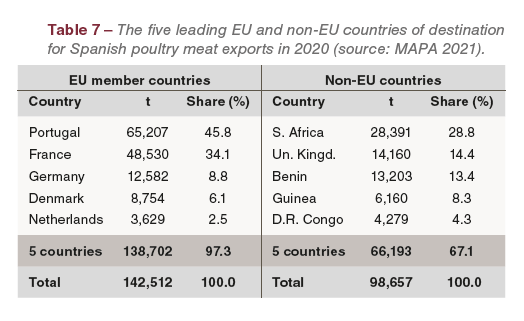

A closer look at Figure 3 shows the considerable decrease of the exports to EU member countries in the past two years. The reasons were Avian Influenza outbreaks, which resulted in import stops, and the Covid-9 pandemic, which caused a decreasing demand because of lockdowns in several countries. Figure 4 documents the lower imports from EU member countries from 2017 on. Here, too, Avian Influenza outbreaks in several countries of origin and the Covid-19 pandemic were the main steering factors. In exports as well as in imports non-EU countries gained in importance in 2020. Table 7 lists the five leading countries of destination for the exports to EU (28) member countries respectively to non-EU countries. The regional concentration in intra-EU trade was extremely high. The five listed countries shared 97.3% of the export volume, Portugal and France together 79.9%. Short transportation distances, which resulted in lower costs, were an important steering factor. In contrast, the regional concentration in trade with non-EU countries was much lower. Nevertheless, the five leading countries shared over two thirds of the export volume, with South Africa in an unchallenged top position. In 2020, 59.2% of the exports to EU member countries was broiler meat and 22.7% turkey meat. With a share of 72.4%, broiler meat dominated exports to non-EU countries, followed by turkey meat with 19.2%.

Table 7 lists the five leading countries of destination for the exports to EU (28) member countries respectively to non-EU countries. The regional concentration in intra-EU trade was extremely high. The five listed countries shared 97.3% of the export volume, Portugal and France together 79.9%. Short transportation distances, which resulted in lower costs, were an important steering factor. In contrast, the regional concentration in trade with non-EU countries was much lower. Nevertheless, the five leading countries shared over two thirds of the export volume, with South Africa in an unchallenged top position. In 2020, 59.2% of the exports to EU member countries was broiler meat and 22.7% turkey meat. With a share of 72.4%, broiler meat dominated exports to non-EU countries, followed by turkey meat with 19.2%. Poultry meat imports reached a maximum with 234,000 t in 2018. In the following two years they fell to 218,600 t. EU (28) member countries contributed 181,640 t or 73.9%, non-EU countries almost 37,000 t respectively 26.1%.

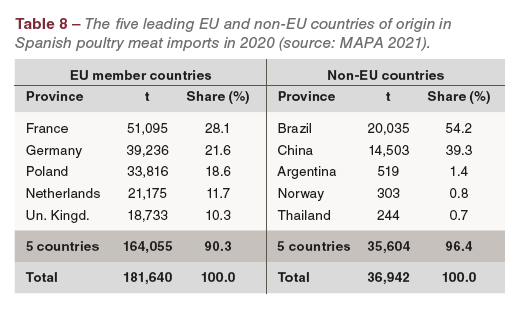

Poultry meat imports reached a maximum with 234,000 t in 2018. In the following two years they fell to 218,600 t. EU (28) member countries contributed 181,640 t or 73.9%, non-EU countries almost 37,000 t respectively 26.1%.  Table 8 lists the five leading EU (28) and non-EU countries of origin. Regarding the EU, France, Germany and Poland were in the top three positions with a share of together 68.3%. Brazil was the leading non-EU country regarding imports with a share of 54.2%, followed by China with 39.3%. Broiler meat shared 87.9% in the imports from non-EU countries. It contributed 30.2% to the imports from EU countries, turkey meat 23.7%. Processed poultry products ranked in first place, however, with a share of 36.4%.

Table 8 lists the five leading EU (28) and non-EU countries of origin. Regarding the EU, France, Germany and Poland were in the top three positions with a share of together 68.3%. Brazil was the leading non-EU country regarding imports with a share of 54.2%, followed by China with 39.3%. Broiler meat shared 87.9% in the imports from non-EU countries. It contributed 30.2% to the imports from EU countries, turkey meat 23.7%. Processed poultry products ranked in first place, however, with a share of 36.4%.

The preceding analysis of the trade relations showed that exports as well as imports decreased considerably between 2018 and 2020. Avian influenza outbreaks and the Covid-19 pandemic were the main factors, which caused the downward trend.

Summary and perspectives

Despite the remarkable dynamics, production grew by over 15% between 2020 and 2015, the poultry industry lost in importance regarding the value of production because of the steep increase of the swine industry and the impacts of the Covid-19 pandemic. Avian Influenza outbreaks in 2020 led to import stops by several countries of destination for poultry meat exports; in addition, the decreasing demand because of the Covid-19 pandemic in most of these countries resulted in a considerable reduction of the export volume. Parallel to this development, imports decreased, resulting from the lower domestic demand, especially in the tourist sector, and Avian Influenza outbreaks in several countries of origin for the imports. If the downward trend can be stopped, will to a high degree depend on the future dynamics of the Covid-19 pandemic, not only in Spain.

Data source

Ministerio de Agricultura, Pesca y Alimentación (MAPA), Dirección General de Producciones y Mercados Agrarios (Ed.): El sector de la avicultura de carne en cifras. Madrid, Julio 2021.