This overview will list theleading countries in egg production in each continent and document their share in the production volume of the continent as well as at the global level. In a second paper, the same method will be used in the analysis of the spatial pattern of global poultry meat production.

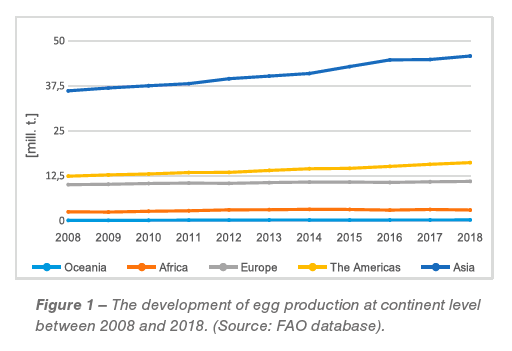

Between 2008 and 2018, global egg production increased from 61.7 mill. t to 76.7 mill. t or by 24.2%. Parallel to this remarkable growth, the regional concentration also grew considerably (Figure 1).

Three countries dominated egg production in Asia

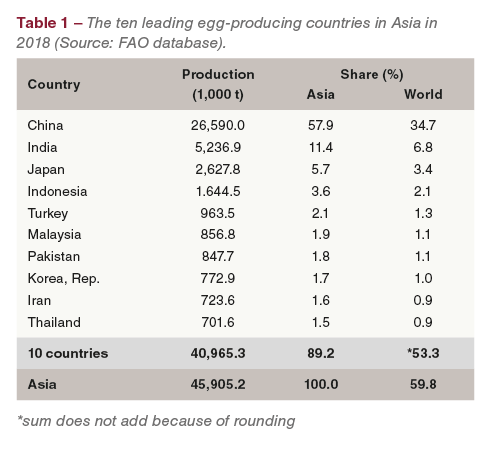

In 2018, Asian countries contributed 59.8% to global egg production. The regional concentration in Asia was very high, as can be seen from the data in Table 1. The ten leading countries shared 89.2% in the production volume of all Asian countries, the three leading countries, China, India and Japan, 75%. The gap between these three countries and those following ranks is quite wide, as Indonesia and Turkey together only contributed 5.7% to the continent’s production volume. Because of the high egg production in China, the ten leading countries shared 53.3% in global egg production in 2018; without China, it would have been only 18.6%.

The regional concentration was also very high in the Americas

The countries of the Americas contributed more than one fifth to the global egg production in 2018. The regional concentration was even higher than in Asia, for the ten leading countries shared 94.2% in the continent’s production volume (Table 2).

Even though the leading position of the USA was not as dominant as that of China in Asia, they were by far the most important egg producing country in the Americas with a share of almost 40% in the production volume of the double continent. The distance to the two following countries, Mexico and Brazil, was 2.6 mill. t respectively 2.8 mill. t. Mexico’s position in second place is a result of the very high domestic demand resulting from the extraordinary per capita consumption of 368 eggs per year. In contrast, only 190 eggs were consumed in Brazil and 272 in the USA. The three top listed countries shared 15.6% in global egg production, the ten leading countries 19.9%.

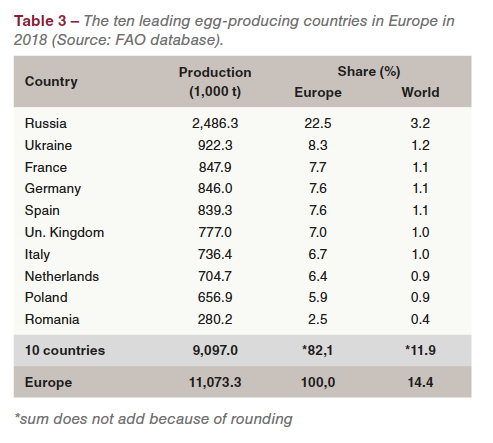

In Europe, production was more evenly distributed

With the exception of Russia, egg production in Europe was more evenly distributed (Table 3). The continent shared 14.4% in the global production volume, the ten leading countries 11.9%.

Between 2008 and 2018, egg production in Russia grew by 300,000 t in Ukraine by almost 70,000 t. The two countries shared 40% in the increase of the European production volume during that decade. Egg production of the following three countries did not differ very much; the same is true for the following four countries. The gap between Poland and Romania was quite wide, however, with over 375,000 t. Egg production in Europe will not increase very much over the present decade because of a stable population and an already high per capita egg consumption.

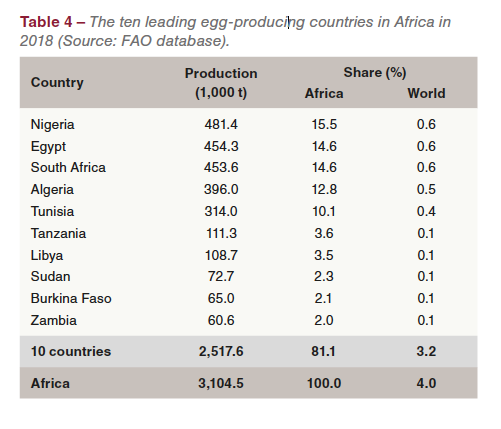

In Africa, five countries shared two thirds in the continent’s egg production

Africa’s egg production grew from 2.6 mill. t in 2008 to 3.1 mill. t in 2018 or by 19.2%. Table 4 documents that only five countries contributed 67.5% to the total egg production volume. Three of the leading countries are located in Northern Africa, only one in Central Africa.

It is worth noting that the production volume of the three leading countries did not differ very much. No country reached a dominating position and the pattern was similar to that in Europe, with the exception of the Russian dominance.

Africa, despite its population of 1.33 billion, only played a minor role in global egg production with a share of 4.0%. The per capita consumption in most countries south of the Sahara is very low, even though it may be underestimated because of backyard flocks, which are used for egg as well as for meat production.

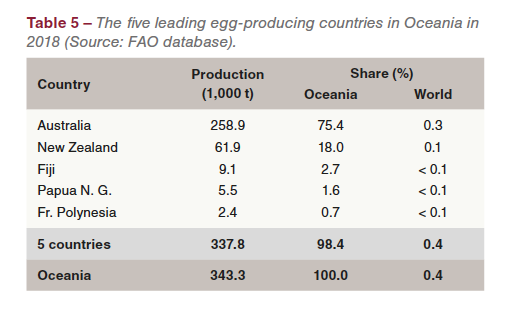

Only two countries are major egg producers in Oceania

From it resource base, Australia would be able to produce more eggs than it did in 2018. A comparatively small population with only a low domestic demand and the peripheral location, which is the main obstacle to exports, are limiting the expansion of the egg industry. In 2018, the country shared 75.4% of the continent’s egg production, followed by New Zealand with 18.0% (Table 5).

Oceanian countries only contributed 0.4% to global egg production. Nevertheless, the production volume increased from only 229,200 t in 2008 to 343,000 t ten years later or by almost 50%.

Summary and perspectives

The preceding analysis could show that the regional concentration of egg production was very high in Asia, the Americas and Oceania. Without Russia, the concentration was much lower in Europe and in Africa.

Table 6 lists the ten leading countries in global egg production in 2018. They contributed 68.4% to the global production volume. The exceptional role of China becomes obvious; without China, the following nine countries shared 33.7% of global production, less than China’s contribution. Five of the leading countries are located in Asia, three in the Americas and two in Europe. It is worth noting that no member country of the EU ranked among the top ten.

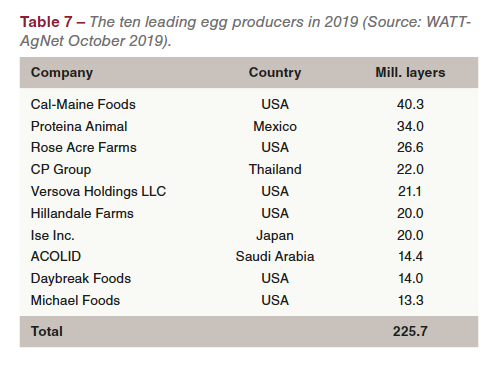

The high regional concentration in global egg production is only partly reflected in a list of the ten leading egg-producing companies (Table 7). It is surprising that, in contrast to broiler production, no Chinese or Indian company ranked among the top 25 egg producers. Obviously, the sectoral concentration in these countries was much lower than in the USA or Mexico. Avril (France), the only European company in the top 25 list, ranked as number 16 with 10 mill. layers.

I expect that the list and the ranking will change during the present decade as some developing countries, i. e. Malaysia and Pakistan, may surpass Ukraine and Turkey. This will further strengthen Asia’s role in the global egg industry.

Even though the production of plant-based egg replacers shows high annual growth rates and they are already listed in leading food stores or are used in food service outlets in the Americas, Europe and Asia, their share in global egg consumption is still quite low. This may, however, change faster than expected and they may reach a share between 10% and 15% in 2030. A similar dynamics is showing up at the horizon for egg white produced by fermentation.

Database

FAO database: http://www.fao.org/faostat Top world egg producers: www.WATTAgNet.com (October 2019)